- Hyperliquid worth is buying and selling round $39.05 at the moment, shifting deeper right into a 6-week symmetrical triangle as volatility will increase.

- Spot flows are regular, with small web inflows marking the primary change after weeks of lively outflows.

- Assist at $38.90 and resistance at $39.80 outline the breakout zone, and a decisive transfer is anticipated as the highest of the triangle approaches.

HyperLiquid’s worth is buying and selling round $39.05 at the moment, sitting inside a narrowing symmetrical triangle of compressed volatility for almost six weeks. The token continues to commerce beneath its 20-day and 50-day EMAs, with spot flows displaying uneven participation throughout exchanges, making a cautious backdrop.

Triangle construction shrinks as patrons defend excessive costs

The day by day chart reveals Hyperliquid shifting deeper into the apex of a symmetrical triangle. Value continues to kind lows alongside the rising help line close to $38.90, however any positive aspects are capped by the downtrend line that has been in place since September.

The EMA construction displays hesitation. The 20-day EMA is situated close to $39.80 and the 50-day EMA is situated at $41.51. Each are buying and selling above present costs, suggesting a impartial to barely bearish development. The 100-day EMA at $42.12 is the subsequent barrier if patrons try a breakout.

Associated: Zcash Value Prediction: ZEC maintains bullish bias whereas Cypherpunk boosts holdings

The supertrend line on the day by day chart is situated close to $35.77, indicating a broader help zone that patrons have been defending by a number of rounds of critiques. So long as Hyperliquid stays above this degree, the upper timeframe construction stays constructive.

Value is approaching the highest of the triangle, which normally precedes a decisive transfer. Merchants expect a breakout or breakout to happen throughout the subsequent few periods as soon as compression reaches its restrict.

Spot flows stabilize after weeks of heavy outflows

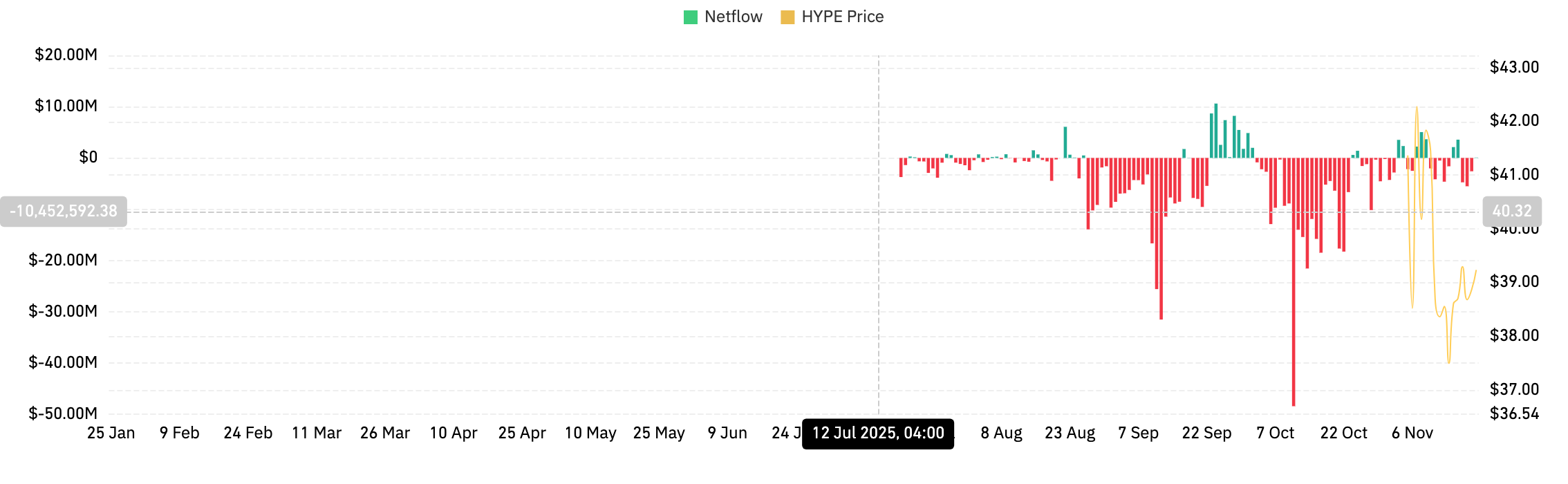

Coinglass knowledge reveals that spot flows have lastly calmed down after a interval of web outflows in September and October. The most recent readings on Nov. 20 present web inflows of simply $60,500. Whereas it is a small quantity in absolute phrases, it represents a change from the multi-million greenback outflow days seen repeatedly earlier within the quarter.

The broader circulation scenario stays advanced. Hyperliquid skilled heavy circulation in late summer time, with a number of days of detrimental flows beneath $10 million. The current stabilization means that sellers are now not actively pushing liquidity again to exchanges.

Intraday momentum signifies cautious consolidation

Charts with shorter time frames exhibit a extra balanced tone. The 30-minute chart highlights a small pullback after the worth failed to interrupt above $40. The parabolic SAR dot reversed above the worth, indicating a lack of intraday momentum after a collection of recent highs early within the session.

The RSI is round 51, reflecting the equilibrium state after cooling from the 63 zone. Patrons proceed to defend the $38.70-$38.90 band that has served as intraday help over the previous 24 hours.

Above $39.70, the SAR sign will reverse and Hyper Liquid will return to a constructive momentum swing. If this degree can’t be restored, intraday strain will stay.

outlook. Will Hyper Liquid go up?

The following transfer will rely on how the worth strikes across the apex of the triangle. Momentum stays impartial, however the construction is nearing decision.

- Bullish case: A breakout above $39.80 and subsequent shut above $41.50 confirms the power. If this occurs, sentiment will change and $47.50 can be focused as the subsequent main bullish zone.

- Bearish case: A detailed of the day beneath $38.90 would point out a break from the elevated help and a transfer in direction of $36. Dropping that degree turns the sample right into a full correction section.

Hyperliquid is within the decision-making stage. The mixing is maturing and the subsequent path will set the tone for the remainder of November.

Disclaimer: The knowledge contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any sort. Coin Version will not be answerable for any losses incurred on account of using the content material, merchandise, or companies talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.