Bitget Pockets, a cryptocurrency pockets with native token BWB, is dedicated to offering a complete person expertise that prioritizes each safety and ease of use. On this interview, we converse with Alvin Kan, COO of Bitget Pockets, to study extra concerning the challenges of Web3 pockets improvement and Bitget Pockets's method to overcoming them. We additionally focus on the upcoming Bitget Onchain Layer, designed to simplify person interplay with the Web3 world.

- Contemplating the present state of the trade, what are essentially the most mandatory incorporates a pockets ought to have to face up to the competitors and cater to customers’ wants?

After conducting intensive analysis into person wants, we’ve got concluded that there are 4 most important drivers of person engagement with Web3 and cryptocurrencies: asset administration, asset discovery, on-chain buying and selling, and earnings. Amongst them, on-chain buying and selling and earnings stand out as an important focus. To cater to those wants, Bitget Pockets has invested closely in constructing a complete buying and selling platform that helps prompt swaps and cross-chain swaps on a variety of blockchains. Bitget Swap, the pockets's native swap function, is ready to mixture liquidity throughout a whole lot of various blockchains to offer customers with the most effective accessible buying and selling routes. On the identical time, we’ve got additionally constructed a strong earnings heart, offering customers with numerous alternatives to earn rewards for interacting with airdrops and featured DApps. To offer much more worth to our customers, we’ve got additionally created a local launchpad on the pockets, which additionally offers customers early entry to new tasks, serving to them take advantage of their time spent on Web3.

All of those options are particularly designed to deal with the wants of our recognized customers, and we imagine that is what offers us the sting we have to stand out from our opponents.

2. Digging deeper into safety points, what are essentially the most frequent safety issues Web3 pockets customers have? Are there any issues which have but to be addressed?

Web3 wallets are primarily divided into custodial and non-custodial wallets, every with completely different controls, comfort, safety, and dangers.

Custodial wallets are managed by a 3rd social gathering, comparable to an trade or pockets service supplier, so customers don’t straight maintain their non-public keys. This setup has a number of benefits: Custodial wallets are simpler to make use of, as customers don’t have to again up and handle their non-public keys themselves. Moreover, these wallets help restoration by means of id authentication in case of misplaced entry, comparable to a forgotten password, and supply customer support help.

Nonetheless, custodial wallets do include sure dangers. Centralization danger is a significant concern, as third-party platforms are topic to hacking and different points that would result in non-public keys being leaked and lack of person funds. Belief danger is one other issue, as customers have to belief that third-party corporations is not going to misuse or lose their funds. Lastly, regulatory danger exists, as some nations could impose rules on custodial platforms, freezing or seizing person funds.

Non-custodial wallets, alternatively, give customers full management and management over their non-public keys, permitting them to soundly handle their crypto belongings. This setup has a number of advantages, together with elevated privateness and safety as a result of solely customers have management over their belongings. So long as your non-public key’s protected, your funds are protected.

Nonetheless, non-custodial wallets additionally include dangers. The executive dangers are excessive and customers require a sure stage of technical data to guard their non-public keys. In case your non-public key’s misplaced or stolen, your belongings can’t be recovered. Phishing danger is certainly one of his issues. Customers could unintentionally reveal their non-public key or authorize a transaction to a phishing website. Websites like this are widespread and a giant downside. Furthermore, the complexity of operation is troublesome for novice customers and might result in lack of funds as a result of operational errors.

Total, non-public key safety is an important concern for pockets customers, no matter whether or not it’s a custodial or non-custodial pockets. Customers ought to select the kind of pockets based mostly on their particular wants. Since wallets are a elementary core element of blockchain know-how, there isn’t a insurmountable downside on the subject of protecting asset information.

3. Though safety is likely one of the key priorities for decentralized wallets, it’s identified that user-friendliness is commonly a draw back to decentralized wallets. How are you going to present a quick and environment friendly UI whereas protecting safety sturdy?

On most decentralized platforms, person friendliness typically comes on the expense of safety. Nonetheless, there are nonetheless sure methods that wallets can undertake to maintain each in steadiness. When it comes to safety design, multi-factor authentication ensures that even when one safety layer is compromised, there are nonetheless further safety parameters to guard person belongings. Moreover, {hardware} pockets compatibility and biometric authentication (comparable to fingerprint or facial recognition) additionally assist present a strong safety framework with out compromising user-friendliness.

One other key space is person training. We imagine that customers additionally play a key position in guaranteeing the safety of their belongings. Together with a complete Assist Heart, Bitget Pockets often produces high-quality tutorials and academic supplies to maintain customers knowledgeable of the most recent safety developments and options.

Internally, practising environment friendly coding and creating optimized code will assist your pockets run easily and shortly, enhancing the general person expertise. Leveraging caching and preloading methods can even assist enhance response pace and cut back load instances.

