The 2020 DeFi Summer time marked a turning level for the blockchain business, with a number of DeFi initiatives debuting through the season and ushering in a brand new period in finance.

The evolution of DeFi throughout this era has not solely induced waves. It facilitated a paradigm shift and established itself as a daring pioneer of this unprecedented motion.

However what does the momentum the business feels in 2020 seem like when it comes to concrete information?

With token costs down by as much as 90% to climate the present bear market turbulence, we’re wanting on the velocity of DeFi adoption and the impression of market cycles on adoption.

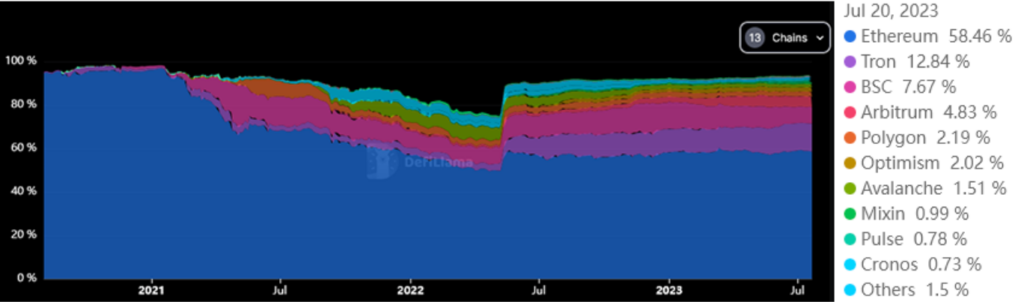

DeFi TVL evaluation by chain since 2017

In opposition to this backdrop, our evaluation focuses on information collected from 2018 to 2023, with a heavy concentrate on adoption throughout chains corresponding to Ethereum, Tron, BNB Chain (BSC), Arbitrum, Polygon, Optimism, Avalanche, Mixin, Pulse, Chronos, Solana, Cardano, and Osmosis.

The desk beneath exhibits the chains analyzed, the date the chain reached all-time highs in TVL (tracked by DefiLlama), the time it took to achieve all-time highs since launch (velocity), all-time highs (ATH), and present TVL.

| chain | Exercise begin* | ATHDate | ATHTVL | velocity | Present TVL |

|---|---|---|---|---|---|

| ethereum | November 2017** | November 2021 | $108.92 billion | 1280 days | $25.73 billion |

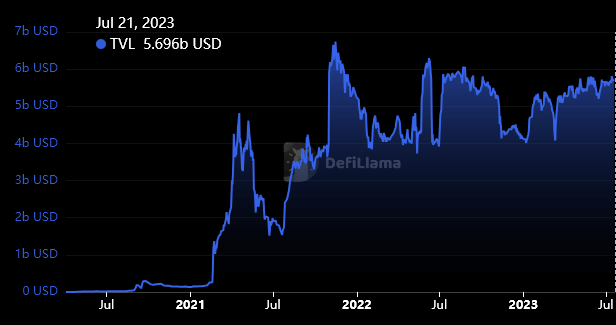

| Tron | August 2020 | November 2021 | $6.74 billion | 470 days | $5.69 billion |

| BSCMore | October 2020 | Might 2021 | $21.94 billion | 186 days | $3.36 billion |

| Arbitrum | August 2021 | Might 2023 | $2.53 billion | 614 days | $2.12 billion |

| polygon | October 2020 | June 2021 | $9.89 billion | 249 days | $9.7 billion |

| optimism | July 2021 | August 2022 | $1.15 billion | 393 days | $9.2 billion |

| avalanche | February 2021 | December 2021 | $11.4 billion | 302 days | $6.6 billion |

| combined in | December 2021 | June 2022 | $0.59 billion | 182 days | $44 million |

| pulse | Might 2023 | Might 2023 | $4.9 billion | 5 days | $0.34 billion |

| Chronos | November 2021 | April 2022 | $3.22 billion | 145 days | $0.32 billion |

| Solana | March 2021 | November 2021 | $10.03 billion | 236 days | $0.31 billion |

| Cardano | January 2022 | March 2022 | $3.3 billion | 81 days | $1.8 billion |

| Penetration | June 2021 | March 2022 | $1.83 billion | 253 days | $1.3 billion |

