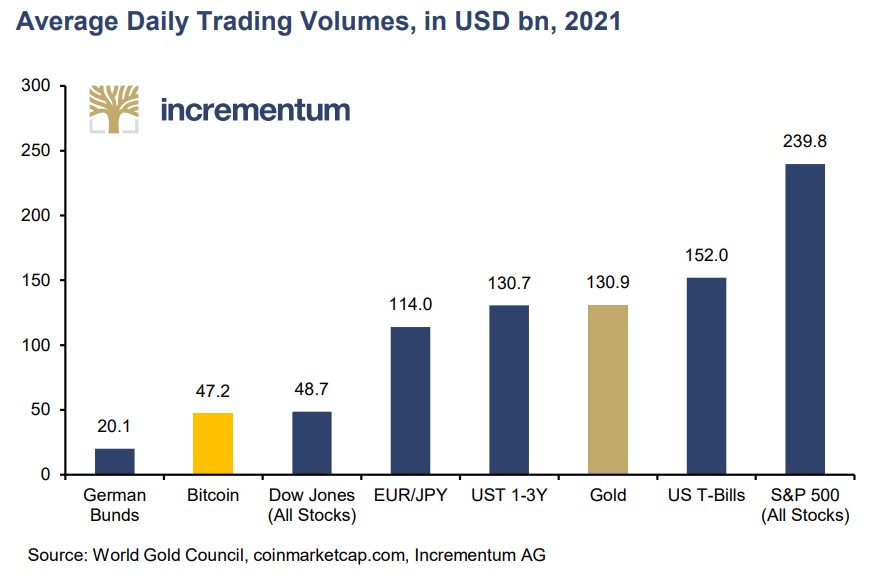

- As Bitcoin Buying and selling Quantity Will increase, A Portfolio Diversified in Gold and Bitcoin Makes Sense

- Gold Stability Offsets Bitcoin Volatility

- On this manner, traders can take part in Bitcoin’s upside potential with out sacrificing threat parameters.

Portfolio administration offers with managing threat. Not all dangers may be averted. Danger-averse traders don’t need to take no threat in any respect.

Relatively, risk-averse traders need larger risk-adjusted returns. Naturally, the upper the potential return, the upper the chance.

Buyers construct portfolios of various property to seek out the very best risk-adjusted returns. Ideally, the property are negatively correlated, giving the investor a diversification benefit.

But it surely additionally is smart to construct a portfolio with correlated property. Portfolios are riskier, however another asset traits could also be engaging to extra risk-taking traders.

As Bitcoin’s common every day buying and selling quantity will increase, such a diversified portfolio may embrace gold and Bitcoin.

Why Add Gold and Bitcoin to Your Portfolio?

Diversifying a portfolio spreads threat throughout uncorrelated property. The portfolio supervisor’s problem is to discover a stage of diversification past which diversification gives no profit.

Historically, gold’s function in a portfolio is to supply stability. By including Bitcoin to your portfolio, you possibly can take part within the upside potential of cryptocurrencies, whereas combining with gold to mitigate the dangers related to Bitcoin’s volatility.

(tags to translate) evaluation

Comments are closed.