Markets are bracing for volatility forward of the launch of the spot ETH ETF within the U.S. as we speak. ETH value motion has been comparatively uninteresting over the previous few weeks, however it seems that giant holders are anticipating value volatility and are speeding to money out.

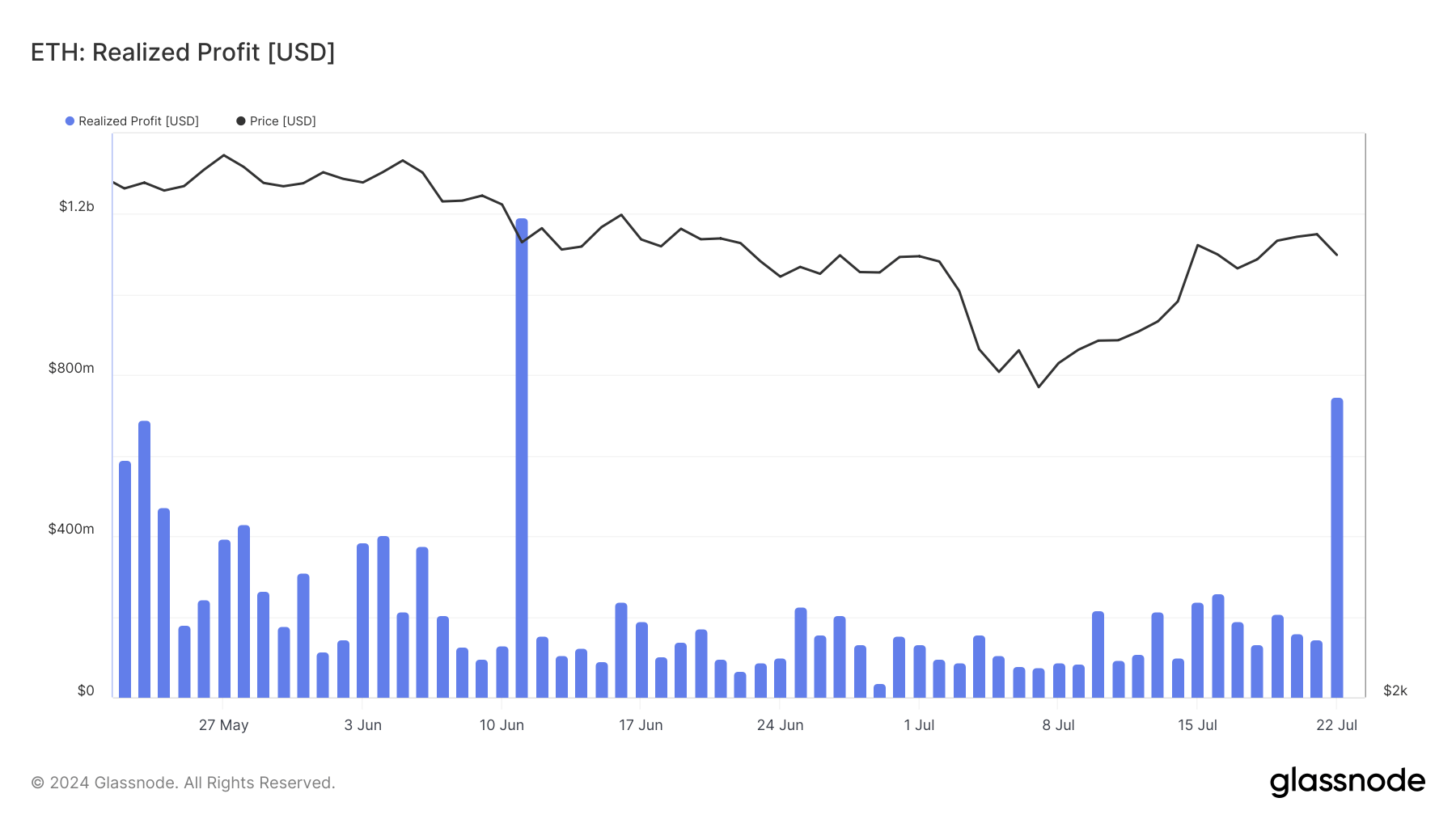

Glassnode information on realized income from Ethereum holders confirmed a dramatic enhance from $144.598 million on July 21 to $747.311 million on July 22. This was a major enhance and the very best realized income in a 40-day interval.