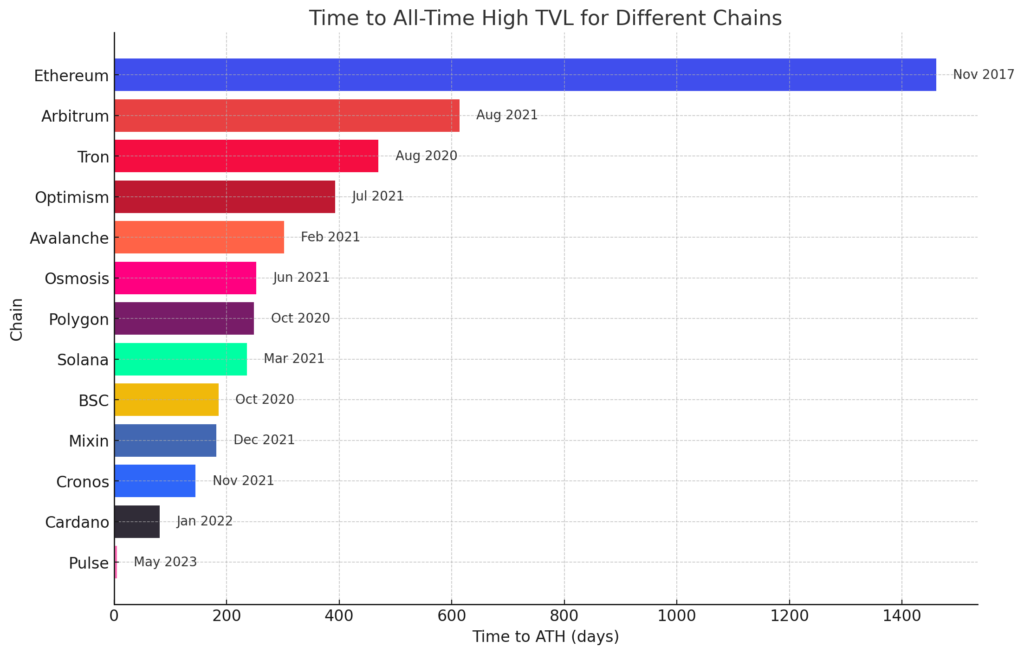

The graph beneath visualizes the velocity of every chain to achieve all-time highs in TVL. DeFi pioneer Ethereum stands out because the slowest adopter, contemplating that it technically has been in DeFi exercise since 2017 and thus reached an all-time excessive in November 2021.

Apparently, November 2021 coincides with Bitcoin’s all-time excessive, which can have influenced Tron and Solana’s DeFi, which peaked round this time.

