- Ethereum has damaged beneath the multi-month uptrend line and falls below the 20-day, 50-day, and 100-day EMAs.

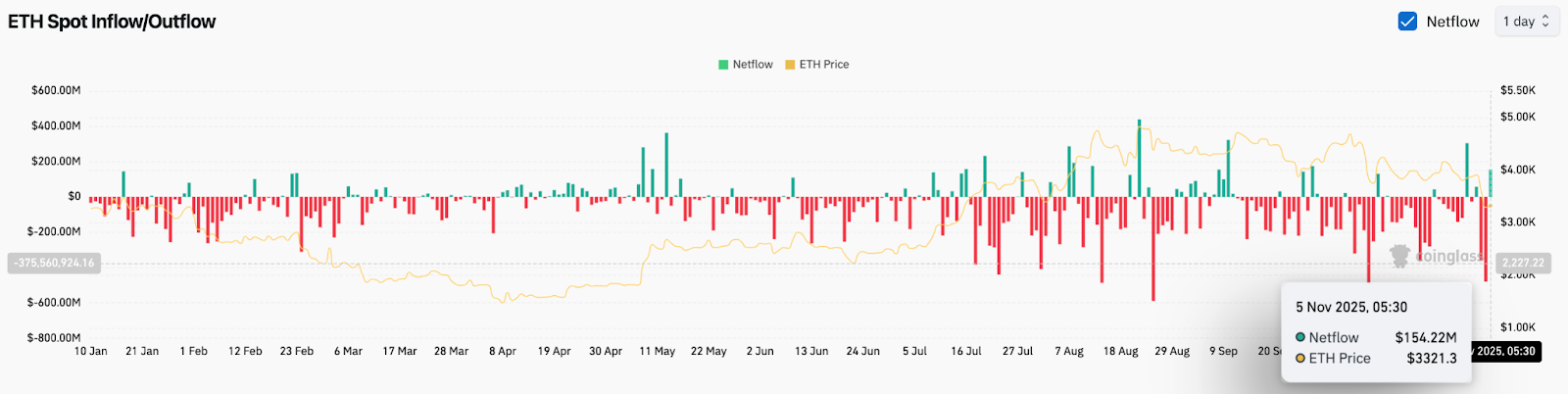

- Coinglass information reveals outflows of $154.2 million, indicating energetic circulation and weak purchaser defenses.

- The liquidity heatmap reveals a worth magnet round $3,000-$2,800, forming the following main draw back goal.

Ethereum worth is buying and selling close to $3,325 right now after shedding its multi-month trendline and falling beneath its 20-day, 50-day, and 100-day transferring averages. This breakdown shifted momentum to the sellers and opened the door to a excessive liquidity zone round $3,000 to $2,800. This space is highlighted by market construction, historic demand, and up to date liquidity heatmap.

Patrons withdraw as spot outflows enhance

Spot move information from Coinglass reveals why the decline accelerated. On November fifth, Ethereum recorded web outflows of $154.2 million, indicating energetic circulation as tokens moved from wallets to exchanges. Outflows of this magnitude usually point out profit-taking or preparations to promote quite than accumulation.

broader flows over the past month, the pink bars dominate the netflow heatmap. Which means exchanges are repeatedly receiving extra ETH than they’re sending, a persistent development that traditionally coincides with short-term worth declines.

When flows flip optimistic and inflows transition to withdrawals, merchants change into assured that accumulation is underway. To date, there isn’t a such proof. The information confirms that holders haven’t stepped in to defend the latest collapse.

A trendline break is a sign of short-term weak spot

The every day chart reveals that Ethereum has damaged beneath the primary uptrend line that has guided the value since Could. For 5 months, each time we fell towards this development line, a response occurred and the lows rose. Dropping this construction signifies that the development has transitioned from a managed pullback to a full breakdown.

This breakdown triggered the value to drop beneath the 20-day, 50-day, and 100-day EMAs unexpectedly. These transferring averages are at the moment sitting overhead, forming a ceiling round $3,600 to $3,900. Sellers are rejecting any makes an attempt to push into this zone, and the construction will stay bearish till worth closes above these transferring averages.

Liquidity zone signifies clear draw back goal

The liquidity map shared by market analyst Ted (@TedPillows) reveals the main liquidity clusters beneath the present worth. In response to the chart, essentially the most concentrated liquidity is between $2,800 and $3,000. Liquidity normally attracts costs like a magnet, particularly after a chapter.

On the upside, the following main pocket of liquidity begins above $4,000. For worth to succeed in that space, Ethereum might want to decisively regain the higher sure of its present EMA. It requires quantity and robust currents, neither of which at the moment exist.

The market is exhibiting the everyday conduct seen in a variety breakdown. The liquidity beneath is first worn out, then the value varieties a base earlier than a sustained reversal.

Intraday chart reveals rejection in VWAP and weak spot in RSI momentum

On the 30-minute chart, Ethereum tried a salvage rebound after the sharp drop, however the worth was unable to regain session VWAP. At the moment, VWAP acts as a dynamic higher restrict, and all makes an attempt to commerce above it are rejected. If the value stays beneath VWAP, it signifies that intraday positioning favors sellers and the common purchaser is underwater.

A rebound from the $3,175 core signifies demand at decrease ranges, however a restoration lacks confidence. The value is struggling to interrupt above short-term help ranges and continues to fall at any time when it approaches the VWAP line.

RSI strengthens this weak spot. After briefly recovering from oversold territory, the RSI topped out close to the center band and did not maintain above 50 ranges. In a downtrend, a decline within the RSI on the midline is a typical signal that the uptrend is correcting quite than reversing. Momentum stays on the vendor facet till the RSI breaks convincingly into the higher half of the vary.

outlook. Will Ethereum go up?

Ethereum is at a important inflection level. The lack of the annual development line and sustained outflows warn that worth might have to filter liquidity pockets between $3,000 and $2,800 earlier than a sustained rally begins.

- Bullish case: If Ethereum regains $3,600 to $3,900 and closes above the transferring common cluster, the development may resume in direction of $4,000 and better liquidity ranges.

- Bearish case: If the resistance shouldn’t be cleared, the construction will change into heavy. Dropping $3,000 would unleash a deeper draw back in direction of $2,800.

Disclaimer: The data contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any sort. Coin Version shouldn’t be answerable for any losses incurred on account of the usage of the content material, merchandise, or companies talked about. We encourage our readers to conduct due diligence earlier than taking any motion associated to our firm.