Coinbase, a number one US-based cryptocurrency alternate, has seen its market share soar after introducing a number of spot Bitcoin exchange-traded funds (ETFs) in January.

In response, Goldman Sachs analysts raised their ranking on Coinbase inventory from promote to impartial and adjusted their worth goal to $282.

coinbase shares

Banking analysts wrote:

“With crypto costs hovering to all-time highs, COIN every day buying and selling quantity reaching ranges not seen since 2021, and our income forecast growing by 48% since early February, we We’re upgrading the inventory from Promote to Impartial.”

Analysts defined that the choice displays altering situations within the cryptocurrency market and the ensuing influence on Coinbase's efficiency.

Beforehand, JPMorgan analysts upgraded Coinbase's inventory from “impartial” to “underweight,” citing crypto market pressures and the potential for income from new ETF launches to shift away from Coinbase. It was downgraded to

Coinbase inventory has risen considerably over the previous month, buying and selling at round $244 in pre-market buying and selling as we speak, marking a formidable 105% acquire over the previous month, in keeping with information from Yahoo Finance.

market share development

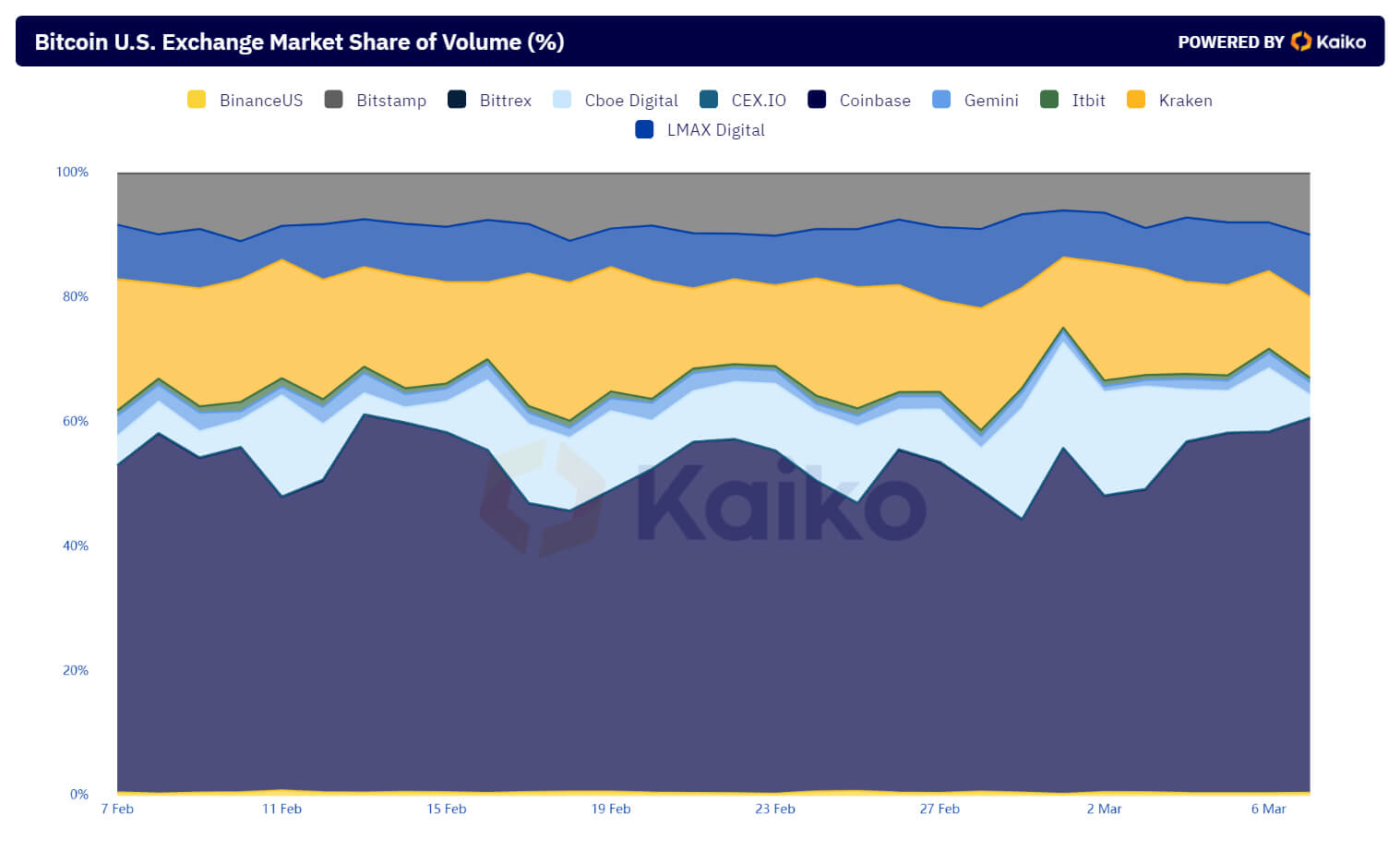

Coinbase’s market energy has surged from 47% to 60% up to now three months because the approval of a Bitcoin ETF in January, in keeping with information from blockchain analytics agency Kaiko.

The platform's spectacular development is because of elevated consumer engagement, propelling its apps to noteworthy rankings. Presently, Coinbase is his thirteenth hottest monetary utility in the US, as tracked by Sensor Tower, which tracks the expansion of platform monitoring apps.

Nevertheless, throughout this rise, Coinbase grappled with technical challenges that resulted in customers experiencing zero balances of their accounts. Coinbase CEO Brian Armstrong attributed the glitch to an enormous spike in visitors attributable to BTC's rise to new file highs.

Past the technical setbacks, Coinbase has weathered a scenario fraught with regulatory hurdles over the previous yr, significantly with the U.S. Securities and Change Fee.

The put up Goldman Sachs Upgrades Coinbase Ranking Amid Rising Cryptocurrency Costs and Rising Market Energy appeared first on currencyjournals.