- Binance CEO Richard Teng mentioned India’s younger and tech-savvy base may make it a pacesetter in cryptocurrencies.

- The Chainaracy 2025 report has already ranked India no 1 in international cryptocurrency adoption.

- Teng needs “sensible” guidelines like these within the US and Europe. FIU registration permits Binance to function once more

Binance CEO Richard Teng informed CNBC’s India viewers that India is a “crucial market” because it combines the world’s largest digitally native youth inhabitants with fast crypto adoption.

India is already performing like a crypto chief

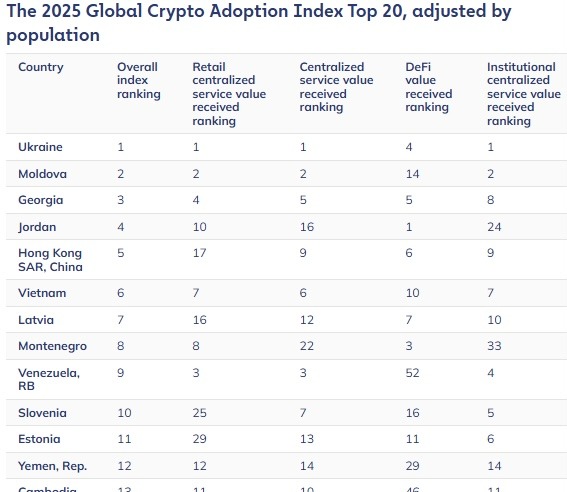

Chainalysis’ 2025 World Crypto Adoption Index reveals India in first place forward of the US in retail, DeFi, centralized companies, and institutional use.

India can also be the core marketplace for the surge in Asia Pacific, with on-chain transaction volumes rising 69% year-on-year. This tells readers within the US/UK/Canada/Australia that India just isn’t “making an attempt” to steer. It’s already performing like the most important grassroots crypto market.

Teng asks: “wise” guidelines, not free guidelines.

He mentioned Binance is working with the Indian authorities to assist its insurance policies. Nonetheless, Teng referred to as on Indian lawmakers to develop wise rules that assist mainstream customers searching for stablecoins, crypto buying and selling, utility, and custody.

Ten mentioned India ought to be taught from the US, which moved from anti-cryptocurrency insurance policies beneath President Joe Biden to pro-cryptocurrency insurance policies beneath President Donald Trump. Teng praised the U.S. authorities’s good intentions in passing the Genius Act and the Readability Act.

Why India is main the best way in digital foreign money adoption

Demographics and abilities

Teng famous that India has led the best way in international cryptocurrency adoption and is poised to proceed to take action given its massive and tech-savvy younger inhabitants.

“India is a vital market, it has the most important inhabitants on the earth, it is very tech-savvy, it is a very younger inhabitants. And each of those nations are likely to have the quickest adoption of cryptocurrencies in comparison with different nations as a result of they’ve very tech-savvy populations and really younger demographics,” Teng mentioned.

Insurance policies are softening, not tightening.

Over the previous decade, the Indian authorities has moved from a whole ban on cryptocurrencies to pro-crypto rules. Previous to 2018, the Indian authorities was closely geared towards banning cryptocurrencies, till they had been re-legalized after a judicial evaluation in 2020.

Associated: Indian courtroom guidelines that digital foreign money is ‘property’, blocking WazirX plan to make use of customers’ XRP to cowl hacking losses

Nonetheless, ranging from 2022, the Indian authorities has enacted some clear crypto rules. From 2022 onwards, India levies a flat fee tax of 30% on digital digital belongings (VDA). Since 2023, the Monetary Intelligence Unit (FIU) has tightened anti-money laundering measures, and Binance needed to pay a effective to re-enter the Indian market.

Market affect

With the mainstream adoption of crypto belongings trending upward in India, Teng burdened that the final word affect will likely be bullish. Teng additional identified that about 7.5% of the world’s inhabitants has adopted cryptoassets.

India’s clear crypto regulatory framework will proceed to draw extra international buyers trying to revenue from the huge market. Furthermore, India just isn’t among the many high 20 nations based mostly on population-adjusted indicators, in accordance with the 2025 Chainalysis report.

Associated: India’s high financial advisor warns of dangers to international financial order from USD stablecoins

Disclaimer: The knowledge contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any type. Coin Version just isn’t liable for any losses incurred because of using the content material, merchandise, or companies talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.