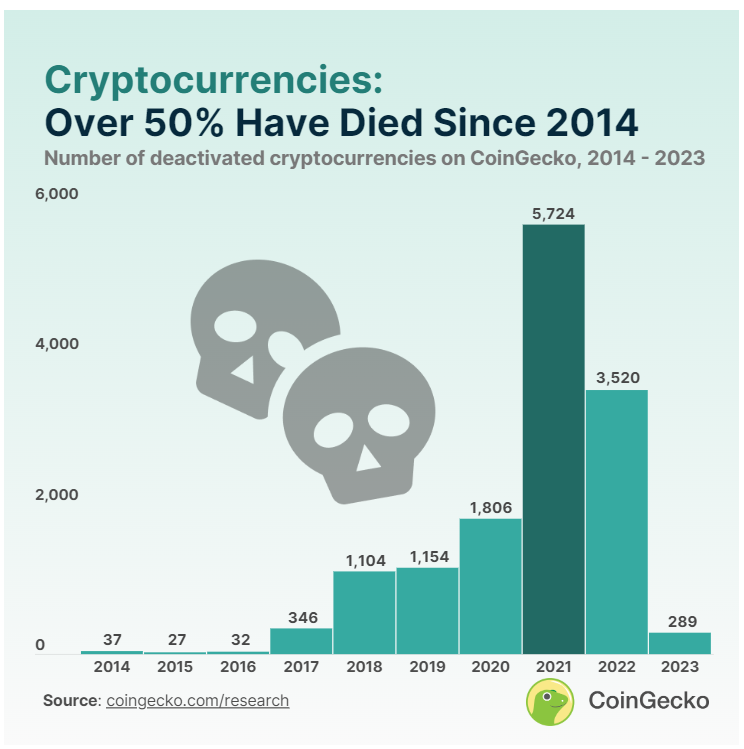

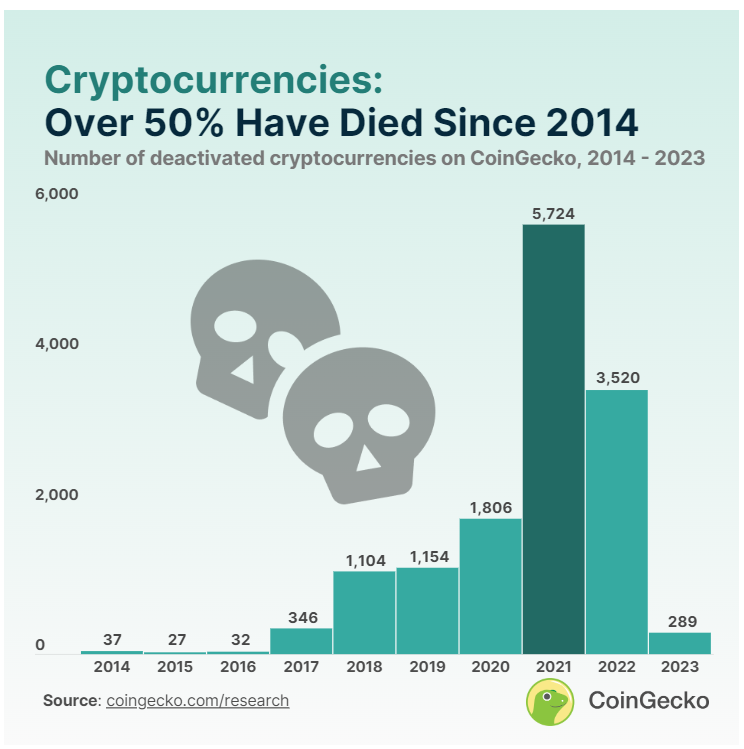

- Greater than 50% of cash and tokens listed on CoinGecko since 2014 at the moment are thought of “useless.”

- Cryptocurrencies launched in 2021 have the very best failure fee, with over 70% failing inside three years.

- Initiatives throughout the 2020-2021 bull market accounted for 53% of all cryptocurrencies that disappeared, totaling 7,530 tasks.

Cryptocurrency knowledge aggregator CoinGecko revealed that greater than 50% of all cash and tokens listed since 2014 have ceased operations or turn out to be fully nugatory. This implies a staggering 14,039 “useless cash” out of over 24,000 cash listed on the platform thus far.

The examine, carried out by CoinGecko, examines the entire variety of cash and tokens, collectively often called “cryptocurrencies,” as soon as listed on the platform and categorizes them as “invalid” or “failed.” The interval coated by the evaluation is from 2014 to 2023.

Cryptocurrencies launched in 2021 had the very best proportion of useless cash, with over 70% (5,724 tasks) failing inside simply three years. This can proceed in 2022, with a failure fee of roughly 60% (3,520 instances). Nevertheless, there’s a silver lining in 2023. To date, lower than 10% (289) of his tasks on the listing have failed.

The report additional analyzes the information and paints a very regarding image for tasks launched throughout the 2020-2021 bull market. A complete of seven,530 tasks, or 53% of all extinct cryptocurrencies, belong to this era. This quantity represents about 70% of the 11,000 crypto tasks listed throughout the bull cycle.

By comparability, the 2017-2018 bull market noticed comparable failure charges of round 70%, regardless of fewer venture launches at round 3,000.

CoinGecko's evaluation believes this development is because of elements comparable to the convenience of token deployment and the proliferation of meme cash, which are sometimes deserted shortly after launch as a consequence of lack of tangible product or utility. .

The report identifies venture failures comparable to lack of buying and selling exercise for 30 days, affirmation of fraud or “lag pulls,” voluntary deactivation of tasks as a consequence of closures or token overhauls, and compliance with sure liquidity and exercise thresholds. We additionally define particular causes.

Disclaimer: The data contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any sort. Coin Version is just not liable for any losses incurred on account of the usage of the content material, merchandise, or providers talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.