Over the previous month, bitcoin’s worth has been eclipsed by main macro occasions, together with the current SEC lawsuits in opposition to Coinbase and Binance, which have alleged a number of securities breaches and include language that would reshape the {industry}. It has modified with every regulatory announcement.

These occasions solely added to the volatility and, whereas bitcoin’s worth volatility was not as violent because it may have been, it created market turmoil and uncertainty.

Nonetheless, this doesn’t stop long-term holders from saving.

diamond palms perpetually

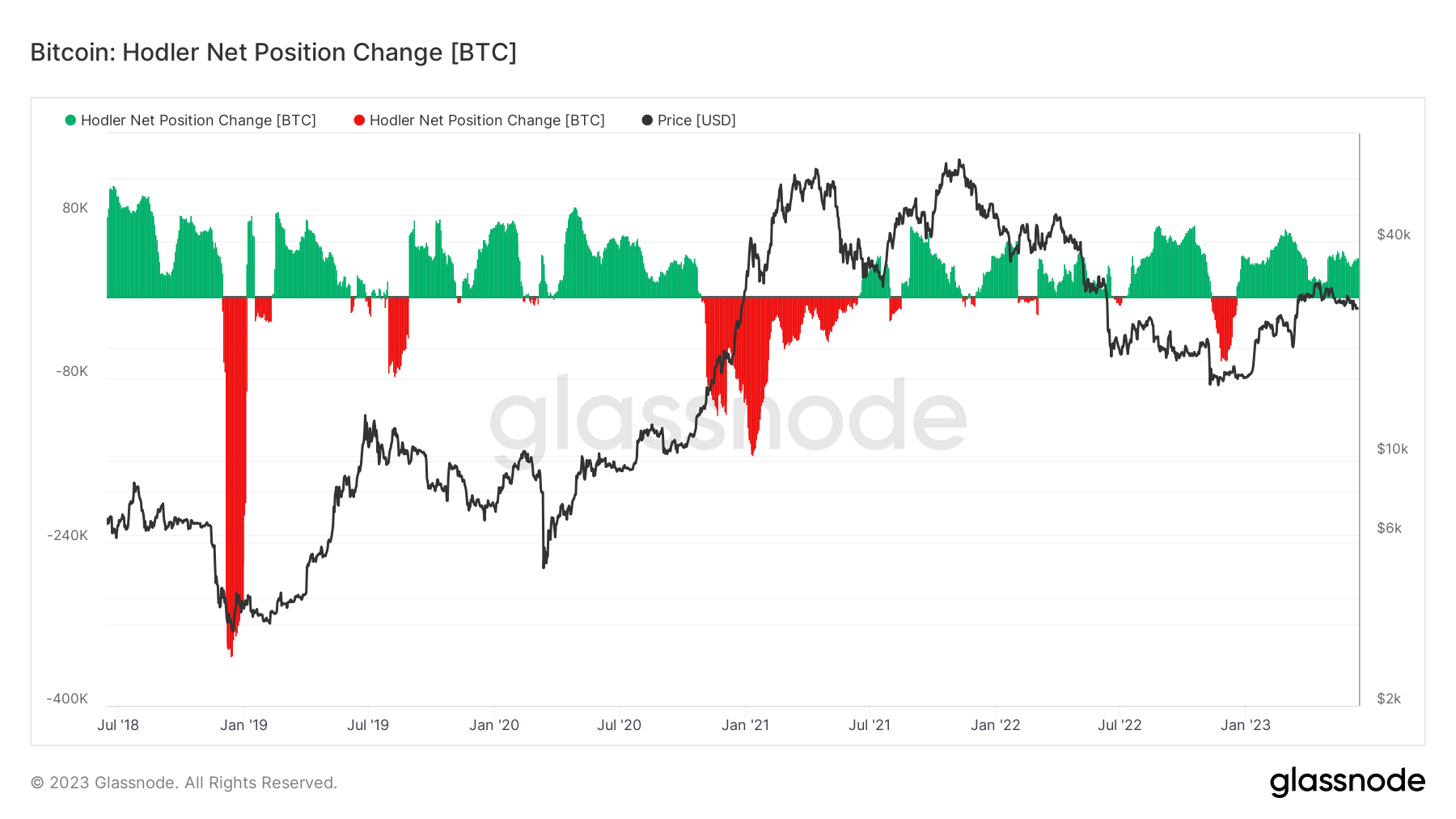

Lengthy-term holders are addresses which have held their cash for at the least 155 days with out transferring them, demonstrating a extra affected person long-term funding strategy to Bitcoin. Due to this fact, it serves as an essential indicator of market sentiment as it’s much less inclined to short-term market fluctuations.