Bitget Pockets additionally conducts common safety audits with main safety corporations within the trade and builds its core code open-source, permitting the group to evaluation and contribute to its total defenses. These are examples of constructing a strong safety framework with out sacrificing person expertise.

4. What about pockets exercise after the BTC halving occasion? Are there giant quantities of deposits and withdrawals occurring? Or are wallets simply dormant?

On April 20, 2024, BTC accomplished its fourth halving. For one month after half-life:

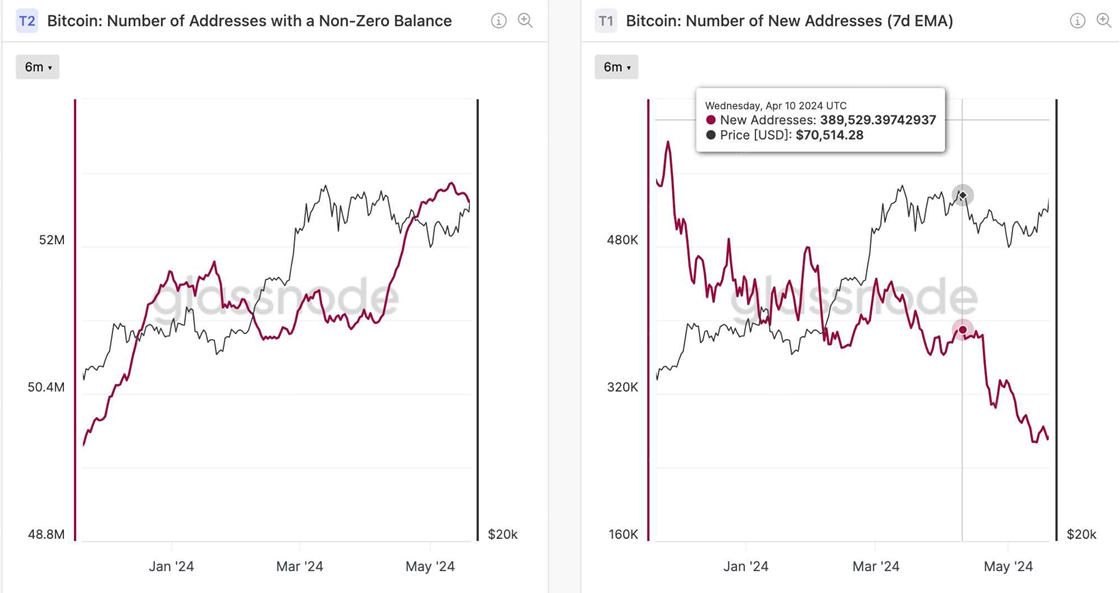

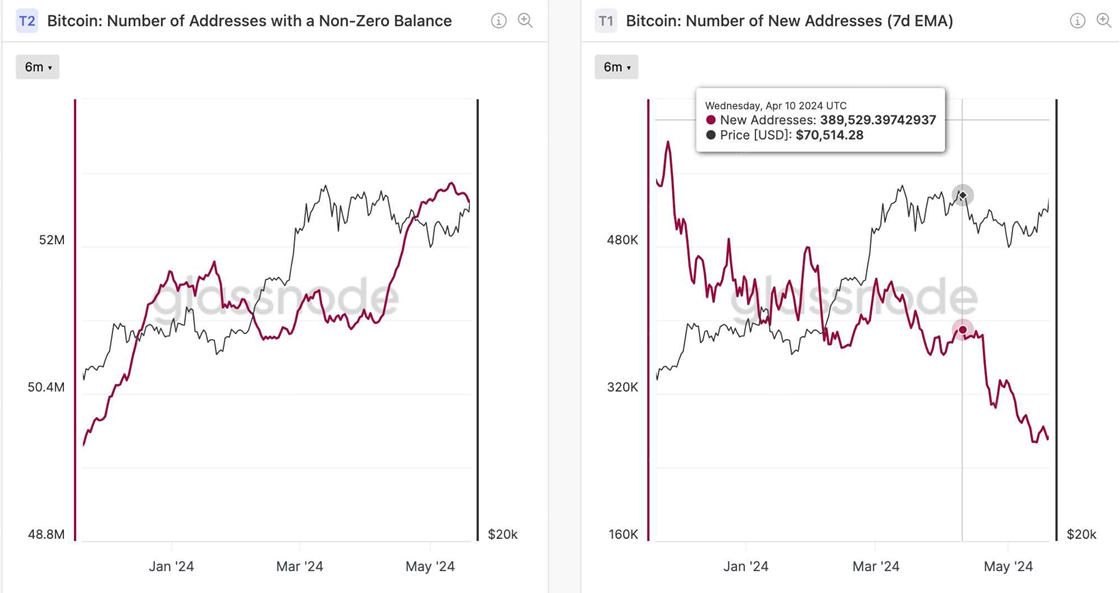

4.1 The variety of lively addresses on the BTC community first elevated after which decreased. This may be associated to numerous on-chain actions comparable to token issuance, minting, and hypothesis.

