Grayscale, one of many issuers of a forthcoming Ethereum exchange-traded fund (ETF), has lowered its administration charges for its mini-trust from 0.25% to 0.15%, in keeping with a July 18 submitting.

The corporate stated:

“Grayscale Investments has up to date the Grayscale Ethereum Mini Belief's registration assertion to incorporate a 0.15% administration charge. As well as, the corporate is waiving charges to 0% for the primary six months for as much as $2 billion in property underneath administration (AUM).”

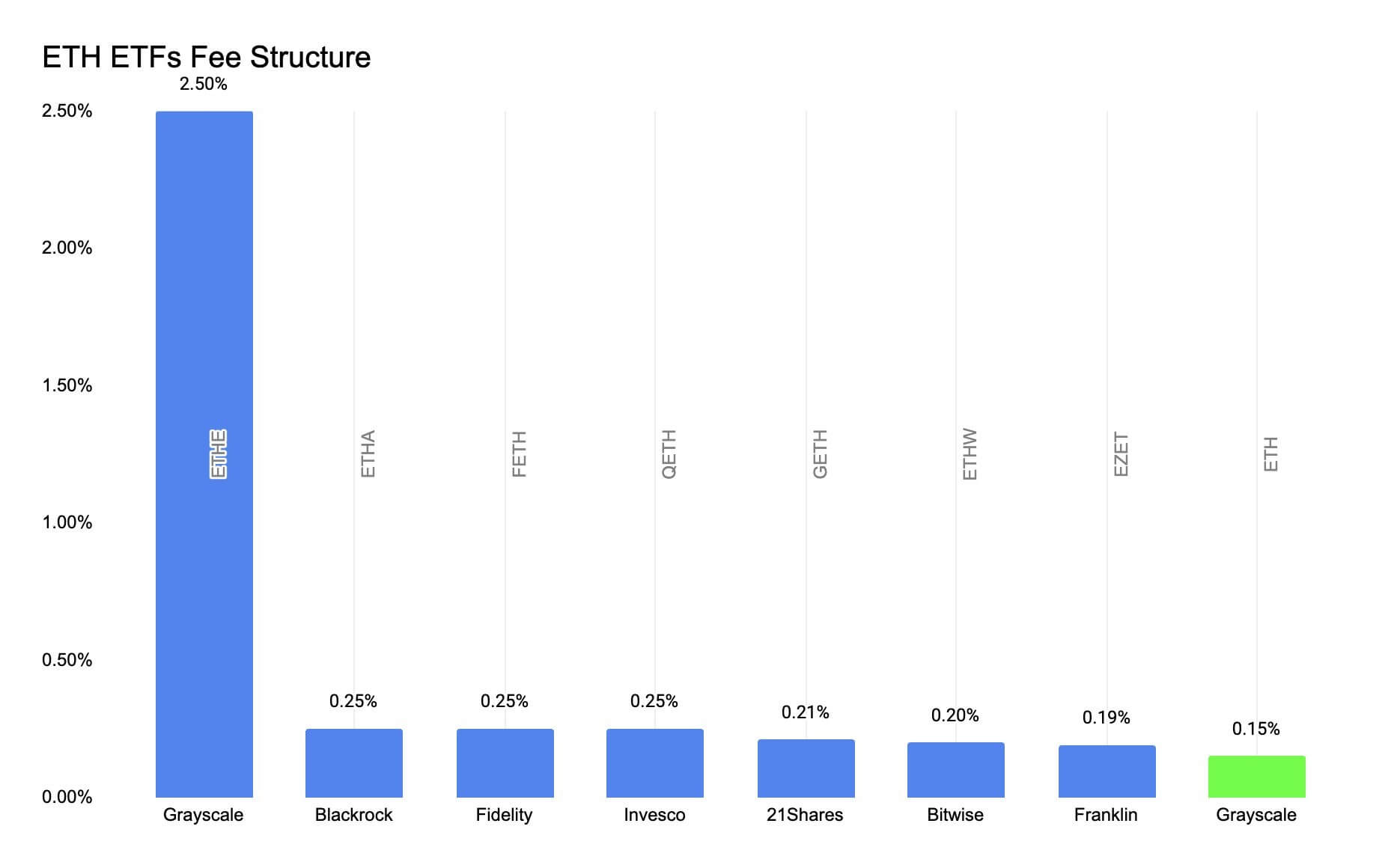

The transfer makes Grayscale's Ethereum ETF each the most affordable and the costliest: The Grayscale Ethereum Belief (ETHE), which can convert into an ETF, will preserve its 2.5% charge construction, however the mini-trust may have the bottom charges in the marketplace.

Market analysts have beforehand predicted that ETHE's excessive charges may drive traders to cheaper options from rivals akin to BlackRock, Constancy Investments, VanEck, Bitwise and Franklin Templeton, which cost charges of 0.19% to 0.25%.

Notably, an analogous state of affairs is going on with spot Bitcoin ETFs: Grayscale's Bitcoin Belief has seen over $18 billion in outflows since changing into an ETF in January, with traders flocking to cheaper ETFs from the likes of BlackRock.

To forestall this from taking place once more, Grayscale is reallocating 10% of the $10 billion from ETHE to fund the mini-trusts, and by reducing the charges for the mini-trusts, Grayscale is providing essentially the most aggressive charges.

Market observers imagine the transfer will stem among the ETHE outflows. Crypto analyst Karl stated:

“Grayscale lowered ETH charges to 0.15%, at the moment essentially the most aggressive ETF from a charge perspective. This may keep away from outflows from Grayscale and probably scale back ETHE outflows. There are rumors that ETHE to ETH conversions are tax-free, which is much more bullish.”

Equally, Nate Geraci, president of ETF Retailer, highlighted the significance of the transfer, saying it was a daring transfer given Grayscale’s key position in launching cryptocurrency ETFs.

He added:

“Grayscale has paved the best way for regulation of spot Bitcoin and Ethereum ETFs. That's it. There's no cause to not reap the benefits of this chance and display management in how we strategy the competitors within the spot cryptocurrency ETF area.”