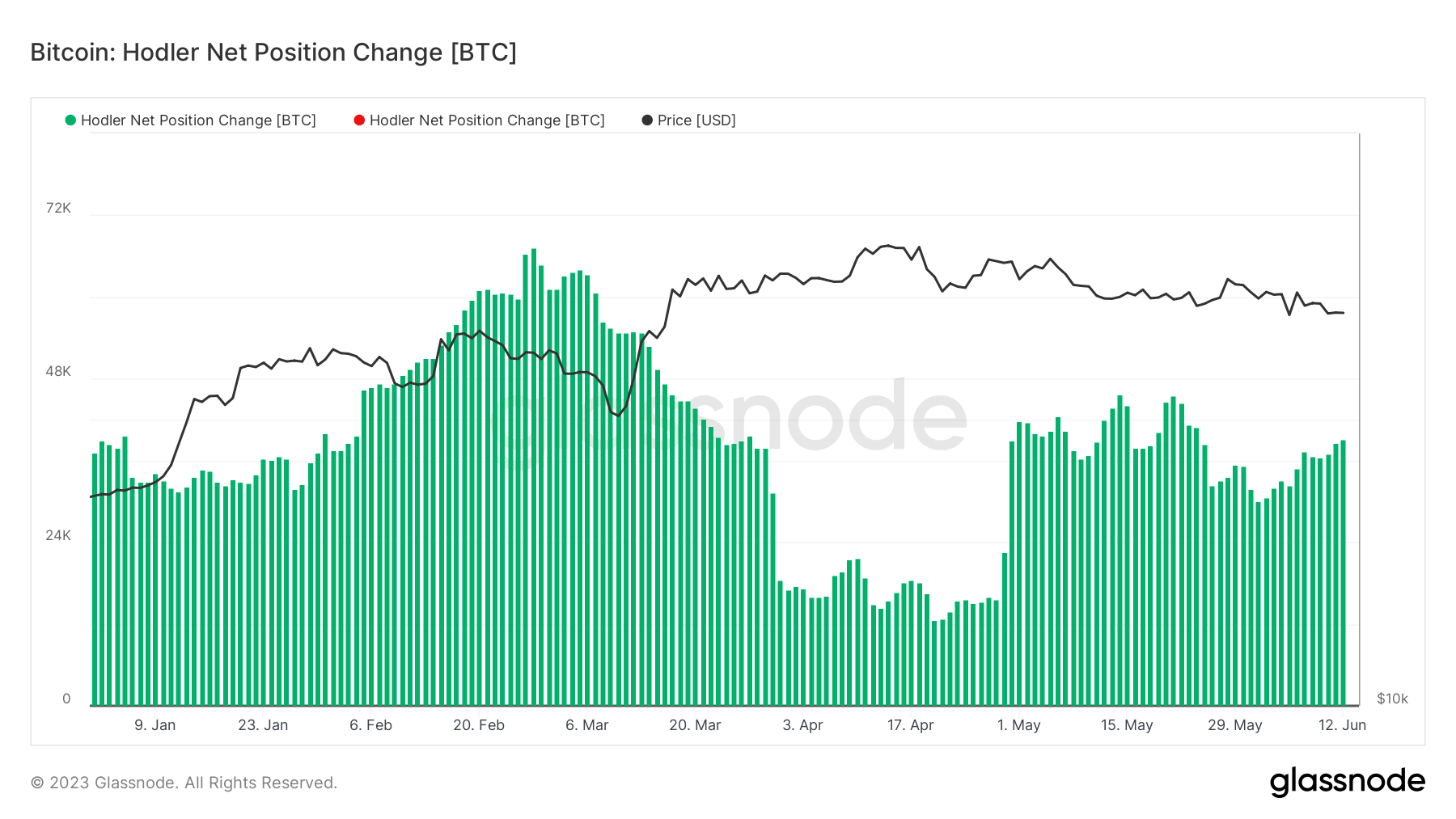

Regardless of continued market uncertainty, holders proceed to build up Bitcoin. Glassnode information exhibits that the holder has been growing his BTC place because the starting of the 12 months, with constructive adjustments in place each day.

A marked surge in accumulation was noticed in early Might, triggering a brand new wave of accumulation. As of June twelfth, Hodler was growing his place at a tempo of 39,233 BTC per thirty days.

Traditionally, internet adjustments in hodler positions have been inversely correlated with Bitcoin worth actions, with long-term hodlers decreasing their positions when Bitcoin worth peaks. This exhibits that skilled market members have a tendency to purchase extra Bitcoin when costs are low and promote when costs rise.