4.2 The variety of addresses with non-zero balances on the BTC community additionally elevated, whereas the variety of each day new addresses on the BTC community decreased. Each metrics observe cyclical developments and didn’t present vital adjustments earlier than or after the halving, so it’s attainable that the halving had no affect on these metrics.

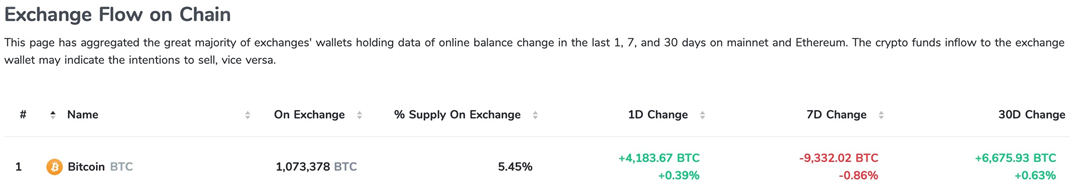

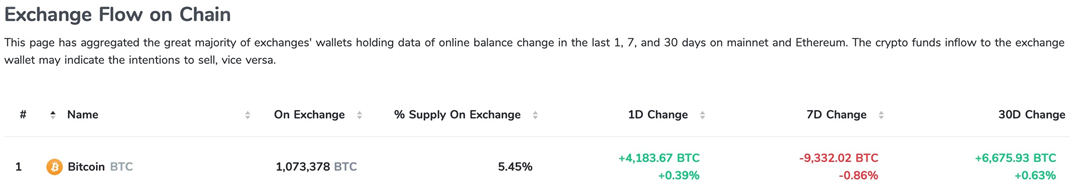

4.3 Study the online inflows/outflows of BTC from the chain to CEX:

- Within the month following the halving, web inflows into the CEX had been 6.6k BTC.

- Prior to now seven days, there was a web outflow of 9,000 BTC from the CEX.

- This corresponds to BTC's worth decline and volatility over the previous month and up to date rise over the previous 7 days.

4.4 Wanting on the broader timeline, the information reveals that the variety of traders prepared to promote BTC has declined since 2018. Many long-term holders have stopped promoting their tokens and stay bullish, persevering with to build up BTC.

5. There's been numerous information about BWB. What precisely is it, what’s its objective, and what’s the worth of the token to customers?

As Bitget Pockets's official platform token, BWB not solely brings many significant use circumstances for customers, but in addition represents an vital milestone in Bitget Pockets's improvement development. Firstly, BWB token holders will get pleasure from advantages comparable to group governance, staking, paying fuel charges on a number of chains, entry to Bitget Pockets's Launchpad and Bitget's platform occasions.

Moreover, BWB may also be bought for subscription on Launchpad. 1,000,000 BWB, or 0.1% of the entire provide, can be supplied throughout the BWB Launchpad subscription occasion. Subscriptions can be break up right into a whitelist spherical and a public spherical, with the latter eligible to customers who’ve accomplished a minimum of one Bitget Swap transaction inside the previous three months. Every BWB token can be supplied at a subscription worth of $0.1 and can be distributed on a first-come, first-served foundation.

6. Are you able to share a teaser of your roadmap? What options are deliberate to easy the UI?

Our future roadmap lies within the creation of the Bitget Onchain Layer, an intermediate layer that abstracts the complexities for customers to work together with the Web3 world. This can be a key effort in the direction of creating a totally seamless UI that facilitates onboarding at scale. To realize this purpose, we’ve got launched the mixing of Modular Performance DApps (MFDs) as a part of the Bitget Onchain Layer. These specialised DApps can perform each as standalone DApps or as native options straight built-in into the Bitget Pockets. The principle objective of those MFDs is to behave as a local gateway for customers to discover a variety of Web3 DeFi providers straight from the comfort of the Bitget Pockets app, having fun with their distinctive advantages comparable to enhanced safety, enhanced liquidity and unparalleled person expertise.

Co-construction has at all times been a core tenet for Bitget Pockets, and we lengthen this to Bitget Onchain Layer. Established his $10 million BWB Ecosystem Fund to incubate and spend money on rising tasks constructed on the Bitget Onchain Layer throughout a variety of DeFi subsectors, together with Telegram Tot, pre-market, and on-chain derivatives markets. did. By collaborating with trade builders to create an efficient and purposeful MFD, Bitget Onchain Layer is not going to solely be the subsequent huge step in remodeling the general person expertise for our customers, but in addition your entire Bitget ecosystem. I imagine it’s going to additionally function a blueprint for his Web3 improvements.

Disclaimer: The data contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any form. Coin Version will not be answerable for any losses incurred because of the usage of the content material, merchandise, or providers talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.