- Japan’s two-year bond yield reached 1.01%, and the yen appreciated, forcing a world threat sell-off.

- This transfer unraveled the “yen carry commerce,” which resulted within the outflow of $646 million in leveraged cryptocurrency bets in a single day.

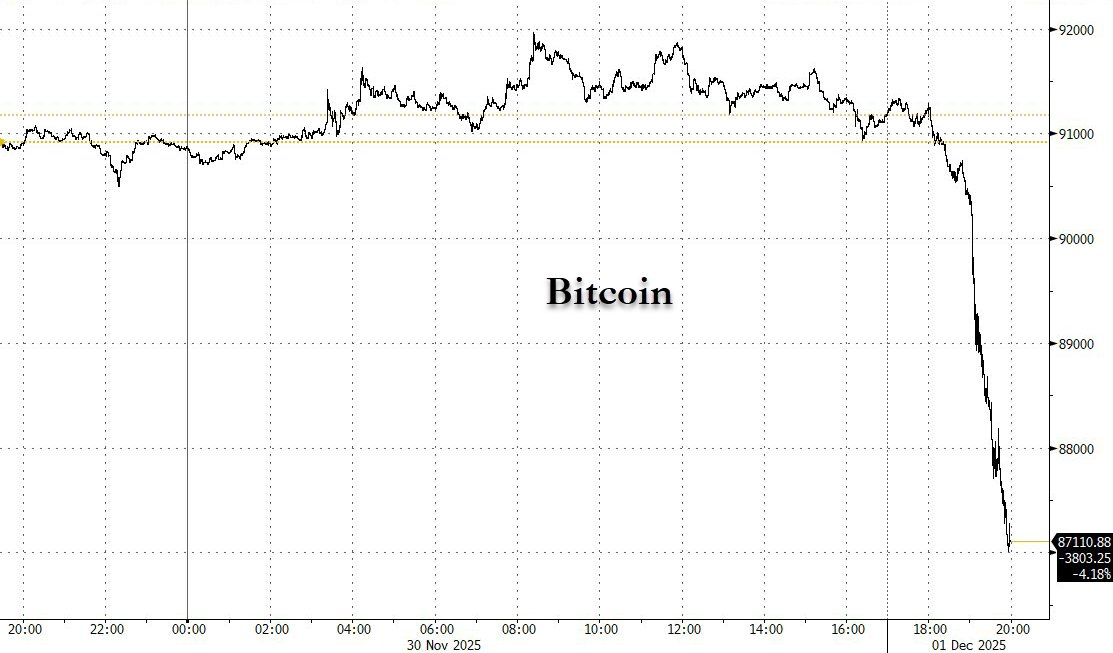

- Whereas Bitcoin plummeted to $86,000, XRP bucked the development by rising 7% on an impartial catalyst.

The sharp rise in Japanese bond yields not solely shocked Asian shares, but in addition hit the crypto market. The digital foreign money market is at the moment in a pointy downturn, with promoting stress on nearly all main cash.

Bitcoin and altcoin crash vs. XRP market divergence

The worldwide cryptocurrency market capitalization fell by greater than 5% in 24 hours to $2.92 trillion. Bitcoin is down 5.3% and buying and selling round $85,992, however it’s nonetheless performing higher than most altcoins. Ethereum was at $2,829, additionally down 5.4%.

So whereas BTC and ETH bore the brunt of the macro shock, XRP emerged as a statistical anomaly.

On the day, the token rose 7.6% to $2.02.

Solana is at the moment down greater than 7% to $126, whereas Dogecoin is down almost 8% to $0.137.

Within the early morning hours of December 1, greater than $646 million in cryptocurrency positions have been liquidated, 89% of which have been lengthy leveraged positions. Bitcoin alone generated $185 million in long-term liquidations, the very best quantity since October 2025.

A stronger yen, larger yields and decrease liquidity have been the principle drivers of crypto promoting on Monday. Specialists say tight liquidity in Asia will make cryptocurrencies extra delicate, and even small actions might result in main crashes.

Associated: Technique CEO Phong Le says he’ll promote Bitcoin: Here is why and when

Unwinding of yen carry commerce begins

Japan’s two-year bond yield soared to 1.01%, its highest degree since 2008. This got here as merchants elevated bets on the opportunity of a Financial institution of Japan rate of interest hike in December, resulting in a stronger yen.

A robust yen poses issues for cryptocurrencies, as many merchants use yen carry trades, borrowing low-cost yen to fund dangerous bets on Bitcoin and Ethereum. Because the yen rises, the value of those trades will increase, forcing merchants to quickly unwind their trades.

Financial institution of Japan Governor Kazuo Ueda has indicated that he’s open to discussing the opportunity of elevating rates of interest on the upcoming December 19 assembly. His feedback raised market expectations for fee hikes by almost 76%, with a direct impression on bonds, shares and international threat belongings.

Ueda stated the Financial institution of Japan would contemplate each the benefits and downsides of elevating rates of interest and make selections primarily based on the most recent financial indicators.

What’s subsequent for Bitcoin?

Bitcoin fell from $90,000 to $86,000, wiping out a wave of lengthy positions. The subsequent main assist zone is round $83,000 to $85,000, the place a cluster of enormous liquidations stays.

If BTC fails to maintain above $86,000, the value might fall to that decrease zone earlier than truly rebounding.

Associated: Uzbekistan will legalize stablecoin funds from January 2026

Disclaimer: The knowledge contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any type. Coin Version is just not accountable for any losses incurred on account of the usage of the content material, merchandise, or providers talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.