- Ethereum has consolidated close to $4,116, suggesting a near-term restoration and bullish potential.

- A surge in futures open curiosity and foreign money buying and selling signifies elevated market engagement.

- The deal with safety continues, with a 51% assault threat highlighting the significance of decentralization.

Ethereum is exhibiting renewed bullish vitality after rebounding from the lows of $3,435. The cryptocurrency is presently buying and selling round $4,116, with worth stability suggesting a pause earlier than a doable continuation.

Market analysts consider the present sample displays a short-term restoration that would result in a broader enlargement as soon as key resistance ranges are cleared. In consequence, Ethereum’s elevated open curiosity and expanded trade exercise point out elevated market engagement from each institutional traders and retail merchants.

Fibonacci and EMA ranges outline subsequent course

Ethereum’s current rally noticed it reclaim the 0.5 Fibonacci retracement degree at $4,099, turning it into speedy help. The following main resistance lies close to the 0.618 retracement close to $4,255, the confluence zone with the 200-EMA. A break above this space might open the way in which to the 0.786 retracement goal at $4,478. Nevertheless, if the worth closes under $4,099, draw back strain might floor in direction of $3,948.

Moreover, the coincidence of the 20, 50, 100, and 200 EMAs is reinforcing the strengthening pattern. Value stays above all short-term shifting averages, with the 50-EMA at $4,077 being the important thing pivot.

Associated: XRP Value Prediction: $60M Outflow and $1B Treasury Push XRP in direction of Main Breakout

If the worth continues to shut above the 200-EMA at $4,103, a transfer in direction of the $4,250 to $4,300 zone is prone to be confirmed. Present market situations recommend that the bulls are steadily regaining management, however resistance stays sturdy.

Derivatives and on-chain exercise help constructive outlook

Open curiosity in Ethereum futures surged to $49.24 billion, the very best degree since mid-2025. This sharp rise signifies elevated dealer participation and capital inflows into the derivatives market.

Rising open curiosity usually precedes giant volatility spikes, suggesting market individuals predict a definitive breakout quickly. Moreover, this pattern displays the sturdy momentum seen throughout main altcoins, reinforcing Ethereum’s key position within the broader restoration.

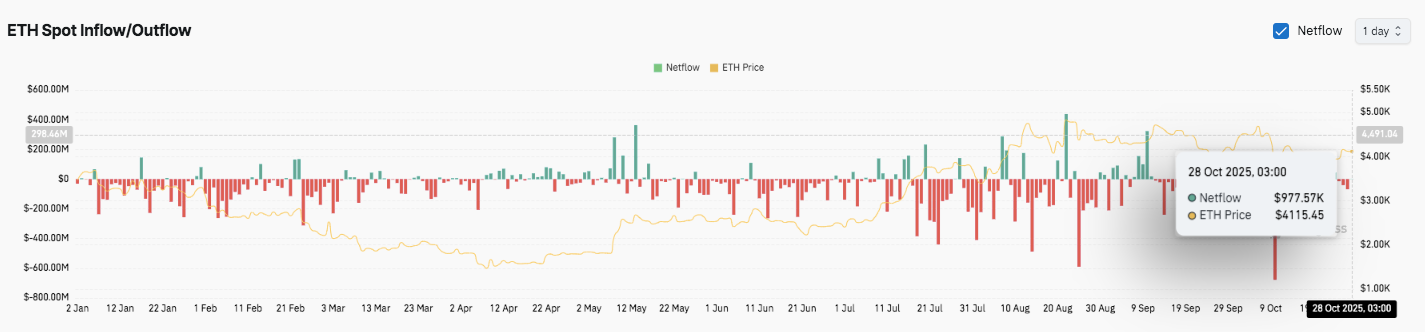

Moreover, on-chain knowledge reveals sustained foreign money outflows all through 2025, reflecting traders’ self-custody orientation throughout market consolidation. Whereas outflow was predominant, there was a brief spike in influx and selective accumulation in Could, July, and September.

Ethereum just lately recorded a modest constructive internet circulate of $977,000, suggesting renewed confidence as the worth stabilized round $4,115. This delicate change means that we could also be coming into a cautious accumulation part earlier than a stronger rally.

Safety debate as soon as once more attracts consideration

Individually, the Ethereum co-founder reignited the talk over blockchain safety by revisiting the influence of the 51% assault. He emphasised that whereas validators can collude to disrupt the community’s consensus, they can not alter the historical past of a sound blockchain or seize its belongings.

His remarks spotlight the continued want for decentralization and minimizing belief inside proof-of-stake methods. Due to this fact, though Ethereum’s worth is exhibiting resilience, this dialogue highlights that safety stays simply as essential for long-term sustainability.

Technical outlook for Ethereum worth

Ethereum is buying and selling round $4,116, holding regular after a powerful restoration from the lows of $3,435, with key ranges nonetheless clearly outlined. Upside aims embrace $4,255 (0.618 Fibonacci) and $4,478 (0.786 degree), each of which function essential resistance zones. A break above $4,255 might pave the way in which to $4,500, and if momentum builds, it might head towards $4,700.

Associated: Chainlink Value Prediction: Whales Rise as LINK Eyes Bullish Reversal

On the draw back, the primary help is round $4,099 (0.5 Fibonacci), adopted by $4,030 and $3,948, with consumers beforehand following the pattern. The 200-EMA close to $4,103 kinds an essential pivot space, and a sustained shut above that is prone to verify a continuation in direction of the next goal.

The technical setup reveals Ethereum firmly in a tightening vary, suggesting volatility can be compressed earlier than enlargement. Due to this fact, a definitive breakout above $4,255 might set off a powerful rebound, whereas failure to maintain $4,099 might end in a short-term correction.

Is Ethereum gearing up for an additional rally?

Ethereum’s outlook for late October will rely upon whether or not consumers can preserve management above the $4,099 to $4,070 zone. Elevated open curiosity and small inflows recommend elevated confidence amongst merchants. If the bullish quantity expands, ETH might retest $4,255 and lengthen in direction of $4,478.

Nevertheless, rejection attributable to resistance can result in motion inside vary earlier than a bigger change in course. For now, Ethereum continues to be in a important part, and sustained power above the 200-EMA might decide the subsequent huge transfer.

Associated: Hedera Value Prediction: HBAR Features Investor Momentum as ETF Launch Nears

Disclaimer: The knowledge contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any variety. Coin Version just isn’t liable for any losses incurred on account of using the content material, merchandise, or providers talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.