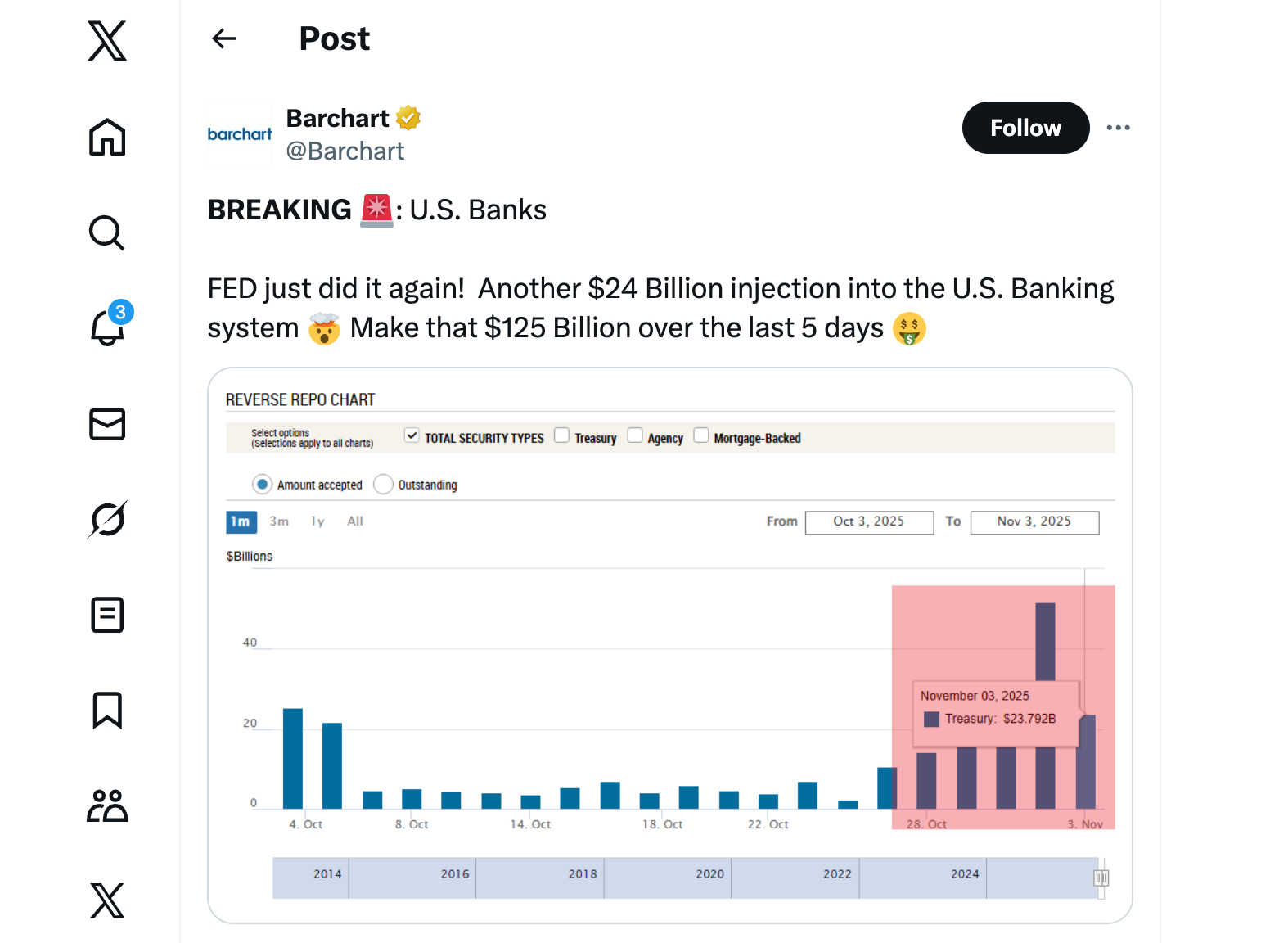

- The Fed injected $125 billion into the US banking system in 5 days.

- This “stealth easing” is at odds with the Fed’s hawkish tone in easing short-term funding stress.

- The market has responded, with the likelihood of a December price lower at 67.3%, in response to the CME FedWatch instrument.

