The launch of the spot Ethereum ETF has but to dwell as much as the market’s preliminary optimism, as mirrored in its efficiency over the previous few weeks.

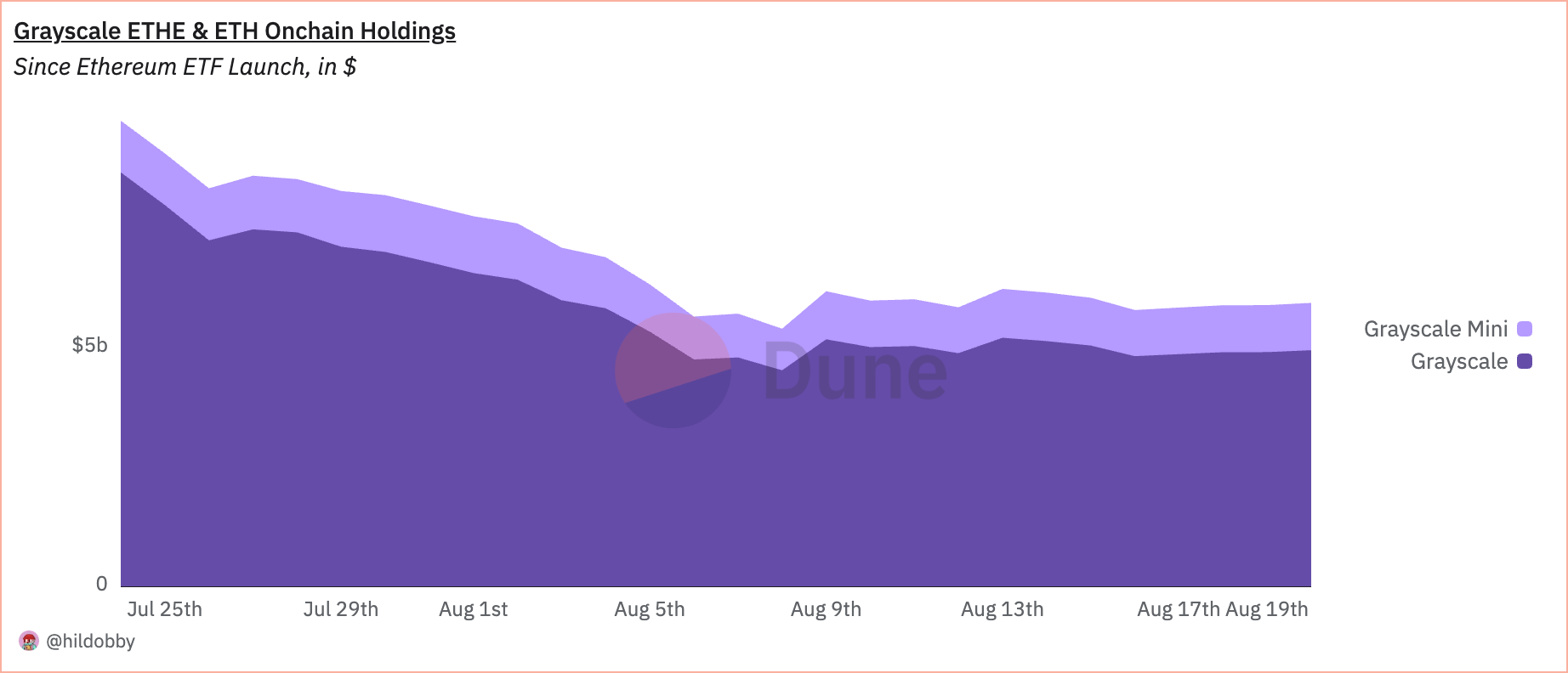

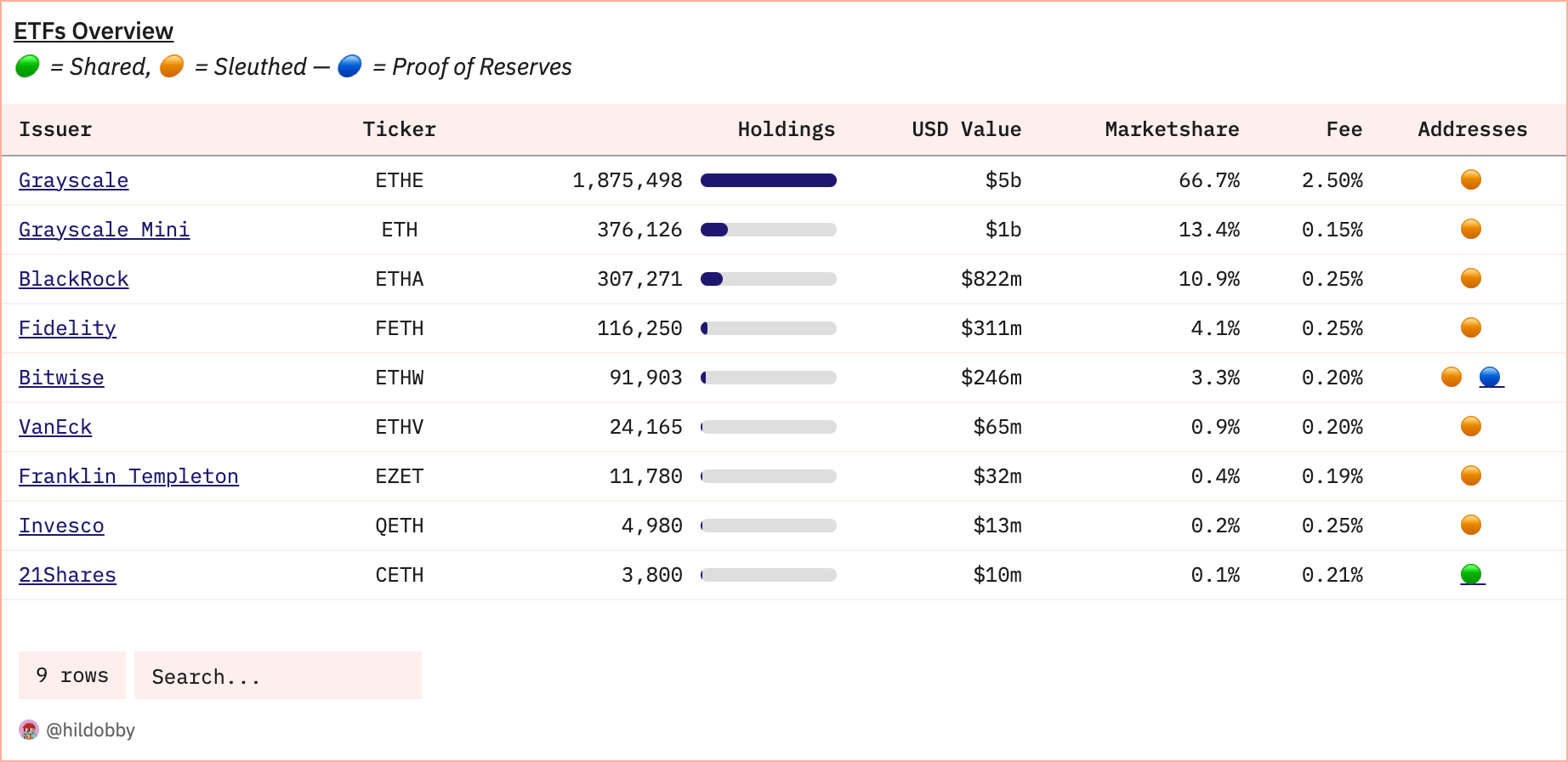

The Ethereum ETF at present has on-chain holdings of roughly 2.81 million ETH, valued at roughly $7.33 billion, representing roughly 2.3% of Ethereum’s whole provide.

Regardless of these important holdings, web outflows since launch have been unfavourable, with whole outflows standing at 136,700 ETH.

