- Bitcoin is approaching historic oversold ranges, suggesting a possible accumulation part.

- Gold has hit document highs and continues to play a safe-haven position.

- Ricardo Salinas predicts Bitcoin will attain $1.5 million, similar to gold’s $30 trillion market cap.

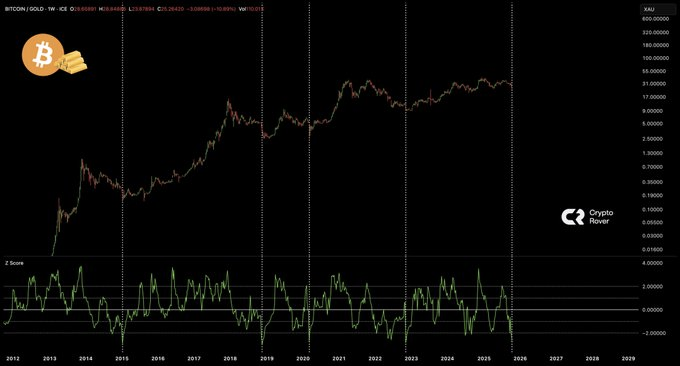

Bitcoin’s efficiency relative to gold has been within the highlight following technical knowledge displaying oversold ranges seen over the previous decade. In line with historic evaluation shared by market analyst Crypto Rover, the Bitcoin-to-gold ratio (BTC/XAU) displays a cyclical sample in line with Bitcoin halving occasions, which frequently precede main bull markets.

The chart, which covers the interval from 2012 to 2025, reveals three distinct phases throughout which Bitcoin outperformed gold: 2013, 2017, and 2021. These cycles had been adopted by correction phases as noticed in 2018, 2022, and mid-2024, throughout which gold briefly regained energy.

The indicator under the chart, the Z-score indicator, is at the moment at near-historic lows, suggesting that Bitcoin could also be getting into a brand new accumulation part. Analysts contemplate these ranges to be an early sign of a potential pattern reversal, in line with the historic long-term restoration cycles noticed within the BTC/XAU ratio.

Bitcoin market efficiency displays short-term pressures

Bitcoin (BTC) was buying and selling at $106,855 on the time of writing, registering a each day achieve of 0.36%, however stays below stress after dropping 5.40% weekly and eight.23% month-to-month. Regardless of the short-term volatility, the cryptocurrency stays up 25.46% over the previous six months and 14.51% year-to-date.

Associated: BTC/XAU chart collapses as gold hits document regardless of billionaire Salinas’ $1.5 million BTC name

Fueled by continued institutional demand and ETF inflows in early 2025, BTC is up 58.61% in 12 months and 840.66% in 5 years.

Gold maintains robust upward pattern as buyers search stability

Gold (XAU) reached an all-time excessive of $4,380 earlier than falling 1.67% in 24 hours to $4,253.97. The steel continued to outperform most asset lessons in 2025, rising 62.05% year-to-date and 57.96% yearly.

Associated: Digital Gold vs. Actual Gold: Bitcoin’s Unstable Rise Closes in on Gold Over $3.5 Million

Reflecting continued demand from buyers amid world uncertainty, gold has gained 16.24% over the previous month, with a six-month efficiency of 27.66%. The five-year return of 123.97% confirms gold’s standing as an essential hedge throughout instances of financial instability.

Salinas Priego plans to make $1.5 million price of Bitcoin to match the worth of gold

Including to the market debate, Mexican billionaire Ricardo Salinas Priego estimated that Bitcoin would want to rise 14 instances to succeed in the identical stage as gold’s $30 trillion market cap. With BTC at the moment at $106,855, Salinas’ prediction units the extent goal at $1,516,000 per coin, a quantity he believes may emerge inside the subsequent 12 months.

Disclaimer: The data contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any variety. Coin Version isn’t answerable for any losses incurred because of using the content material, merchandise, or companies talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.