- Caroline Ellison sentenced to 2 years in jail for fraud in Alameda/FTX's $8 billion misuse of funds.

- Ellison's actions, influenced by Bankman Freed, assist cut back her sentence.

- The choose imposed a two-year jail sentence and $11 billion in fines for monetary fraud, refusing to droop the sentence.

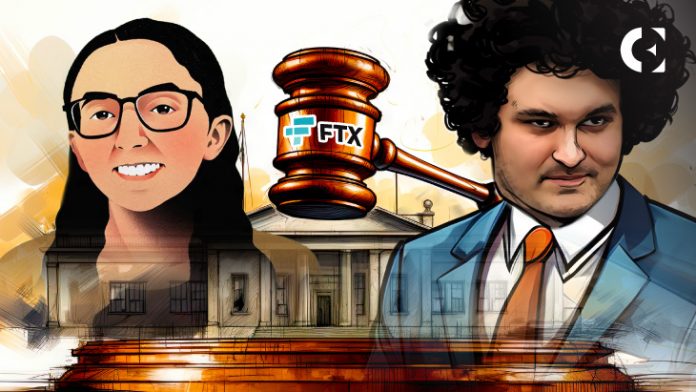

Former Alameda Analysis CEO Caroline Ellison was sentenced to 2 years in jail for her function within the collapse of cryptocurrency alternate FTX. Ellison's sentencing in New York federal court docket follows her responsible plea to fraud and conspiracy prices associated to the FTX fraud, which price prospects billions of {dollars}.

Mr. Ellison, who headed Alameda Analysis, was concerned within the misappropriation of buyer funds. Alameda obtained roughly $8 billion from FTX accounts below the course of Sam Bankman Fried. These funds have been then used for Alameda's buying and selling operations and different functions, leading to enormous losses for patrons and buyers.

Additionally learn: Was justice served? Caroline Ellison’s function within the FTX scandal and her sentence

Mr. Ellison's actions influenced by Bankman Freed

Assistant U.S. Lawyer Daniel Sassoon mentioned Ellison was accountable however argued her actions have been influenced by her former boss. Mr. Sassoon in contrast Mr. Ellison's actions to these of Mr. Bankman-Freed, who appeared to don’t have any regret and was at better danger of reoffending.

Ms. Ellison's lawyer, Anjan Sahni, described her as being below the affect of Bankman Freed each publicly and privately. Sarni mentioned Ellison's involvement within the unlawful actions in Alameda was pushed by her want to fulfill Bankman Freed's expectations.

ALSO READ: Blame the drama: Caroline Ellison says it was 'Sam' who ruined FTX

Decide's assertion and sentencing

U.S. District Decide Lewis Kaplan, who dealt with each the Bankman Fried and Ellison instances, expressed an identical opinion at sentencing. Kaplan acknowledged Ellison's guilt however cited his intensive cooperation with prosecutors as a consider decreasing his sentence. Mr. Kaplan additionally famous Bankman Freed's affect on Mr. Ellison, describing him as “kryptonite.”

Ellison's sentence was harsher than the no-prison supervised launch advisable by the Probation Division. She was sentenced to 2 years in jail and ordered to pay $11 billion in restitution. The case concerned the chapter of a $32 billion firm and ranks as one of many largest monetary frauds in U.S. historical past.

Disclaimer: The knowledge contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any sort. Coin Version just isn’t liable for any losses incurred because of the usage of the content material, merchandise, or providers talked about. We encourage our readers to conduct due diligence earlier than taking any motion associated to our firm.