- ETH is buying and selling under the key EMA as a resistance stack, retaining the short-term construction susceptible

- Rising ETH open curiosity indicators confidence and will increase volatility danger on breakout

- Identification of spill and dialogue of protocol complexity heightens vigilance regardless of long-held beliefs

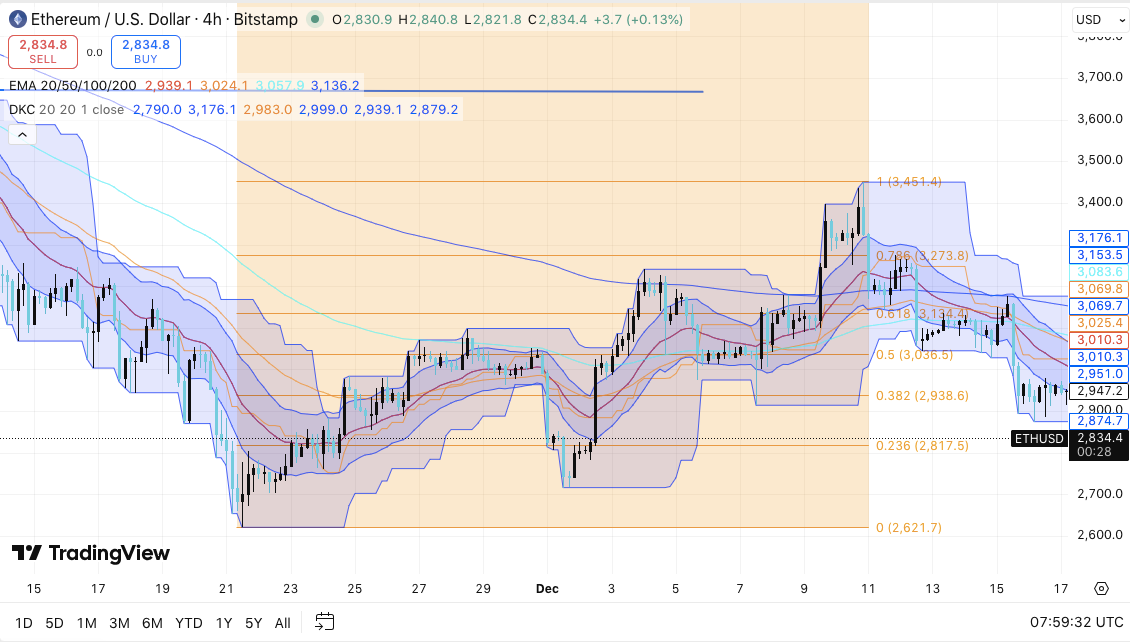

Ethereum’s worth motion displays a cautious market tone as merchants weigh long-term structural confidence in opposition to technical weaknesses. On Bitstamp’s 4-hour ETH/USD chart, the value is buying and selling round $2,835 after failing to take care of momentum above current highs.

Quick-term worth construction stays fragile

Ethereum continues its correction part following a rejection close to the swing highs between $3,450 and $3,500. Worth is at present under key short-term and intermediate-term shifting averages, limiting bullish follow-through. Due to this fact, until consumers regain misplaced floor, the market will favor consolidation.

Fast resistance lies close to $2,940 to $2,960, the place Fibonacci ranges and short-term averages converge. Moreover, sellers proceed to defend the $3,025 to $3,070 zone, which coincides with the 50 EMA and 100 EMA. A stronger higher sure emerges round $3,150 to $3,180, close to the 200 EMA and the earlier vary excessive.

On the draw back, Ethereum stays above the $2,820 to $2,800 help band. Nonetheless, a breakdown under this space might be $2,740 to $2,720. Moreover, a broader sell-off may prolong into the $2,620 to $2,600 demand zone, indicating a broader cyclical help space.

Derivatives exercise suggests conviction, not termination

Whereas spot costs are falling, Ethereum futures positioning tells a special image. Open curiosity has grown steadily over the previous 12 months, rising from lower than $10 billion to a peak of greater than $35 billion. Importantly, this development continued throughout each the upswing and the downturn.

Associated: Chainlink Worth Prediction: Constructing a Lengthy-term Story as LINK Checks…

In accordance with current information, ETH is buying and selling round $2,830, with open curiosity of almost $35.9 billion. This conduct means that merchants are sustaining publicity slightly than exiting positions.