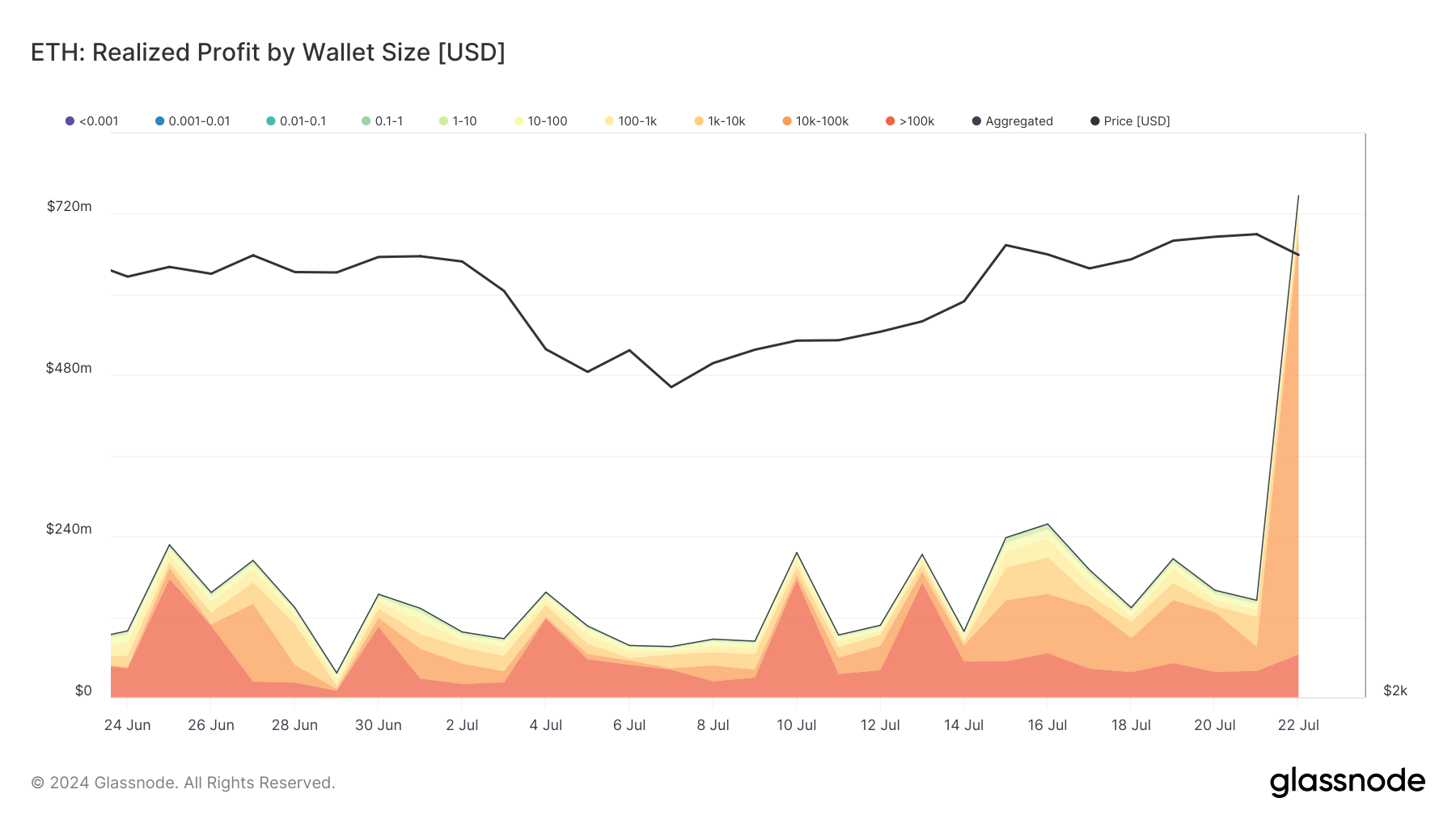

Such a surge requires nearer scrutiny of the dimensions and holding interval of the wallets concerned within the selloff. The information exhibits that wallets holding between 10,000 and 100,000 ETH made $626,982,000 on July 22, up from $35,744,000 the day earlier than. This means that bigger holders, probably establishments and excessive web value people, are cashing out forward of the ETF's launch.

