- Presently, the RSI is 67.13, approaching an extreme stage.

- For the primary time since January, the improbable oscillator has reversed positively.

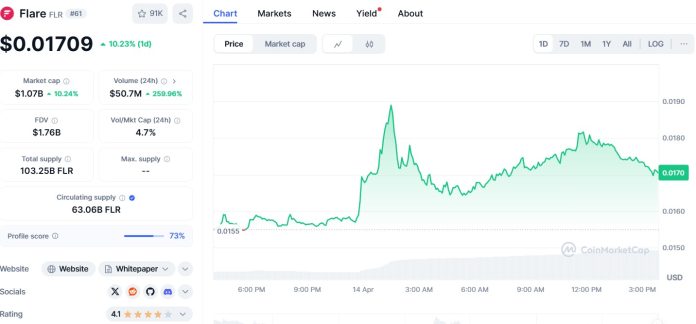

- FLR broke previous resistance at $0.016.

Flare (FLR) appeared this week as probably the most highly effective performers within the Altcoin market, gaining a 57% enhance over the previous seven days to a brand new native excessive of $0.018 on the time of writing.

Supply: CoinMarketCap

The transfer marks a unbroken bullish rally that started on April ninth, with the FLR hitting new day by day highs each day.

Key technical indicators such because the Relative Energy Index (RSI) and Superior Oscillator (AO) recommend that sturdy buying actions outweigh gross sales pressures.

Nevertheless, as RSI ranges are approaching the world of overbuying, analysts warn that if earnings are strengthened, pullbacks might be on the horizon.

RSI of 67 exhibits sturdy shopping for traits

Flare’s relative power index stands at 67.13 on the time of writing, approaching the necessary 70 mark, which normally signifies the situation that was purchased.

The RSI indicator tracks momentum on a scale of 0-100 by evaluating the magnitude of current earnings and losses over a set interval. An RSI above 70 suggests you can overbuy property and repair them rapidly, whereas a price under 30 signifies the alternative.

The upward development of FLR RSI means that patrons at present dominate the market and mirror a sustained curiosity in property. Though the 70 threshold has not but been exceeded, the present worth signifies that the FLR is approaching a possible inflection level.

As the present momentum continues, RSI will rapidly see overbuying indicators, rising the probabilities of a short-term worth drop.

AO reverses constructive for the primary time in two months

Along with bullish feelings, Flare’s superb oscillator has been constructive for the primary time since January twenty sixth.

The AO consists of histogram bars measuring the distinction between easy transferring averages for 5 and 34 intervals, offering perception into market traits and reversals.

The bar has not too long ago flipped over the zero line, displaying a rise in top, indicating a rise in constructive market momentum.

When the AO bar exceeds zero, it normally refers to a reinforcement development. Within the case of FLR, the constant progress of those bars means bullish convictions are constructed throughout the market.

This expertise improvement helps the concept FLR’s current earnings aren’t merely short-term spikes, however are a part of a wider uptrend pushed by bettering investor sentiment.

Value exceeds $0.016 resistance, and eyes $0.021

A current FLR assembly has surpassed the resistance stage, a worth vary that beforehand stored the upward motion down, at $0.016. Sustaining past this stage is taken into account an necessary think about figuring out whether or not the assembly might be expanded.

If $0.016 is held as new help, analysts recommend that AltCoin can rise additional and check the following key resistance at $0.021. Nevertheless, the potential for short-term earnings might problem this bullish prediction.

A brand new wave of gross sales strain might push flr again to below $0.016 and $0.010, notably if RSI has been acquired throughout territory and market members are attempting to lock in earnings.

Technical indicators help short-term advantages

General, the technical indicators of FLR stay largely constructive. The mix of rising RSI, constructive AO crossovers, and breakouts above earlier ranges of resistance present steady bullish momentum within the quick time period.

Nevertheless, merchants are suggested to watch RSI carefully. Shifting past 70 might point out that the correction might be due, particularly if quantity begins to drop or if the candlestick sample suggests hesitant amongst patrons.

At this stage, integration capabilities above $0.016 might decide the following stage of worth motion.

Technical Flash over-purchase first appeared on Coinjournal, leading to a 57% post-flare (FLR) spike in every week.