Due to this fact, the derivatives market displays confidence, deeper liquidity, and elevated institutional investor participation. In consequence, future breakouts or breakouts might lead to sharper worth reactions.

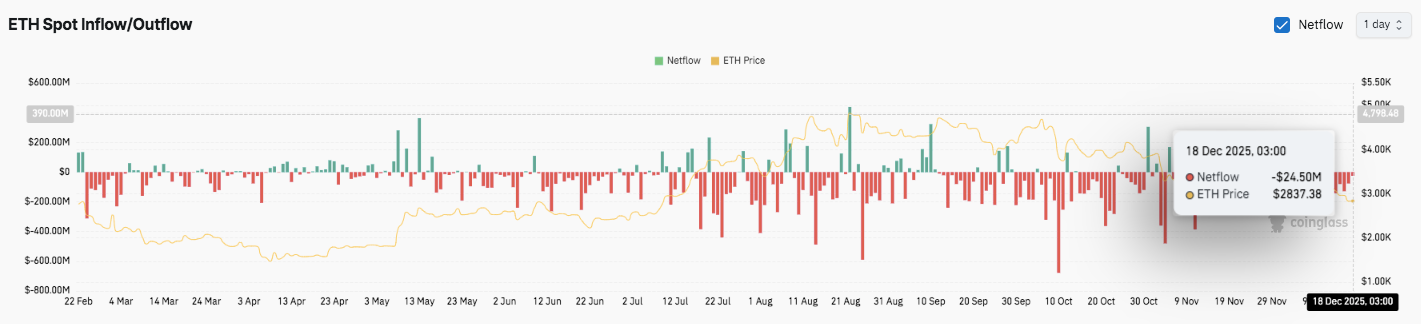

Watch out with discussions about spot flows and protocols

Spot circulation information continues to point out web outflows dominating current periods. The crimson outflow bar exceeds inflows, indicating restricted confidence in shopping for the dip. Moreover, current web outflows of almost $25 million coincide with the inventory buying and selling under restoration ranges, reinforcing cautious sentiment.

Past the market, Ethereum is dealing with inside reflection relating to the complexity of its protocol. Vitalik Buterin lately emphasised that trustless relies upon not solely on decentralization but additionally on person understanding. He argued that extreme complexity narrows the group that may audit the system. Due to this fact, simplicity might strengthen long-term belief, even when performance is restricted.

Moreover, ecosystem builders expressed issues that an opaque design would undermine true decentralization. This debate highlights the broader stress between innovation and accessibility. Ethereum’s future might due to this fact rely upon balancing technical ambition and readability, each on the charts and inside its protocol.

Technical outlook for Ethereum worth

Ethereum trades inside a short-term correction construction, so key ranges stay well-defined.

Upside ranges embrace the primary resistance cluster between $2,940 and $2,960. If the value sustains a break above this zone, it may head towards $3,025-$3,070. Past that, $3,150 to $3,180 stands as a key barrier across the 200 EMA. A full bullish reset would require a breakout above the swing highs between $3,450 and $3,500.

On the draw back, instant help is between $2,820 and $2,800. Failure to maintain this space may expose $2,740 to $2,720, adopted by a deeper demand zone round $2,620 to $2,600. This degree represents vital cyclical help if promoting stress accelerates.

Associated: Pi Worth Prediction: Pi faces promoting stress as worth falls and market unlocks

The technical construction means that Ethereum is buying and selling under short-term and intermediate-term shifting averages, and momentum stays cautious. The volatility band exhibits the value caught on the decrease finish of the vary, indicating stress, however leaving room for a rescue rebound if the help holds.

Will Ethereum rise additional?

Ethereum’s near-term course will rely upon whether or not consumers can follow the $2,800 threshold and regain $2,940. Stronger inflows and follow-through may result in a rally in direction of $3,070 and above.

Nonetheless, if it fails to carry $2,800, there’s a danger of one other draw back transfer in direction of $2,740 and even $2,620. For now, Ethereum stays at a important inflection level, the affirmation of which can decide the following leg.

Disclaimer: The data contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any sort. Coin Version shouldn’t be accountable for any losses incurred because of using the content material, merchandise, or companies talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.