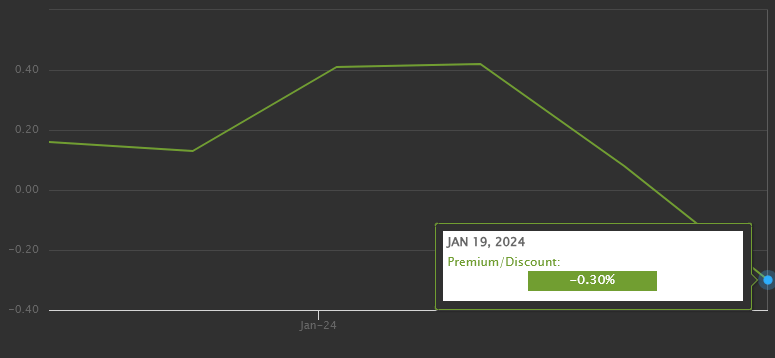

BlackRock's iShares Bitcoin Belief recorded its first low cost to web asset worth (NAV) on January 19, with the low cost charge dropping to -0.30%, in keeping with BlackRock's official knowledge.

“The desk and line graph above present details about the distinction between the day by day closing worth of the Fund's shares and the Fund's web asset worth. The closing worth is decided by the Fund's listed change.” – Black Rock

Conversely, Grayscale (GBTC)'s NAV has now shrunk barely, at simply -0.27%, after a protracted interval of deep reductions, in keeping with Y-Chart knowledge. GBTC was at a staggering 48% low cost to NAV on December twenty second. Nonetheless, the low cost ended because the Bitcoin ETF rose in anticipation of the conversion to identify, reaching simply -1.55% on the conversion date. This low cost charge continues to shut and exceeds even a number of the “new child 9” Bitcoin ETFs equivalent to IBIT.

iShares Bitcoin Belief had a unstable first week, with NAV per share beginning at $26.59 and falling to $23.87 by January nineteenth. Throughout the identical interval, the Belief's excellent shares elevated considerably from 400,000 to greater than 50 million.

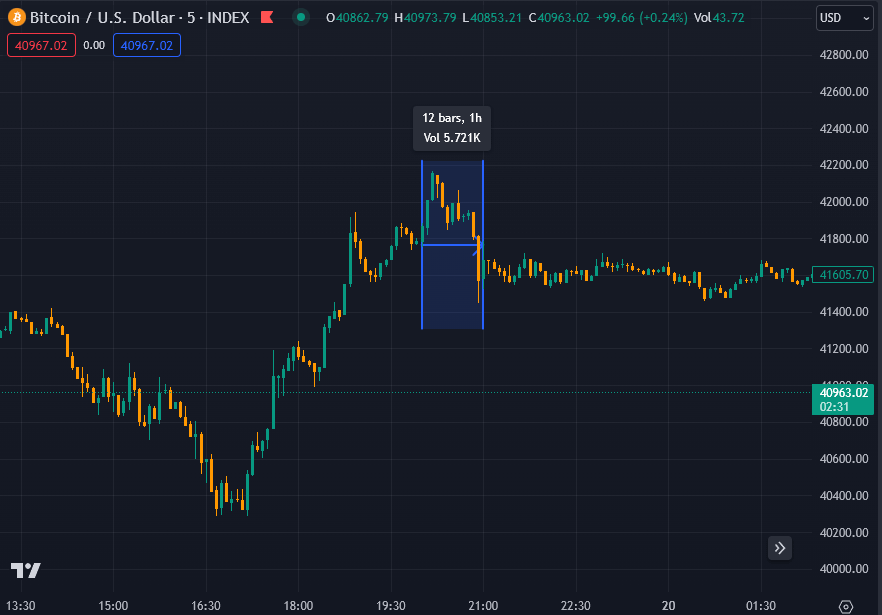

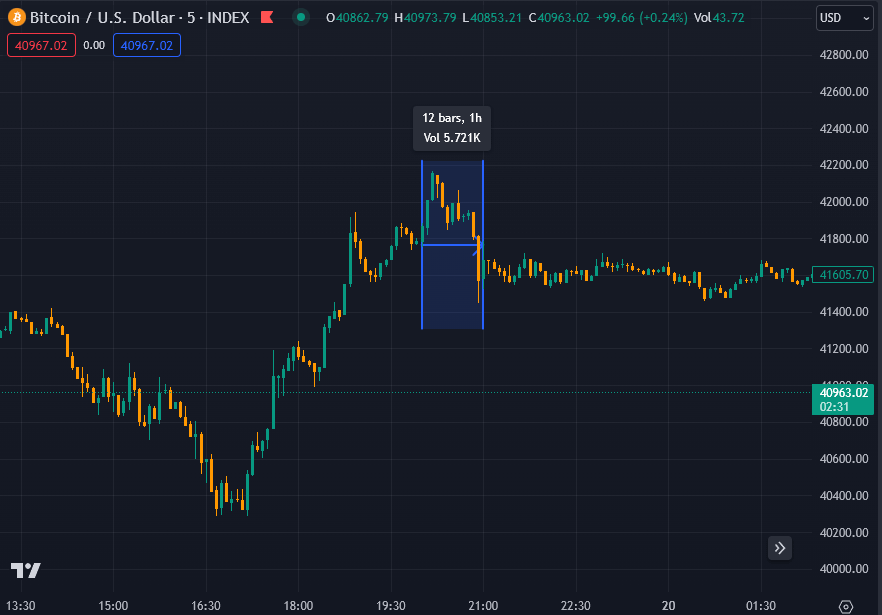

NAV premium/low cost fluctuated barely, registering a 0.16% premium on launch day, peaking at 0.42% by January 17, after which falling again to low cost. This variation signifies traders' fairness valuation of the underlying Bitcoin belongings held by the belief. A premium signifies that the inventory's valuation is greater than his NAV, and a reduction signifies that the valuation is decrease. As highlighted within the chart beneath, the Bitcoin base charge used was $41,898 calculated between 8:00 PM and 9:00 PM GMT (3:00 PM and 4:00 PM EST). did.

Whereas Bitcoin's underlying worth has fallen in direction of the psychological assist of $40,000 and is buying and selling at $40,840 on the time of writing, IBIT inventory has fallen to the market after closing at $23.80 on Friday, January nineteenth. It was beforehand buying and selling at $23.39.

In consequence, IBIT inventory has fallen 1.72% since Friday's buying and selling hours. In distinction, the underlying asset, Bitcoin, would fall by round 2.5% if it doesn’t recuperate by the point the bottom rate of interest (BRRNY) is calculated later at present. If IBIT inventory trades like Bitcoin throughout January twenty second, the low cost may reverse and probably rise to a premium of as a lot as 0.7%, primarily based on present calculations. Nonetheless, with main markets not opening for a number of hours, IBIT is prone to fill this hole throughout official buying and selling hours.

Because of the time lag in reporting ETF knowledge, the influence of reported NAV is proscribed. BlackRock mentioned in his prospectus that it’ll publish the Intraday Indicator Navigator (IIV). Nonetheless, this knowledge shouldn’t be revealed on the official web site, however needs to be out there at IBIT.IIV by way of the Nasdaq buying and selling terminal.

Since its inception, iShares Bitcoin Belief's belongings beneath administration (AUM) have reached $1,346,912,907.59 with 33,430 BTC beneath administration, highlighting the size of the belief's operations and the extent of funding it has attracted in a brief time frame. With the variety of shares excellent rising by greater than 10x, the general well being of the belief suggests elevated investor curiosity.

(Tag translation) Bitcoin

Comments are closed.