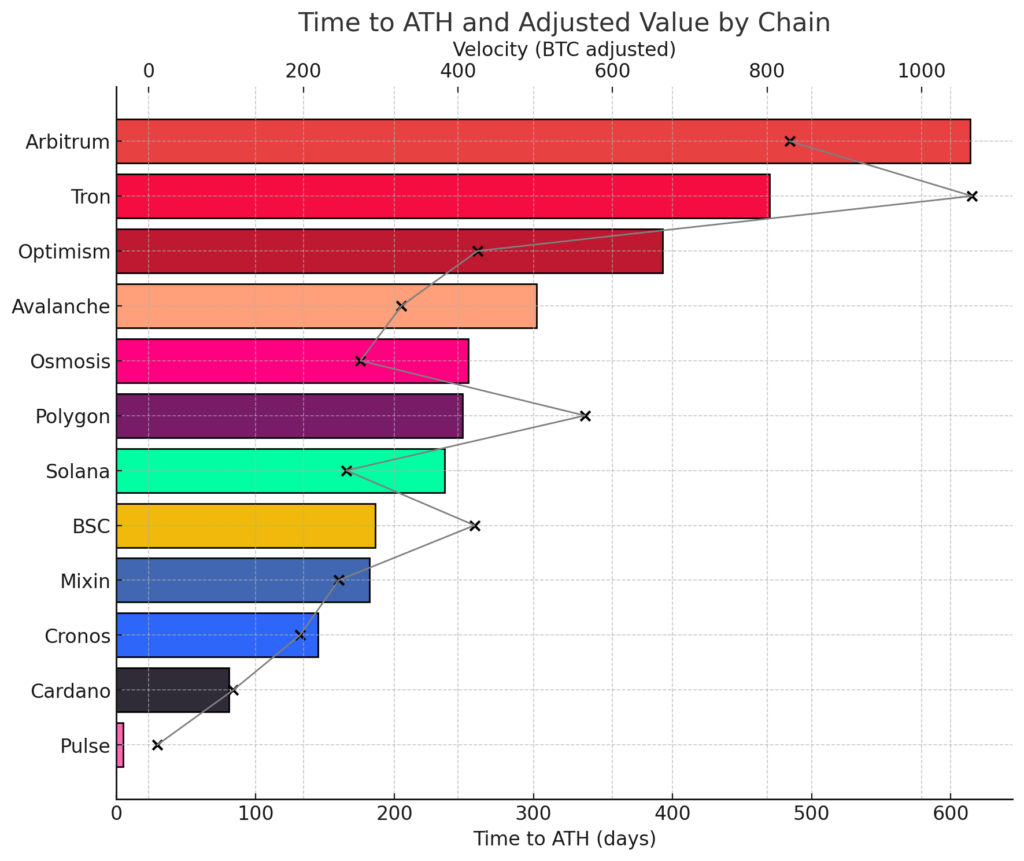

Bitcoin adjusted velocity

Since Bitcoin is seen as a barometer of the well being of the complete cryptocurrency market, the velocity of DeFi adoption was calibrated based mostly on the worth of Bitcoin at every chain’s DeFi launch.

crypto slate We cross-referenced Bitcoin worth and all-time excessive information to create the Bitcoin Adjusted Velocity (BaV) for every chain.

The grey strains and plot factors within the chart beneath symbolize BaV for every chain. The chart reveals that his DeFi ecosystems of Tron, Polygon and BSC have all been positively impacted by the worth of Bitcoin and the bullish market sentiment that underpins it.

Chain velocity evaluation

Ethereum has been faraway from the chart above for readability because it recorded a large velocity rating of seven,936 in comparison with the subsequent shut with 1,065 for Tron and 829 for Arbitrum.

Contemplating the bear market, Pulse slowed down and reached ATH in simply 5 days, giving it a rating of simply 10.98. The following lowest is Cardano at 109, which is about 10 occasions larger.

Utilizing the BaV metric, the most effective performing chains seemed to be Pule, Cardano, Cronos, Solana, and Osmosis. Ethereum, Tron, and Arbitrum stood out because the slowest.

Tron is at the moment one in all its closest chains to ATH and is performing properly in 2023. If Tron crosses $6.47 billion ATH from its present degree of $5.6 billion, it may outperform Ethereum on BaV and commonplace velocity measures.

The various trajectory of DeFi adoption throughout numerous blockchain networks highlights the significance of timing, market situations, and the inherent benefits of being first movers on this area. However because the notable Pulse case exhibits, even new entrants can obtain fast progress with the precise substances.

make sense of the info

The velocity at which TVL reaches all-time highs is a posh metric. Some may argue that the quicker you climb, the quicker you descend, and that is undoubtedly true with some chains.

Nonetheless, the elemental issue we analyze right here issues momentum and adoption. Moreover, all listed initiatives have grossed not less than $330 million on the rock, most of which exceed his $1 billion mark. These should not initiatives with low market capitalization or low liquidity.

The initiatives analyzed on this article are essential for figuring out the strengths and weaknesses of the DeFi onboarding course of so far. The common time it took for a sequence to achieve ATH was about 338 days, which signifies that, apart from outliers, most chains took nearly a yr to achieve the height of his DeFi exercise.

*Launch date refers back to the date of first information tracked by DefiLama for every chain**

** We use MakerDAO’s DAI launch because the date for the Ethereum DeFi launch, with information based mostly on CoinmarketCap’s historic information.

***Further information included as a result of DefiLlama 2020 deadline.

(Tag translation) Avalanche

Comments are closed.