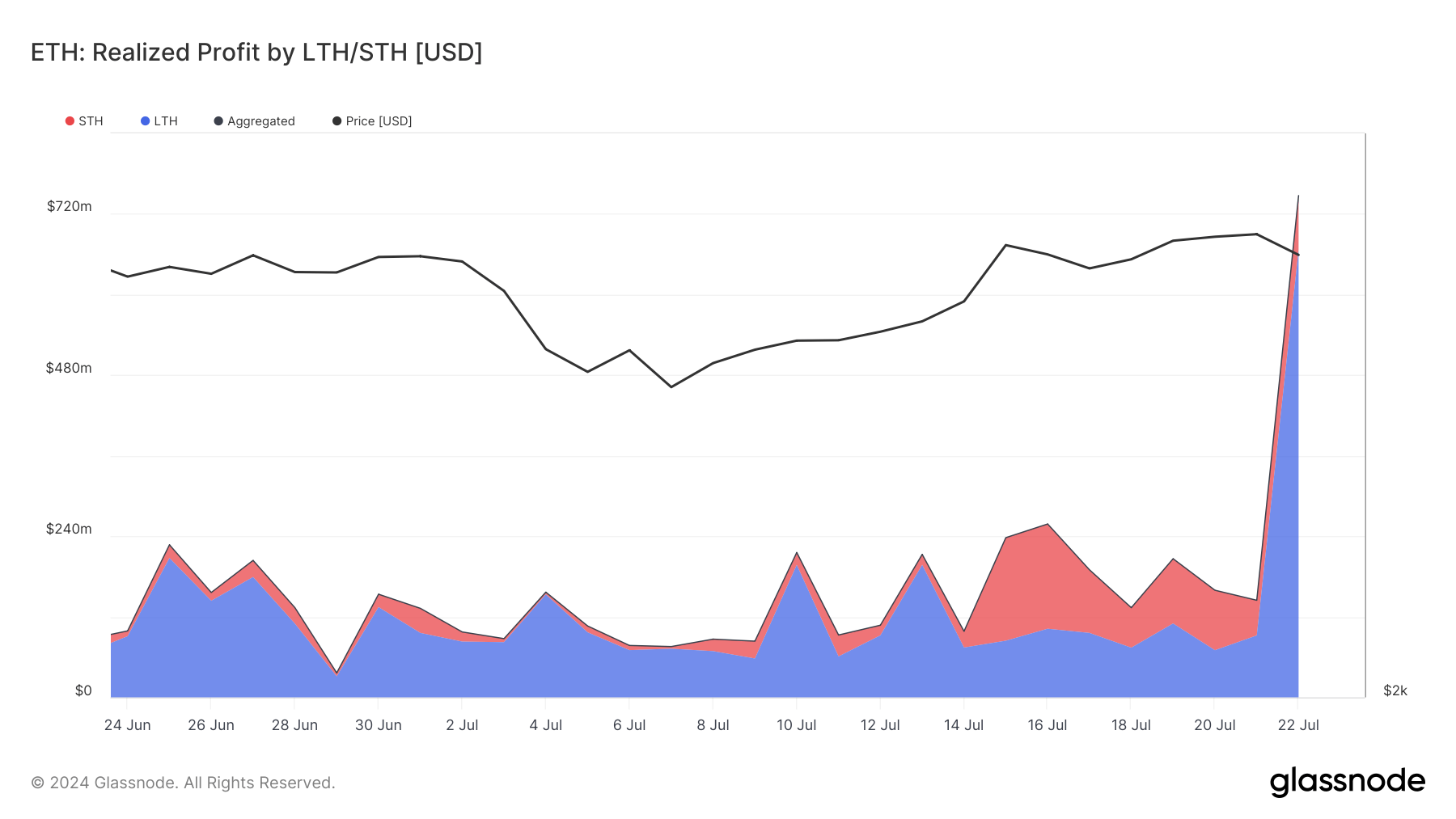

Moreover, the big enhance in realized positive aspects was primarily pushed by long-term holders: Earnings from wallets holding ETH for over a yr surged from $92.751M to $666.227M. This conduct is in keeping with a strategic transfer to lock in income forward of potential market volatility related to the ETF's launch.

