abstract

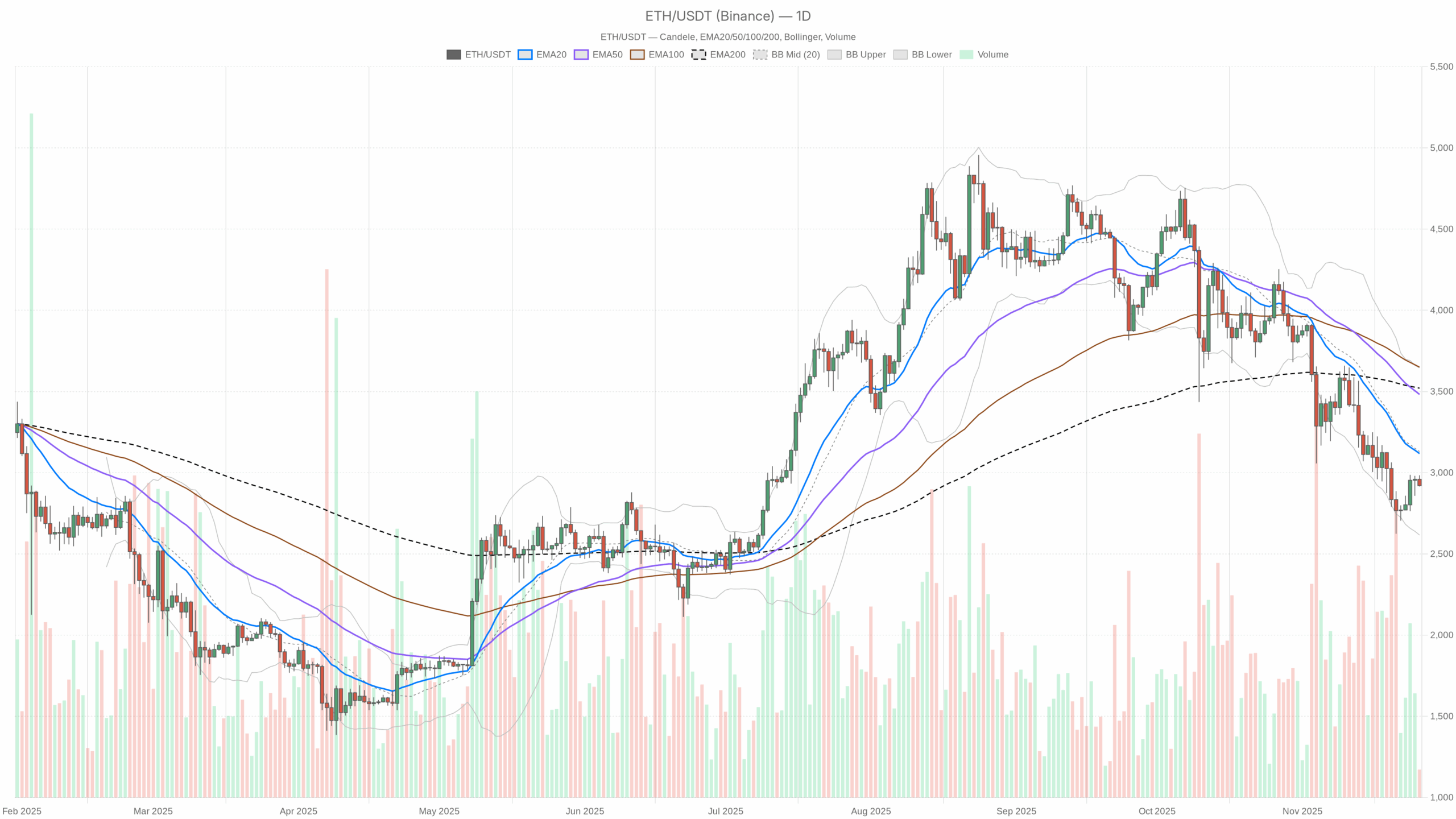

On the day by day chart, the asset is buying and selling round 2920, clearly beneath the 20-day, 50-day, and 200-day exponential shifting averages. dominant bearish authorities. Though momentum is weak and the histogram suggests an early stabilization, the RSI stays within the mid-30s and the MACD stays detrimental. Moreover, Bollinger Bands point out that worth is leaning towards the decrease finish of the vary, which is according to sustained downward strain fairly than a wholesome consolidation. Volatility on greater time frames continues to rise, as evidenced by the day by day ATR above 200, which means intraday swings can nonetheless be intense in both course. Nevertheless, volatility has diminished on the hourly and 15-minute charts, indicating a short-term cooling part inside a bigger downtrend. Investor sentiment throughout the crypto market is dominated by worry, and liquidity seems to be extra cautious than proactive.

Market state of affairs and course

The broader context isn’t notably supportive of lively risk-taking. The market capitalization of cryptocurrencies has exceeded $3.09 trillion, a modest enhance of about 0.76% in 24 hours, indicating that the market is stabilizing however not in full risk-on mode. Bitcoin accounts for about 56.4% of the market capitalization, and will increase in its share usually Defensive positioning benefit of enormous caps Relatively than a broad altcoin rally. Moreover, the Concern & Greed Index sits deep within the 15 “excessive worry” zone, indicating that many merchants are nonetheless in capital conservation mode.

