- Ethereum is presently holding beneath a key resistance stage.

- Solana and Polkadot are ready for a bullish breakout.

- Arbitrum costs have fallen from vital ranges.

The altcoin market is displaying indicators of development and restoration, and sure traits point out upside potential.

Whereas the broader market, together with altcoins reminiscent of Dogecoin and XRP, is gaining momentum, it’s not but clear when the massive altseason will happen. Traditionally, February has been a robust month for cryptocurrencies, particularly Ethereum, and this 12 months might observe the identical sample.

Analyst Miles Deutscher lists the highest altcoins for February.

Ethereum (ETH)

The analyst mentioned Ethereum stays a basic asset for a lot of portfolios. Regardless of its excessive volatility, its giant ecosystem, good contract capabilities, and powerful developer neighborhood make it an important software for long-term publicity to the crypto area.

Ethereum is presently buying and selling beneath a key resistance stage at $3,350, having fallen 4% over the previous week. The worth chart reveals attention-grabbing worth motion, and it stays to be seen whether or not ETH will rise above $3,400 quickly.

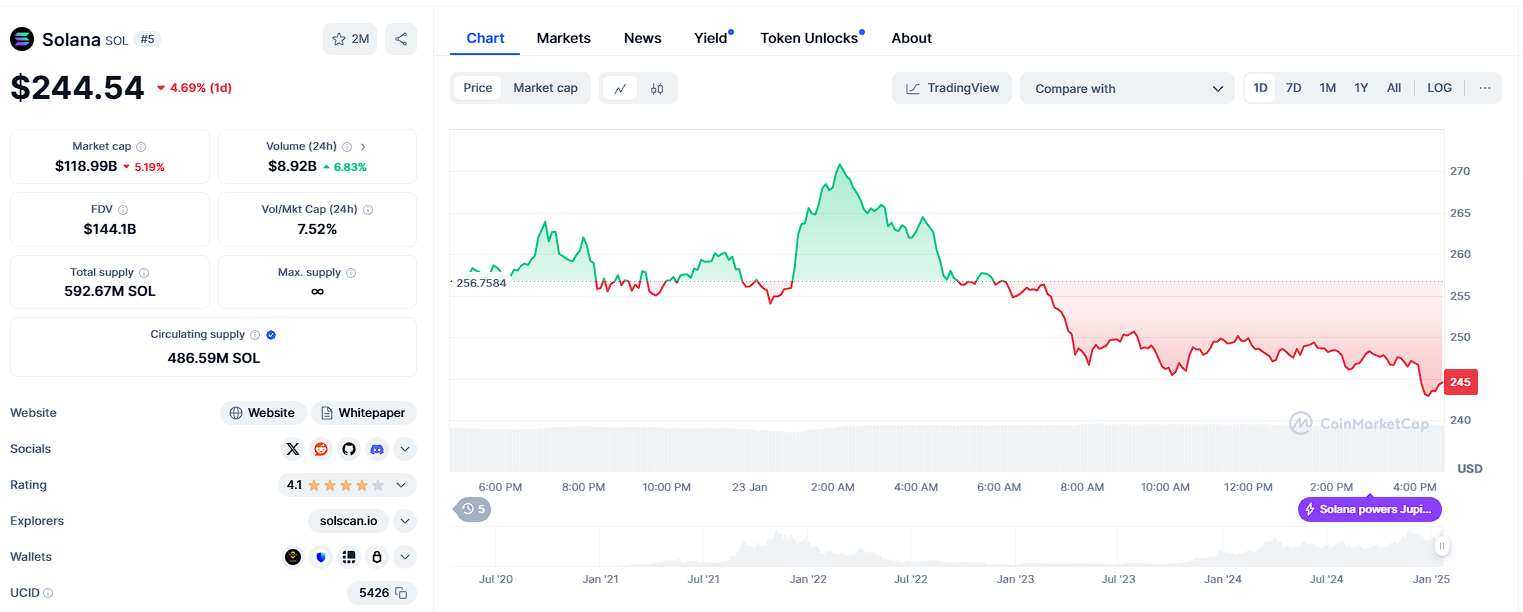

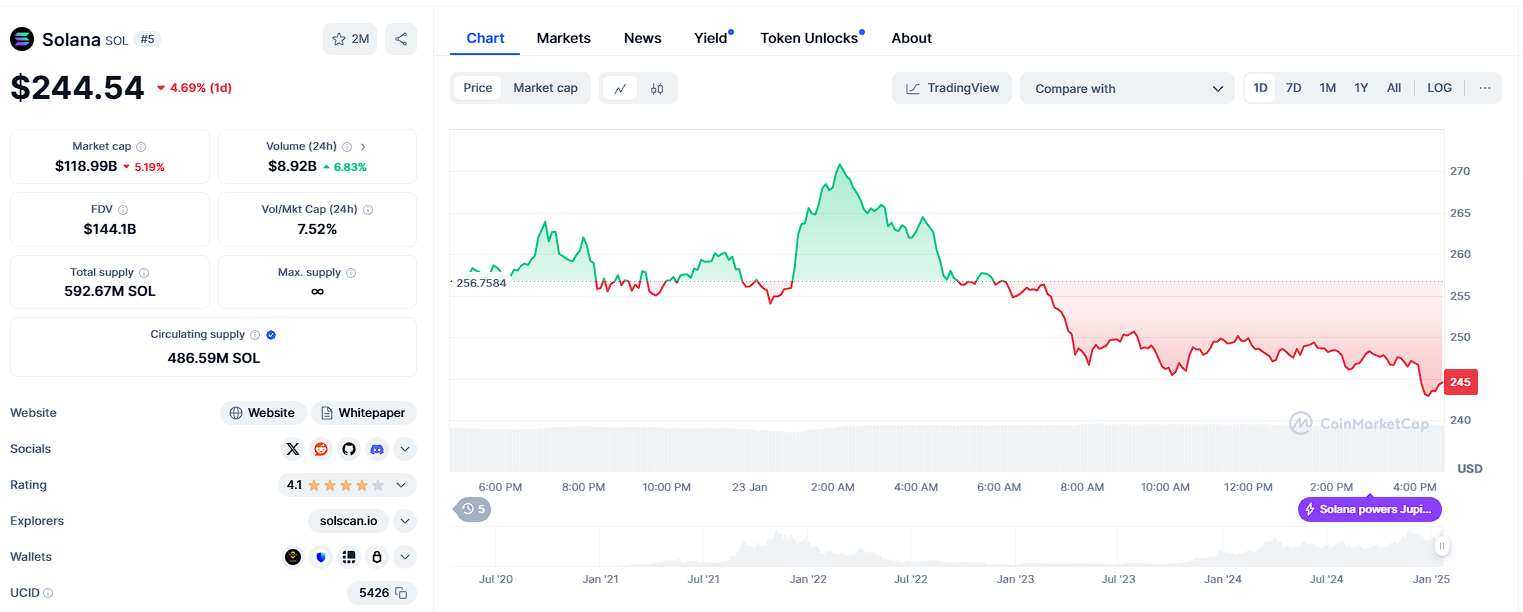

Solana (SOL)

Solana emerges as a quick and scalable different to Ethereum, providing low transaction charges and a quickly rising ecosystem.

Though it faces challenges reminiscent of community downtime, technological enhancements and elevated adoption make it a robust candidate for long-term development.

Solana has gained over 22% over the previous seven days. The coin is presently on monitor to interrupt by $294 and set a brand new all-time excessive.

Polkadot (DOT)

Analysts say Polkadot’s method targeted on interoperability units it aside within the blockchain area. Its technology-focused basis gives many prospects within the medium to long run.

