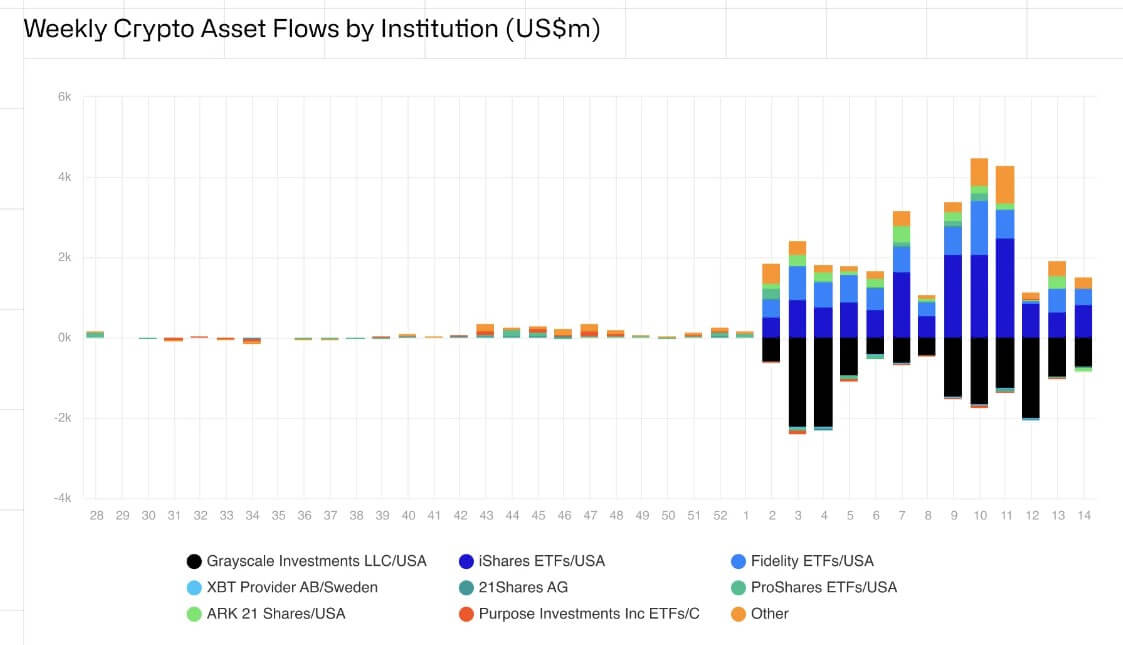

Crypto-related funding merchandise proceed their upward trajectory, recording $646 million in inflows over the previous week, in keeping with CoinShares weekly report.

This inflow introduced the annual whole to an unprecedented $13.8 billion, and whole property below administration to a staggering $94.47 billion.

Curbing the Bitcoin ETF Hype

The buying and selling quantity of crypto funding merchandise fell final week, falling to $17.4 billion from $43 billion within the first week of March. This means that investor curiosity in Bitcoin trade traded funds (ETFs) could decelerate after weeks of hype.

In the meantime, Bitcoin continues to be the main target of traders' consideration, sustaining its dominance out there because the ETF was authorised in January. Final week, BTC-related merchandise recorded a big optimistic web circulation for him of $663 million.

The majority of this influx got here from BlackRock's iShares, which raised $811 million, adopted by Constancy FBTC with $395.83 million. In distinction, Grayscale GBTC recorded his $731 million outflow.

Whereas Bitcoin merchandise flourished, whole web inflows fell to $646 million attributable to outflows from different digital property. Ethereum recorded outflows for the fourth consecutive week, with a further $22.5 million in outflows. Consequently, ETH's year-to-date web flows have decreased to $52 million.

Quite the opposite, some altcoins have proven resilience. Solana, Litecoin, and Filecoin noticed notable inflows of $4 million, $4.4 million, and $1.4 million, respectively.

Moreover, the present bullish sentiment out there has resulted in a complete outflow of $9.5 million from quick Bitcoin merchandise for the third consecutive week. This displays waning confidence amongst bearish traders, particularly as BTC's worth has elevated by round 4% over the previous week to over $70,000 on the time of writing.

Regardless of “moderating” demand for Bitcoin ETFs, the US remained the main market, with whole inflows reaching $648 million. Brazil, Germany, and Hong Kong additionally noticed vital inflows of $9.8 million, $9.6 million, and $9 million, respectively.

Conversely, Canada and Switzerland noticed outflows of $27 million and $7.3 million, respectively, highlighting regional variations in market sentiment.

The put up Investor enthusiasm for Bitcoin ETFs has cooled regardless of the crypto fund’s weekly surge of $646 million appeared first on currencyjournals.