- Bitcoin was buying and selling at $103,800, down 3% in 24 hours and 15% for the month.

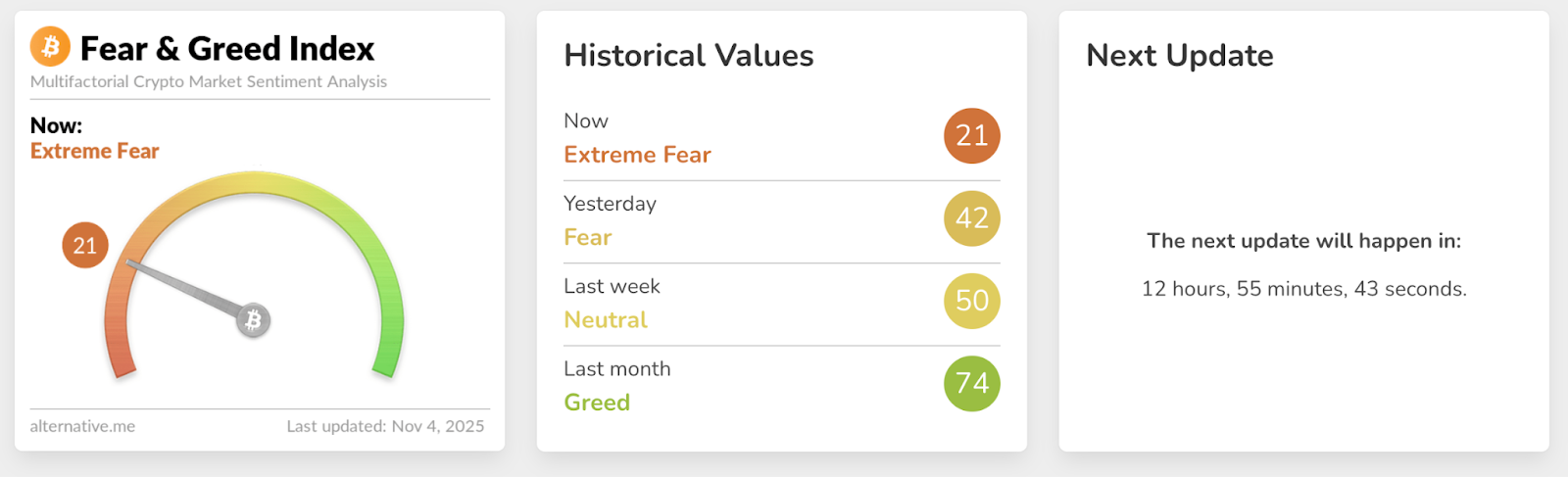

- The Cryptocurrency Worry and Greed Index plummets to 21, indicating “excessive worry.”

- The Fed’s cautious stance and ETF outflows have prompted broad sentiment to say no.

Bitcoin market sentiment fell into “excessive worry” territory on Tuesday as the worth fell under $104,000. The newest studying of the Alternate options Crypto Worry and Greed Index reveals a rating of 21, reflecting a pointy decline in investor confidence.

Bitcoin value is at present $103,803, down 3% prior to now day, 9% within the week, and 16% prior to now month. The pullback erased most of October’s beneficial properties and dampened pleasure after an preliminary surge above $110,000.

Associated: Cryptocurrency Worry and Greed Index declines as market sentiment cools round Bitcoin’s $121,000 stage

Switch of whale raises issues about sale

Market anxiousness deepened after two main Bitcoin holders moved $1.8 billion price of BTC to exchanges, elevating issues about potential promoting strain. In accordance with Lookonchain, dealer “BitcoinOG (1011short)” has transferred roughly 13,000 BTC ($1.48 billion) to Kraken since October 1st.

On the identical time, early adopter Owen Ganden transferred 3,265 BTC ($364.5 million) to the identical trade since October twenty first.

Massive foreign money inflows like this are sometimes taken as an indication that whales could also be getting ready to promote.

Fed coverage shift shakes investor confidence

Bitcoin’s decline additionally adopted the Federal Reserve’s second rate of interest lower of the 12 months final Wednesday. The transfer initially raised hopes for extra liquidity, however the Fed’s message that no additional charge cuts have been deliberate in 2025 dissatisfied traders who had hoped for an extended easing cycle.

A cautious tone weighed on threat belongings, together with cryptocurrencies, as merchants adjusted their expectations for alleviating monetary situations. The Fed’s concentrate on curbing inflation has lowered urge for food for funding in speculative belongings.

ETF outflows add strain

Institutional sentiment additionally weakened. Bitcoin ETFs recorded internet outflows of $188 million on Monday. The Ethereum ETF suffered a lack of $135 million, pointing to cooling demand amongst skilled traders. In distinction, the Solana (SOL) product attracted $44.5 million in weekly inflows.

Worry and greed index indicating excessive anxiousness

The Worry and Greed Index plummeted from final month’s “greed” (74) to “excessive worry” (21) this week. The index measures components equivalent to volatility, quantity, dominance, social media sentiment, and Google search traits to evaluate the general temper of the market.

This speedy change highlights how emotional the market is after the latest sell-off. Traditionally, excessive worry ranges have typically coincided with market bottoms, however analysts warning that sentiment alone just isn’t a dependable sign for entry.

Historic traits supply hope

Regardless of the present financial downturn, historic information reveals that Bitcoin typically rebounds after a pointy drop. November was the strongest month for Bitcoin since 2011, with a mean achieve of 37.5%.

Associated: Bitcoin Value Prediction: $118,000 Potential with Fed QT Suspension and Trump-Xi Summit

Quarterly information additionally suggests room for restoration. After posting a meager +6.4% in Q3, Bitcoin’s return in This fall 2025 is barely -8.4%, leaving the opportunity of a rebound if sentiment stabilizes within the coming weeks.

Disclaimer: The knowledge contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any variety. Coin Version just isn’t chargeable for any losses incurred because of using the content material, merchandise, or providers talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.