Polkadot has fallen greater than 9% over the previous week, however is predicted to expertise a robust bullish breakout with a goal of $11.65, the all-time excessive reached on December 4th.

chain hyperlink (hyperlink)

Chainlink is the main decentralized oracle resolution, offering real-world knowledge to blockchains to be used in good contracts. As a bridge between off-chain and on-chain knowledge, it is a highly effective long-term technique.

Chainlink’s worth has soared 50% since January fifteenth, rising to $27.14 earlier than encountering resistance. The $32 stage is presently an vital space to look at for LINK.

Avalanche (AVAX)

Avalanche is one other quick blockchain that competes with Ethereum and Solana. With a rising ecosystem and powerful developer assist, AVAX is without doubt one of the corporations to look at for medium-term development.

Avalanche worth has fallen beneath the $48 resistance stage, displaying indicators of bearish strain and is down 8% this week. Any motion above $40 might be carefully monitored.

Arbitrum (ARB)

As a layer 2 scaling resolution for Ethereum, Arbitrum reduces congestion on the Ethereum community by offering quicker and cheaper transactions. Ethereum’s excessive fuel charges make Arbitrum stand out as a sensible resolution.

Arbitrum’s worth fell from $0.82 on the weekend to $0.67 on Monday, indicating a bearish transfer. If it strikes increased, the subsequent resistance stage to take a look at is $0.78.

Disclaimer: The knowledge contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any type. Coin Version isn’t accountable for any losses incurred on account of using the content material, merchandise, or companies talked about. We encourage our readers to conduct due diligence earlier than taking any motion associated to our firm.