Inflows into the New child 9 ETF fell greater than 50% over the previous week, from $254 million to $126 million, in accordance with CoinShares' weekly report.

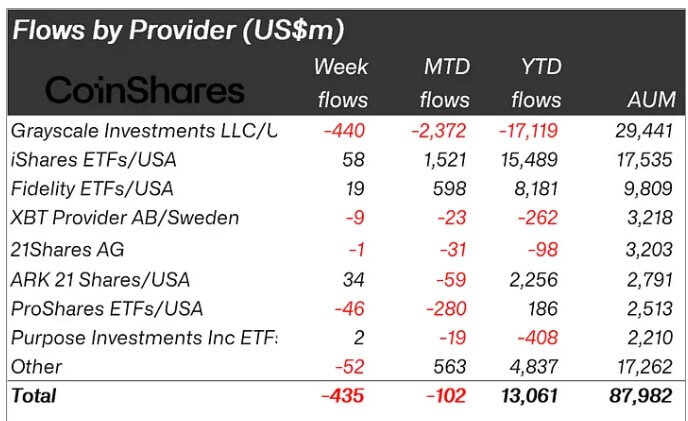

These declines in inflows resulted within the third consecutive week of $435 million in outflows recorded by main crypto-related funding merchandise in the identical week, the most important outflow since March, in accordance with the report.

Grayscale leads regardless of 'slowing outflow'

A breakdown of flows exhibits that Grayscale GBTC nonetheless accounts for almost all of outflows, with $440 million flowing out of this product final week.

Nonetheless, that is the bottom weekly GBTC outflow in 9 weeks, exhibiting indicators that outflows are slowing. Regardless of this, whole outflows from GBTC year-to-date have exceeded $17 billion.

James Butterfill, Head of Analysis at CoinShares, added:

“Grayscale's outflows proceed to sluggish, however inflows from new issuers have additionally slowed, with inflows of $126 million final week in comparison with $254 million the earlier week. It stayed.”

As a result of slowdown in inflows, buying and selling quantity additionally fell, falling from $18 billion to $11.8 billion.

Final week, main ETF issuers like BlackRock and Constancy recorded a number of days with zero flows. Market observers interpreted this development as an indication that investor curiosity within the asset class was waning.

Altcoins entice consideration

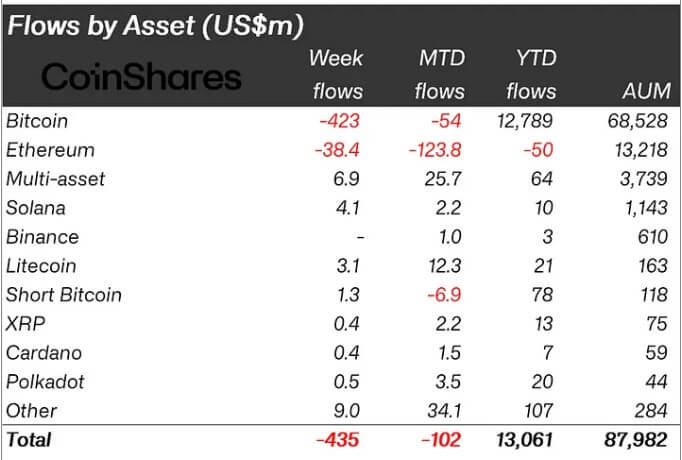

Final week noticed inflows into funding merchandise associated to digital property reminiscent of Solana, XRP, Cardano, Polkadot, and Chainlink. CoinShares experiences that cumulative inflows into these property are over $25 million.

In the meantime, Ethereum continued its development of outflows, with one other $38.4 million in outflows, bringing the full for the month to $123.8 million. Yr-to-date stream is destructive $50 million.

Notably, the prevailing bearish sentiment out there attracted bears, who added $1.3 million to their brief curiosity in Bitcoin funding merchandise.

talked about on this article

(Tag translation) Bitcoin