- Yesterday, a crypto Twitter consumer tweeted that Huobi’s BTC collateral was dangerously low.

- The submit additionally warned {that a} run may happen if Huobi didn’t enhance its reserves quickly.

- On the time of writing, BTC was buying and selling at $30,351.14 after falling 1.35% in 24 hours.

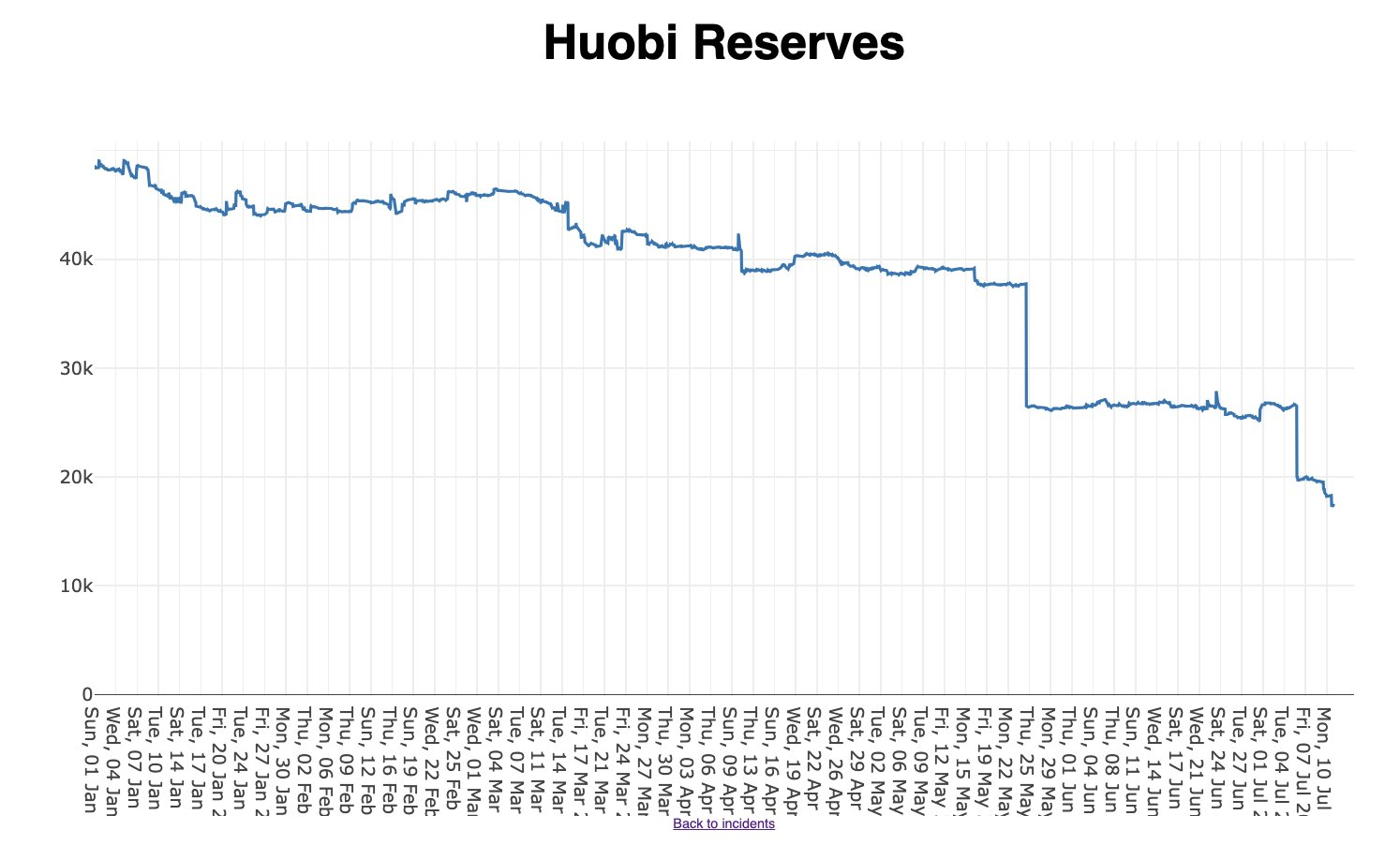

Analyst Willie Wu revealed in a tweet yesterday that Huobi’s Bitcoin (BTC) collateral is “beginning to get dangerously low.” He additionally warned that the change may quickly be prone to a run-on.

In a submit, Wu revealed that change reserves have been declining over the previous few weeks. As of the start of the yr, Huobi’s reserves had reached over his $40,000. However since then, the full has fallen beneath $20,000.

In associated information, in accordance with CoinMarketCap, BTC was priced at $30,351.14 on the time of writing. It got here after a drop of about 1.35% prior to now 24 hours. This destructive day by day efficiency additionally pushed the market chief’s weekly efficiency into the purple. In consequence, the cryptocurrency has fallen 0.89% over the previous seven days.

A 24-hour loss meant that the cryptocurrency was nearing its day by day low of $30,228, whereas its 24-hour excessive was $30,959.97. Along with falling in opposition to the greenback, BTC has additionally outperformed Ethereum (ETH) over the previous 24 hours. On the time of writing, BTC was down 0.08% in opposition to the most important altcoin by market cap.

From a technical standpoint, BTC was buying and selling beneath the 9-day EMA line on the time of writing. If as we speak’s day by day candle does not shut above the technical indicator, there’s a danger of a drop to the 20-day EMA line at round $30,000 throughout the subsequent 48 hours. Continued promoting stress may even see BTC drop to the essential assist of $29,550 subsequent week.

Nonetheless, if BTC manages to shut the following two day by day candles above $30,400, it may retest the important thing resistance degree at $31,060 within the subsequent few days. If the foremost cryptocurrencies can flip this key resistance into assist, a transparent path to $32,000 might be paved.

Disclaimer: As with all data shared on this pricing evaluation, views and opinions are shared in good religion. Readers ought to do their very own analysis and due diligence. Readers are strictly liable for their very own actions. COIN EDITION AND ITS AFFILIATES SHALL NOT BE LIABLE FOR ANY DIRECT OR INDIRECT DAMAGES OR LOSSES.

Comments are closed.