The US Federal Reserve has injected $125 billion into the banking system over the previous 5 days, the biggest short-term liquidity transfer since early 2020. The biggest single-day injection of $29.4 billion was made by in a single day repurchase agreements on October 31, in response to official Fed information.

Repos enable banks to commerce U.S. Treasuries in a single day and switch them into money, serving to alleviate short-term funding stress. The transfer comes as financial institution reserves have fallen to $2.8 trillion, the bottom in additional than 4 years.

Powell speaks robust however actions present ‘stealth easing’

Analysts say the injections sign a break up within the Fed’s technique. Whereas Mr. Powell continues to make robust statements about inflation, the Fed has been quietly including liquidity. The measures seem aimed toward stopping cracks within the monetary system, particularly for small banks which can be beneath pressure.

This obvious “stealth mitigation” seems to be buying and selling available on the market. Federal Reserve Chairman Jerome Powell continues to emphasise the necessity for restrictive coverage to fight inflation. However repo injections successfully add to reserves, decrease short-term borrowing prices, and ease credit score situations — the alternative of tightening.

Analysts say Mr. Powell’s technique seems to be pragmatic: projecting energy publicly whereas quietly stabilizing liquidity behind the scenes.

Associated: China is printing cash quicker than the US, and Bitcoin likes it that means

The market is pricing in a 67.3% probability of a December rate of interest lower.

Merchants imagine there’s a 67.3% probability the Fed will lower rates of interest by 25 foundation factors in December, in response to the CME FedWatch instrument. An additional 22.3% anticipate a big price lower by January, whereas solely 32.7% assume charges will stay unchanged.

Mixed with the Fed’s plan to finish steadiness sheet outflows on Dec. 1, markets are taking this as a sign that tightening is nearly over.

Influence on crypto property and danger property

Cryptocurrency merchants are watching intently. Bitcoin and different dangerous property have a tendency to profit from elevated liquidity. Bitcoin is presently buying and selling at $104,218, down 3.4% over the previous day and 16% over the previous month.

Analysts notice that whereas repos aren’t the identical as long-term quantitative easing, the sudden $125 billion improve in liquidity may nonetheless act as a near-term tailwind for cryptocurrencies by easing funding stress and bettering sentiment.

AI platform Grok famous that Fed liquidity injections have traditionally been bullish for Bitcoin, rising inflation expectations and supporting BTC as a hedge towards fiat devaluation.

X dealer Merlin claimed that international liquidity is about to rise once more. He cited Fed repo inflows, Treasury spending, Asian financial stimulus, and potential credit score easing. For him, this setup may set off a broad market rebound, with altcoins prone to observe as soon as liquidity is absolutely restored.

In the meantime, Thomas Clarow warned that the present repo displays a liquidity squeeze, not an easing. He mentioned Bitcoin typically struggles when liquidity dries up, however it tends to get well when situations enhance.

Analysts are divided on coverage course

Market individuals are divided on what this implies for future Fed coverage. Some see the liquidity transfer as a preemptive measure to stop a money crunch, whereas others interpret it as an early shift towards easing.

Associated: Bitcoin Worth Prediction: $118,000 Doable with Fed QT Suspension and Trump-Xi Summit

Andy Constan of Dumped Spring Advisors mentioned this was possible only a short-term imbalance, including: “If reserves are really briefly provide, the Fed might want to act extra aggressively. For now, that is largely value ignoring.”

Disclaimer: The data contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any type. Coin Version is just not accountable for any losses incurred because of using the content material, merchandise, or companies talked about. We encourage our readers to conduct due diligence earlier than taking any motion associated to our firm.

!operate(e,n,c,t,o,r,d){!operate e(n,c,t,o,r,m,d,s,a){s=c.getElementsByTagName

!operate(f,b,e,v,n,t,s)

{if(f.fbq)return;n=f.fbq=operate(){n.callMethod?

n.callMethod.apply(n,arguments):n.queue.push(arguments)};

if(!f._fbq)f._fbq=n;n.push=n;n.loaded=!0;n.model=’2.0′;

n.queue=();t=b.createElement(e);t.async=!0;

t.src=v;s=b.getElementsByTagName(e)(0);

s.parentNode.insertBefore(t,s)}(window, doc,’script’,

‘https://join.fb.web/en_US/fbevents.js’);

fbq(‘init’, ‘1279980307265195’);

fbq(‘observe’, ‘PageView’);