Over the previous few months, financial institution accounts of cryptocurrency professionals have more and more been frozen or restricted throughout the UK, US and EU. They are saying they usually don't care till one thing occurs to them. Properly, that was the case this week as effectively. To my actual shock, it got here from a spot I least anticipated.

Revolut has lengthy been thought of the UK's most crypto-friendly financial institution, providing in-app crypto purchases, and in 2023 will lastly provide the power to ship and obtain crypto, albeit with sure restrictions. Added. Nonetheless, current occasions have referred to as into query banks' dedication to offering a seamless expertise for purchasers utilizing cryptocurrencies.

Though the UK is now not a part of the European Union and the MiCA EU laws apply, the brand new journey guidelines require related disclosures. Which means that customers might want to reveal and establish the homeowners of non-hosted wallets which can be recipients of withdrawals from Revolut.

Nonetheless, UK cryptocurrency firms are allowed to use a risk-based method to deciding when to gather details about non-hosted wallets. All you want is the power to establish the place your clients are transacting utilizing unhosted wallets and assess the chance of these transactions.

How the UK's most crypto-friendly financial institution froze 0.23 ETH in my account

Two days in the past, I purchased a small quantity of 0.23 ETH (£550) by the Revolut app and tried to switch the funds to my private Ethereum pockets linked to a widely known ENS area. To my shock, Revolut blocked the transaction and took a payment from my account. Moreover, all my financial institution accounts have been frozen, together with my joint account with my spouse.

After a number of hours of frustration and confusion, the account was lastly unfrozen and the payment was refunded after additional requests. Nonetheless, sure pockets addresses stay blocked and you might be unable to switch funds to that account. This expertise led me to query the character of Revolut's affinity for cryptocurrencies. Contemplating the UK's options, Revolut stays the best choice for these not happy with conventional banks, however the bar is low. I consider incidents like this have much less to do with Revolut being “anti-crypto” and extra to do with concern of regulatory retaliation.

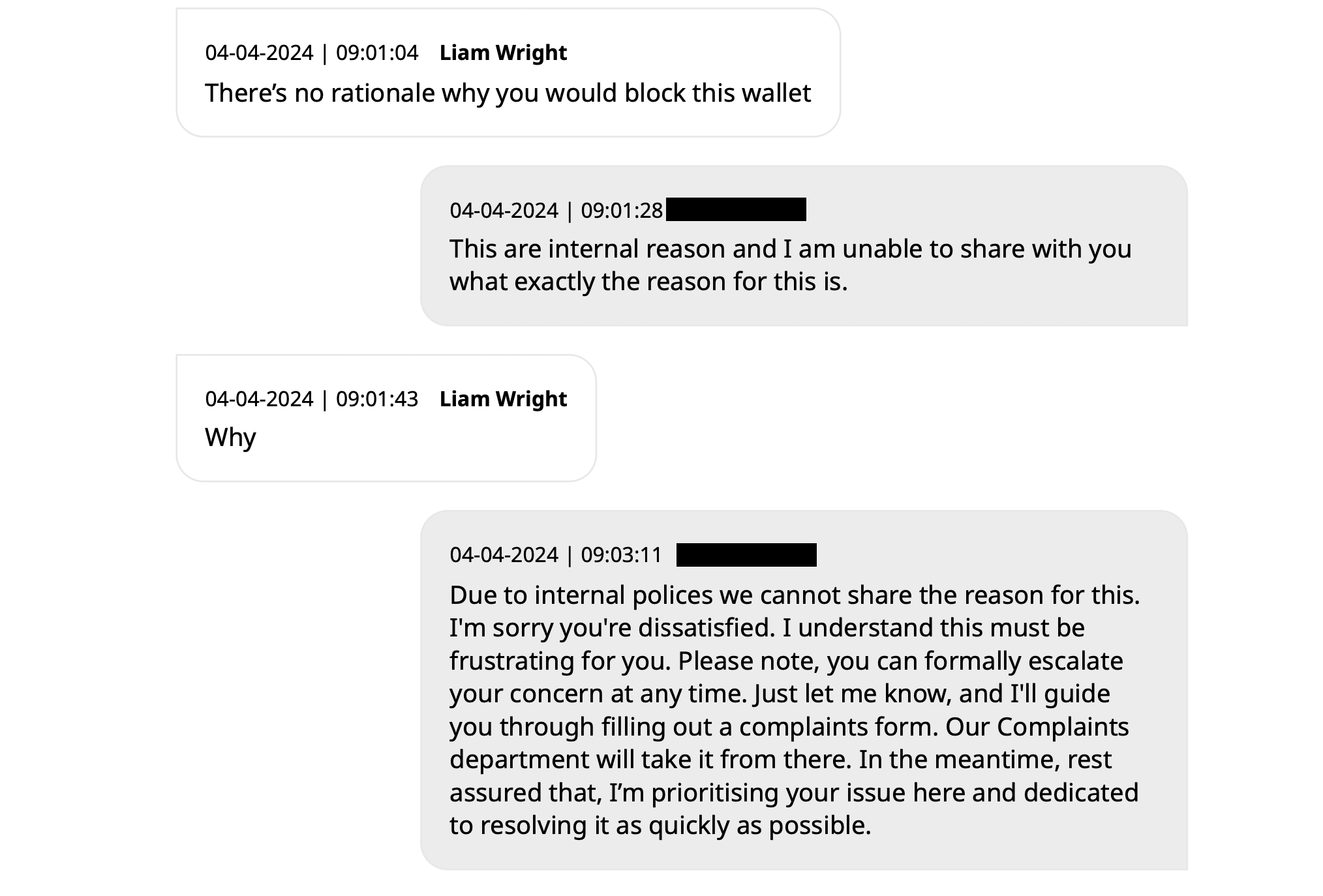

Nonetheless, chat transcripts between Revolut's help workforce and me reveal a scarcity of transparency relating to the explanations behind account freezes and pockets handle blocks. Assist representatives have been unable to supply a transparent rationalization, citing inner insurance policies that forestall them from sharing particular causes for such actions.