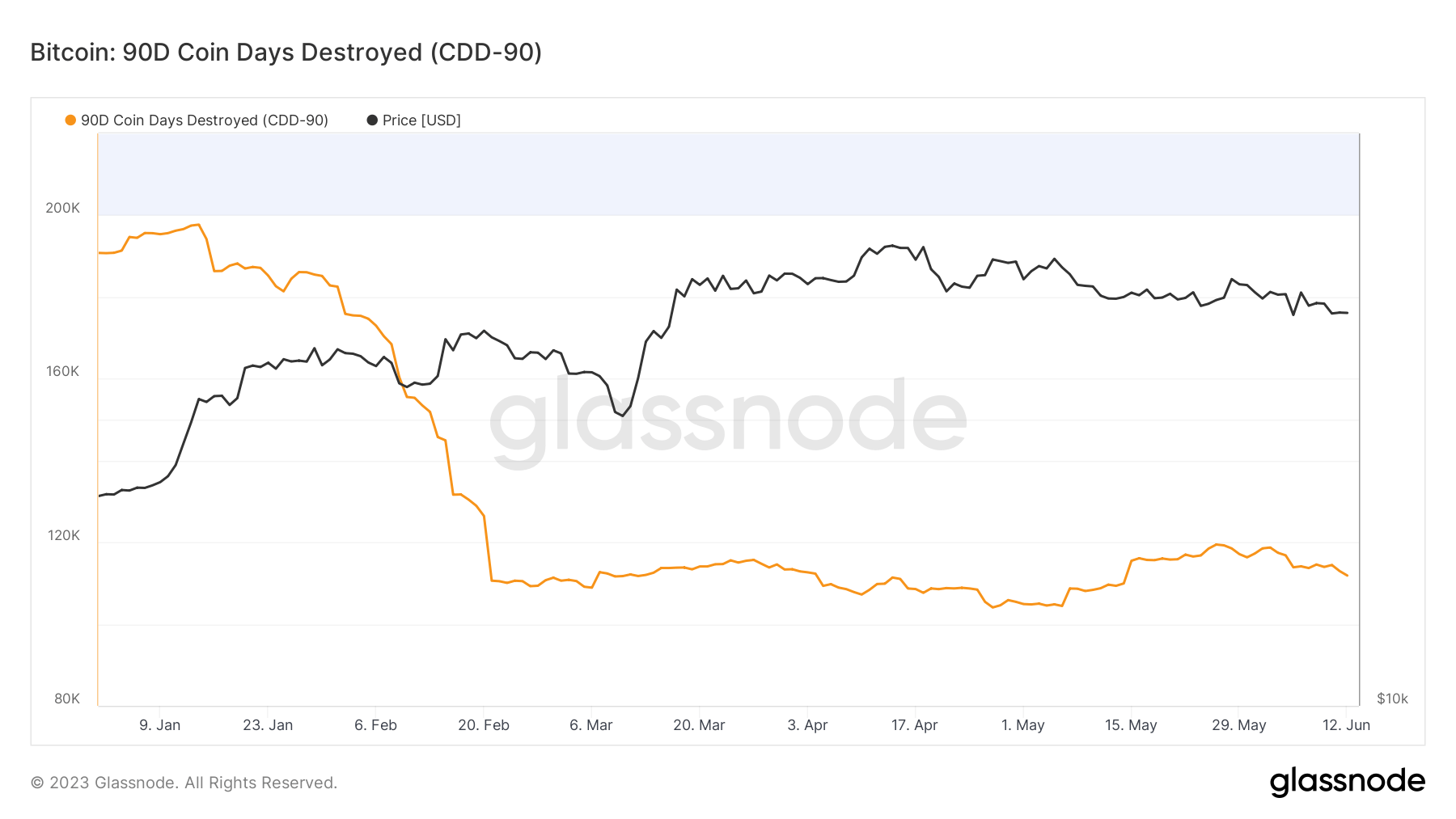

One other on-chain metric, Coin Days Destroyed 90 (CDD-90), additional confirms this accumulation pattern.

Coin Days Destroyed is a technique of measuring the motion of outdated cash. Holding one bitcoin for a day creates a coin day, and transferring a bitcoin destroys a coin day. CDD tracks the entire age of all Bitcoins moved on a given day, offering perception into whether or not the variety of older cash held by long-term holders has moved.

CDD offers a stable overview of the situation of older cash, however CDD-90 is a extra related measure. This metric aggregates all CDDs during the last 90 days and gives a greater perception into Bitcoin’s financial exercise over an extended time frame. An upward pattern within the CDD signifies that holders of long-lived cash are promoting, whereas a downward pattern signifies declining curiosity.

Since February twenty first, CDD-90 has been transferring sideways. This means Hodler is spending much less and growing his Bitcoin place. This buildup reduces the quantity of Bitcoin obtainable in the marketplace and tightens the provision.

Lengthy-term hodler accumulation and CDD-90 flat pattern recommend continued curiosity in Bitcoin regardless of market uncertainty. Bitcoin’s near-term future stays unsure given the complexity of macro and intra-industry elements, however these indicators sign a quiet however agency confidence within the asset.

An article about Hodlers persevering with to build up bitcoin amid US regulatory onslaught first appeared on currencyjournals.

Comments are closed.