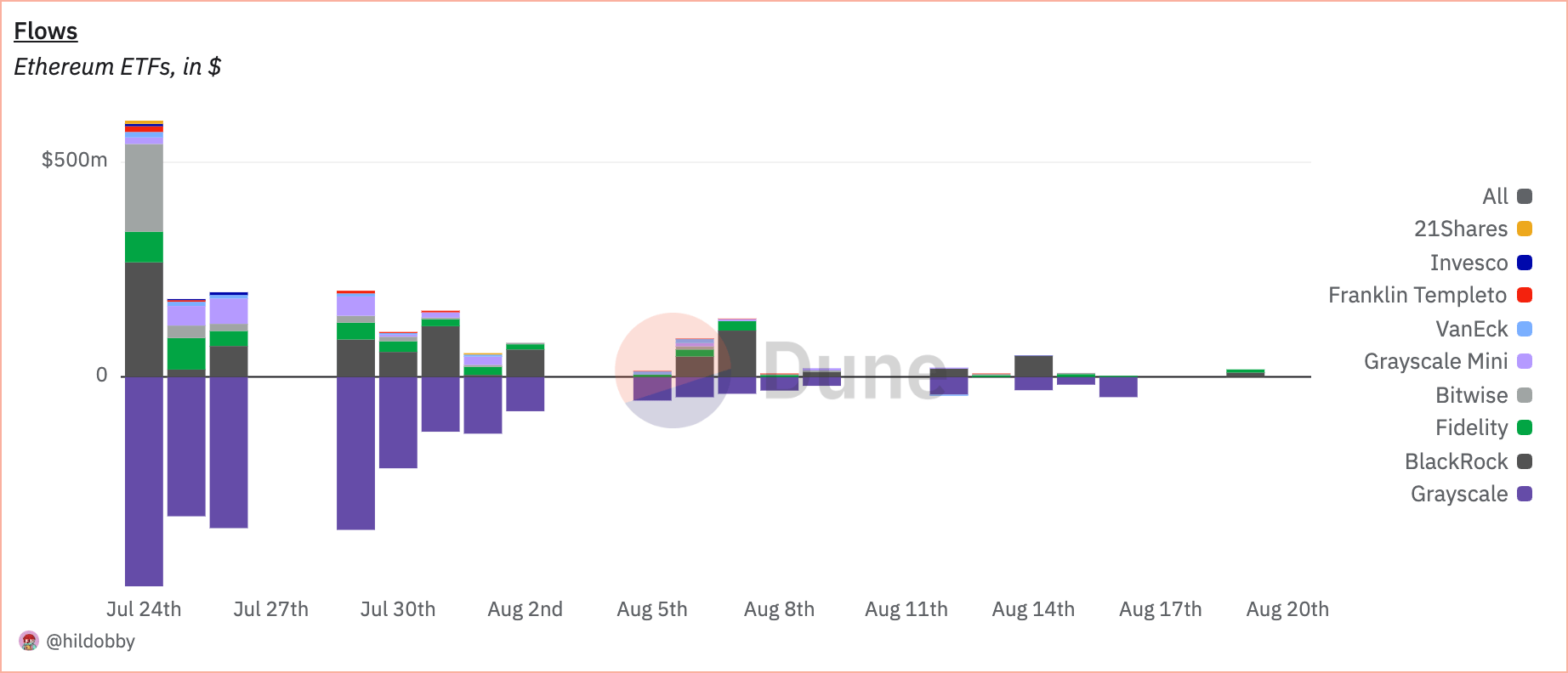

The outflows have been primarily pushed by Grayscale's ETHE, which noticed $487.88 million in outflows on its first day of buying and selling alone. Whereas different Ethereum ETFs have seen regular inflows, it has not been sufficient to offset ETHE's outflows.

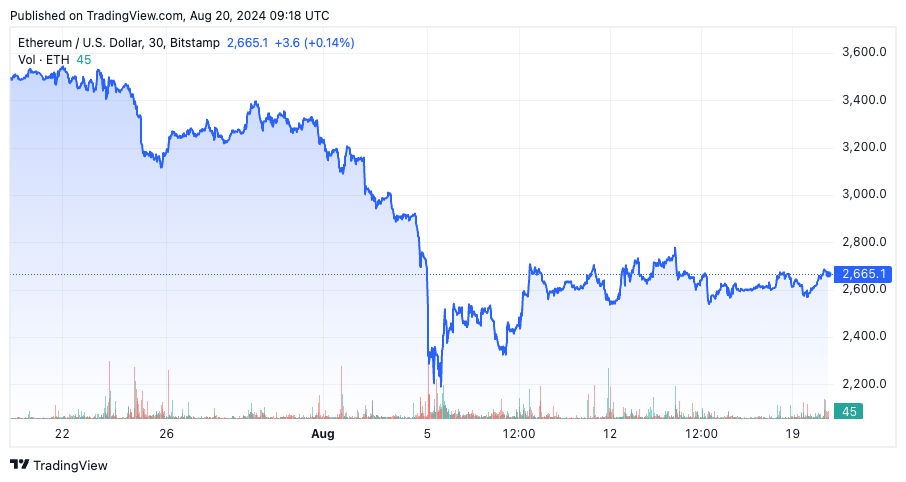

The market response to those outflows is mirrored within the worth of Ethereum, which has struggled to take care of momentum since its launch. After an preliminary rally on anticipation of the ETF launch, Ethereum worth has since fallen sharply, hitting a low of $2,338 on Aug. 7.

Since then, the value has hovered round $2,600 and has seen some restoration, however general sentiment stays cautious. The broader market downturn has additional exacerbated this uncertainty, inflicting Ethereum to lose any clear upward momentum.

Including to the complexity, leverage ratios have risen considerably within the Ethereum futures market, signaling elevated risk-taking by merchants. This spike in leverage means that whereas some traders are betting on short-term worth actions, general sentiment stays risky. The market response to those leveraged positions may additional exacerbate worth volatility, particularly if unfavourable sentiment continues to prevail.

Regardless of these challenges, institutional curiosity in Ethereum-based monetary merchandise stays sturdy, with BlackRock’s iShares Ethereum Belief (ETHA) constantly attracting among the highest inflows amongst Ethereum ETFs, suggesting that not all traders are bearish on Ethereum’s long-term prospects.

Moreover, the general Ethereum ETF market has been displaying some optimistic motion, with occasional days of web inflows, notably from ETHE, as outflows have begun to gradual. This has led some analysts to invest that the worst of the outflows could also be over and each ETF inflows and Ethereum costs might even see a restoration.

The present state of Ethereum ETFs signifies that the market remains to be discovering its footing amid broader volatility and particular challenges associated to Grayscale's ETHE.

Whereas preliminary efficiency has been disappointing in comparison with spot Bitcoin ETFs, we consider there may be room for optimism within the medium to long run provided that outflows from ETHE have slowed and institutional curiosity continues.

For now, nevertheless, Ethereum and its ETF are in a risky place, and its future efficiency is prone to be intently tied to broader market traits and the actions of main institutional traders.

This text Grayscale Exodus Overshadows Ethereum ETF Inflows initially appeared on currencyjournals.