In such a state of affairs, it isn’t stunning that the day by day regime of this pair is taken into account bearish. The asset is beneath medium- to long-term development norms, and any rally is prone to be seen as a possibility to scale back threat fairly than chasing upside. That stated, excessive worry also can precede a tipping level, particularly if technical indicators start to counsel draw back exhaustion.

Technical Perspective: Learn the general setup

On the day by day time-frame, the worth closes round 2920, whereas the 20-day EMA is close to 3118, the 50-day EMA is close to 3482, and the 200-day EMA is close to 3520. This stack configuration displays the worth being beneath all three curves. Downward momentum has been established and no rebound development has been confirmed.. For intermediate-term buyers, the distinction between the spot and the 200-day common highlights that the market has but to restore the injury achieved by the latest decline.

The day by day RSI of roughly 36.6 confirms this example. It’s beneath the impartial 50 line, indicating bearish momentum however not but in oversold territory. This means that whereas promoting strain remains to be current, there’s nonetheless room for additional decline earlier than a full-on capitulation-type rebound turns into doubtless. However, the MACD line is detrimental round -221, the sign line is round -232, and the histogram is barely optimistic round 10. A detrimental line signifies that the medium-term development is down, whereas a optimistic histogram signifies that: Early indicators that the draw back is dropping momentumis commonly a prerequisite for the combination part.

The Bollinger Bands on the day by day chart have a center band round 3131, an higher band round 3645, and a decrease band round 2616. The market stays unstable as costs are buying and selling properly beneath the midline and near the decrease band. A strain zone the place draw back exploration is extra widespread than a sustained breakout.. Nevertheless, the truth that the worth isn’t exactly mounted within the decrease band means that essentially the most aggressive a part of the decline could already be over, not less than briefly.

The ATR per day is roughly 203 factors. Elevated volatility. Fluctuations of a number of proportion factors per day are nonetheless widespread, which implies place sizing and threat limits are extra vital than normal. Pivot ranges add context. The day by day pivot level is close to 2939, the primary resistance space is close to 2965, and the primary assist space is close to 2896. Buying and selling slightly below the pivot means that the bears keep a slight tactical benefit, and a sustained rally above that zone could be the primary small signal that near-term sentiment is enhancing.

Intraday outlook and ETHUSDT token momentum

On the hourly chart, the state of affairs is extra balanced. Value is hovering round 2920, sandwiched between EMA20 close to 2934, EMA50 slightly below 2910, and EMA200 close to 2919. This common clustering is Quick-term impartial systemneither bulls nor bears have the higher hand through the day. The hourly RSI close to 48 is near equilibrium, supporting the concept that the latest motion is pausing fairly than accelerating.

However, the hourly MACD is barely detrimental, with a line simply above 8 and a sign round 12, producing a small detrimental histogram. This means a slight lack of upward momentum after a quick rebound, according to the market digesting earlier volatility. The Bollinger band for H1 has a midline round 2934, the higher and decrease bands are round 2979 and 2889, and the ATR is round 31. In consequence, short-term volatility is comparatively suppressed in comparison with day by day charts. Consolidation pockets exist inside bigger, extra unstable downtrends.

The 15-minute chart displays this stance. The worth is barely beneath the short-term EMA, with the 20-period and 50-period averages concentrated round 2937-2939, and the 200-period common concentrated round 2911. The intraday RSI of round 38 suggests a light bearish bias, and the MACD is barely detrimental, indicating that the microstructure nonetheless favors sellers within the very quick time period. Nevertheless, an ATR close to 11 signifies a slender vary, suggesting that quick scalpers are working in a extra mechanical vary buying and selling atmosphere fairly than a trending atmosphere.

Key ranges and market reactions

From a ranges perspective, the market is at the moment oscillating slightly below the day by day pivot round 2939. If the patrons handle to reclaim that space and maintain above the primary resistance space round 2965, this transfer may result in one other transfer. Quick-term breakout set off for mean-reverting gamersConversely, a repeated failure beneath the pivot, adopted by a slide beneath the preliminary assist close to 2896, will proceed to focus consideration on the decrease space of the Bollinger Bands close to 2616 as a possible draw back magnet.

In the course of the day, the 2928 Hour Pivot and close by 2941 Resistance outline a good battlefield. Pushing this pocket greater as quantity will increase would assist the concept that intraday merchants are beginning to transfer forward of a possible day by day stabilization. If as a substitute, the worth continues to say no round this ceiling and drops beneath the hourly assist round 2907, it will affirm the next: Bears nonetheless management short-term liquidity shifts.

Future eventualities and funding outlook

General, the principle state of affairs stays bearish on the day by day time-frame, with the asset buying and selling beneath all main EMAs, RSI subdued and MACD remaining detrimental. The short-term chart exhibits a impartial to barely detrimental bias, indicating a consolidation fairly than a brand new impulsive leg. For swing merchants, this implies specializing in weakening pullbacks to resistance whereas carefully monitoring for pullbacks. Decisive momentum change It might point out a extra sturdy bottoming course of. Lengthy-term buyers could choose to attend for clearer affirmation, resembling a restoration above the 20-day EMA or the day by day RSI shifting again towards the 50 zone, earlier than reassessing threat publicity.

This evaluation is for informational functions solely and doesn’t represent monetary recommendation.

Readers ought to conduct their very own analysis earlier than making any funding selections.