- Ethereum’s rising construction and restoration ranges point out that near-term bullish momentum is stable.

- The surge in open curiosity of over $40 billion signifies robust dealer conviction and better leverage threat.

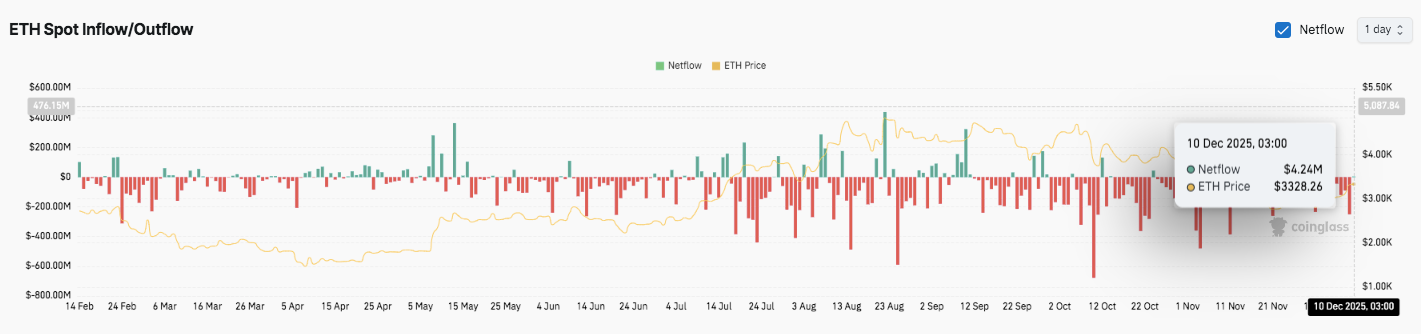

- Sustained foreign money outflows point out tighter liquid provides that might assist value energy.

Ethereum has been constructing regular upward momentum as market circumstances shift in Ethereum’s favor, with value energy, derivatives exercise, and foreign money flows presently exhibiting a extra constructive pattern. Merchants are rising publicity by means of the futures market, because the asset continues to get well from its November lows.

Moreover, the foreign money steadiness signifies that provide is step by step reducing, which may impression value developments within the coming weeks. This mix offers us a clearer image of how Ethereum’s market construction is evolving as 2025 attracts to a detailed.

Worth construction reveals regular enchancment

Ethereum has regained its short-term transferring common and damaged by means of the $3,247 stage, which has been a key barrier throughout the current financial downturn. Moreover, the 4-hour pattern reveals a collection of upper lows reinforcing short-term energy. The worth stays hovering round $3,318, close to the higher Bollinger Bands, indicating continued momentum.

Moreover, the subsequent main targets are at $3,375 and $3,439, with merchants anticipating stronger resistance. A transfer by means of these areas may pave the way in which to the $3,631 space, which marks an necessary retracement level.

Associated: Bitcoin Worth Prediction: Consumers Stay Channel Help Amid Fed Determination Boosts…

The present assist value is $3,247 and inside the EMA cluster is round $3,164 to $3,196. These zones decide whether or not consumers can preserve management throughout occasions of volatility.

Derivatives exercise accelerates

Ethereum futures open curiosity is exhibiting a big improve by means of 2025 as extra merchants take part. In consequence, open curiosity exceeded $40 billion by December 10, indicating elevated confidence throughout leveraged markets.

This improve goes hand in hand with rising costs, indicating directional curiosity moderately than pressured repositioning. Moreover, elevated futures publicity suggests elevated speculative exercise as merchants put together for a possible upside try. Nonetheless, elevated leverage may improve liquidation threat throughout fast market actions.

Substitute circulate fee signifies discount in liquid provide

Foreign money information has proven continued outflows by means of many of the yr, indicating a shift in the direction of long-term holding conduct. Outflows elevated from late October to November, when there was a big market decline.

Associated: Avalanche Worth Prediction: AVAX tries to show round in purchaser take a look at…

As well as, deposits briefly elevated on December 10, leading to a small constructive internet circulate. This modification didn’t alter the broader pattern of declining alternate provide. Due to this fact, if demand continues to rise, a discount in out there liquidity may assist value stability.

Technical outlook for Ethereum value

At the same time as Ethereum enters a pivotal buying and selling zone, key ranges stay well-defined.

- High stage: The speedy hurdles are $3,375, $3,439 (0.5 Fib), and $3,631 (0.618 Fib). If a breakout above these ranges is confirmed, it opens the door to $3,905 and $4,253.

- Lower cost stage: Help is at $3,247 (0.382 Fib) adopted by an EMA cluster between $3,164 and $3,196. A deeper decline exposes $3,087 and $2,953.

- Higher restrict of resistance: The $3,439 zone stays the primary axis. It has rejected the rally throughout November and is now serving as a key stage for reversal in the direction of medium-term bullish continuation.

The technical image reveals that Ethereum is crawling out of a corrective construction whereas being pushed into the resistance outlined by the 0.5-0.618 Fibonacci band. The market is presently buying and selling inside an increasing momentum section, however Bollinger Band strain is exhibiting early indicators of lessening volatility. Deterministic actions exterior this compression window may end up in stronger directional waves.

Will Ethereum go greater from right here?

Ethereum’s subsequent transfer will rely on whether or not consumers can defend $3,247 lengthy sufficient to interrupt by means of the $3,375 and heavier $3,439 boundaries. Continued inflows, bettering open curiosity, and strengthening EMA corrections assist continued bullishness if momentum is maintained.

If consumers improve strain, ETH may broaden in the direction of the golden pocket of $3,631, which stays a very powerful medium-term breakout stage. Clearing that zone reopens the trail to $3,905 and presumably $4,253.

Nonetheless, failure to carry $3,247 would put the rally in danger and expose ETH to a deeper assist band between $3,164 and $3,196. The breakdown shifts focus to $3,087 and $2,953, the place the broader construction weakens.

Associated: Chainlink Worth Prediction: LINK Makes an attempt Brief-Time period Restoration…

For now, ETH is within the crucial zone. The broader story in December, elevated derivatives participation, and lowered FX provide all assist upside room. Nonetheless, affirmation of the circulate of conviction and a breakout above $3,439 will decide whether or not Ethereum strikes into a bigger pattern reversal or pauses for additional consolidation.

Disclaimer: The knowledge contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any variety. Coin Version shouldn’t be chargeable for any losses incurred on account of using the content material, merchandise, or companies talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.