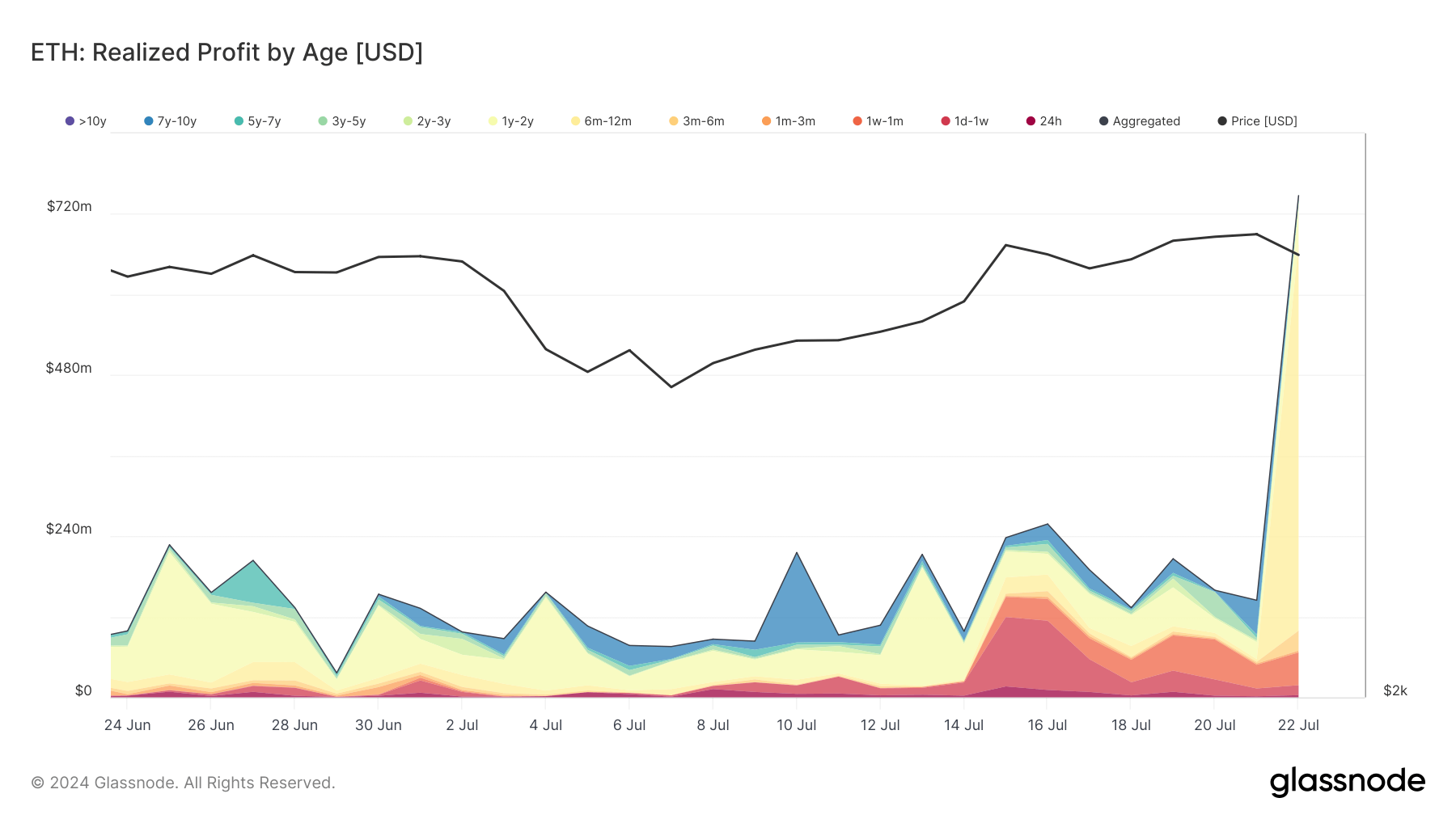

Breaking down realized positive aspects by holding interval, probably the most notable enhance is seen within the 6-12 month holding interval class, the place realized positive aspects jumped from $3.964 million to $577.677 million, suggesting that holders from mid-2023 onwards are locking in positive aspects.

The surge in realized positive aspects highlights the market's cautious angle in direction of the modifications anticipated with the arrival of the spot ETH ETF. Additional realized positive aspects are anticipated to happen within the coming weeks as buying and selling picks up. currencyjournals beforehand reported that pre-market buying and selling for the ETH ETF has already attracted vital curiosity, indicating the market is making ready for all of the potential alternatives and dangers related to the brand new ETF.

It is usually doable that giant institutional traders and Ethereum holders are realizing positive aspects and reinvesting them into ETH ETFs somewhat than holding spot ETH straight. For institutional traders and excessive web value people, the regulatory oversight and transparency of ETFs can mitigate the dangers related to holding ETH straight. One other main profit is the simplification of tax reporting related to ETFs. In lots of jurisdictions, ETFs are handled extra favorably for tax functions than straight holding the underlying property. This interprets into extra environment friendly tax administration, particularly for traders with giant asset volumes.

Liquidity can also be an necessary issue. ETFs are traded on conventional inventory exchanges, which implies they’re extremely liquid and trades are simply settled. For giant holders, the flexibility to rapidly liquidate ETH positions with no vital affect in the marketplace value is a significant benefit.

The publish Massive Holders Money Out Forward of Ethereum ETF Launch appeared first on currencyjournals