The incident raises issues in regards to the autonomy and management Revolut customers have over their funds, notably in terms of digital asset buying and selling. Blocking a person’s pockets handle with out a passable rationalization undermines confidence in banks’ capacity to facilitate easy cryptocurrency transactions.

Because the UK navigates the post-Brexit monetary panorama, banks like Revolut might want to steadiness regulatory compliance with offering an easy-to-use expertise for purchasers. Strict enforcement of the legislation and lack of transparency in addressing account and pockets points dangers alienating cryptocurrency customers who depend on these companies. That is very true provided that the corporate is contemplating opening a devoted cryptocurrency change.

Deactivate financial institution accounts of US crypto customers

In the USA, even crypto customers who’re long-time clients of conventional banks are going through account closures on account of their involvement in digital property. ETH Denver co-founder John Paylor lately shared his expertise on Twitter, revealing that Wells Fargo de-banked him after 26 years of sponsorship and thousands and thousands of {dollars} in charges. revealed. Paler's checking, financial savings, bank cards, private traces, non-profit accounts, and enterprise accounts have been all closed with out rationalization, though he didn’t use his private accounts to buy crypto property lately.

Caitlin Lengthy, founder and CEO of Custodea Financial institution, responded to Parra's tweet, saying the financial institution has obtained a lot of inquiries from crypto firms urgently searching for replacements for closed financial institution accounts. It was identified that there was a rise in She referred to as this pattern a brand new wave of “Operation Choke Level 2.0” and prompt a full-scale witch hunt in opposition to crypto-related companies.

Bob Summerwill, director of the Ethereum Basic Cooperative, echoed related sentiments, emphasizing the necessity for banks like Custodea. He shared his expertise with PayPal, which closed the Ethereum Basic Cooperative account with out giving a particular purpose, solely saying that the choice is everlasting and can’t be reversed.

These incidents spotlight rising issues throughout the crypto neighborhood. Even individuals who have established relationships with conventional banks and are compliant are prone to shedding entry to banking companies. The shortage of transparency and sudden nature of those account closures raises questions in regards to the underlying motivations behind these actions and their potential affect on the expansion and adoption of cryptocurrencies in the USA.

Optimistic friction really means a horrible consumer expertise

As a facet word, I’ve additionally heard from at the least 5 different people who work in cryptocurrencies and usually transfer giant quantities of fiat foreign money by conventional banks who’ve had their accounts frozen. I'm not advocating the Wild West. All I ask for is frequent sense regulation.

The UK's method to regulation additionally contains what the UK considers 'optimistic friction'. The idea refers to a set of regulatory measures aimed toward introducing sure limitations and checks that decelerate the method of investing in digital property. These measures are aimed toward countering the social and emotional pressures that may lead people to make hasty or poorly knowledgeable funding selections. The Monetary Conduct Authority (FCA) launched these “optimistic frictions” as a part of the Monetary Promotion Act, which goals to strengthen client safety within the crypto market.

Examples of “optimistic friction” embrace personalised danger warnings and 24-hour cooling-off intervals for first-time buyers in an organization. These measures be sure that people are totally knowledgeable in regards to the dangers related to cryptocurrency investments and have enough time to rethink their funding selections with out being influenced by instant emotional or social pressures. It’s designed to.

In actuality, the unpleasant banner warning that seems on the high of each crypto app seems after a sequence of questions aimed toward scaring new buyers and by no means disappears even after assembly all the necessities. Apparently not.

I wish to know when the federal government will check fractional reserve banking for all conventional monetary clients. You might want to know the nuances of presidency regulation of currencies. Suppose he’s on the road and asks 10 folks what’s going to occur in the event that they deposit cash into their checking account. How many individuals will move the examination?

How many individuals know that banks within the US and UK have a reserve requirement ratio of 0%? The earlier cap of 5-10% was eliminated in 2020, and now solely a portion of buyer funds is definitely How a lot is held in money is on the sole discretion of banks. It’s due to this fact completely authorized for the financial institution to take her £1,000 deposit and lend your complete quantity to a different get together.

In fact, conventional finance is regulated and your cash is “assured” by authorities insurance coverage, so that you don't have to fret. Don't look again to 2008 once you needed to depend on instruments like this. He stated it took clients lower than 10% of the time to withdraw their funds earlier than Northern Rock collapsed.

Banks don't have your entire cash. Properly-run crypto exchanges and self-custodial wallets achieve this, however does regulation counsel we must always concern cryptocurrencies?

I feel it's the banks which can be scared.

Previous to this editorial, I requested Revolut's help and X workforce if their PR division want to touch upon my state of affairs, however my questions have been repeatedly ignored.

talked about on this article

(Tag translation) Ethereum