- Digital asset funding merchandise noticed an influx of $130 million, the primary influx after 4 weeks of outflows.

- Bitcoin stays above $62,000 and noticed $144 million in inflows final week.

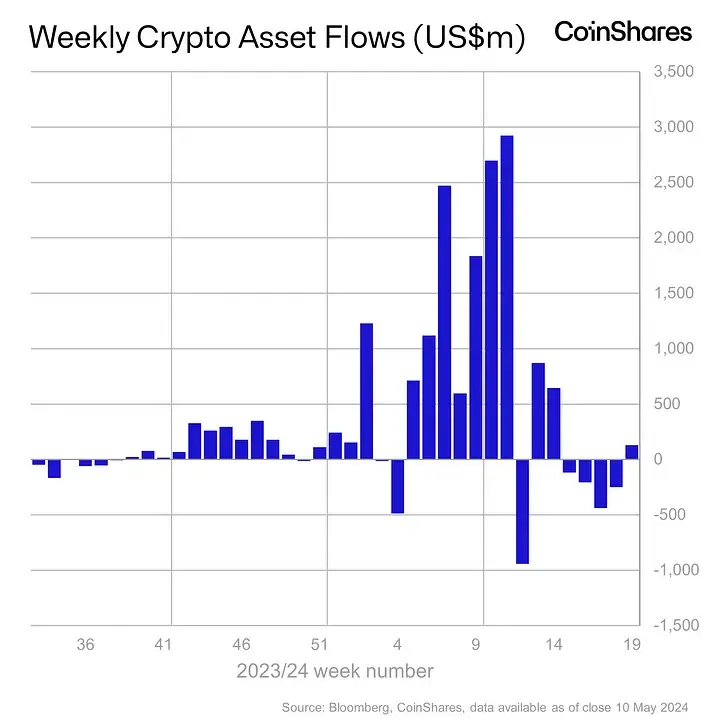

Digital asset funding merchandise noticed inflows for the primary time in additional than a month final week, the most recent market information reveals, as Bitcoin reveals renewed resilience because it climbs above $62,000.

On Monday, digital asset administration firm CoinShares launched its weekly report on crypto funding merchandise.

Particulars present that within the week ending Might 10, inflows into the trade have been $130 million. That is the primary time the index has been optimistic for the reason that first week of April, when outflows continued for 4 consecutive weeks.

Particularly, Bitcoin had an influx of $144 million, whereas the Quick Bitcoin ETP recorded an outflow of $5.1 million.

Many of the inflows got here from america, at $135 million. Hong Kong had an influx of $19 million. Amongst different nations, Canada and Germany recorded outflows of $20 million and $15 million, respectively.

ETP quantity stays low

Regardless of seeing total inflows this week, CoinShares head of analysis James Butterfill wrote on the corporate's weblog that ETP buying and selling quantity continues to say no.

For instance, final week's market ETP buying and selling quantity was $8 billion, whereas April's common ETP buying and selling quantity was $17 billion.

“These buying and selling volumes spotlight that ETP traders are at present collaborating much less within the cryptocurrency ecosystem, accounting for 22% of the world's trusted exchanges' complete buying and selling quantity, up from 31% within the final month. in comparison with %'' Butterfill mentioned.

(Tag Translation) Market

Comments are closed.