- Amid market uncertainty, Bitcoin addresses holding between 10 and 10,000 BTC have collected 133,300 cash over the previous month.

- Bitcoin holdings by publicly listed firms have surged practically 200% prior to now yr, from $7.2 billion to $20 billion.

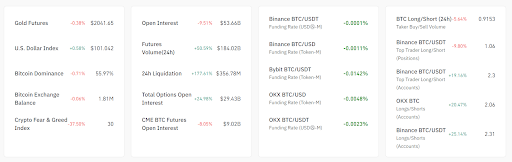

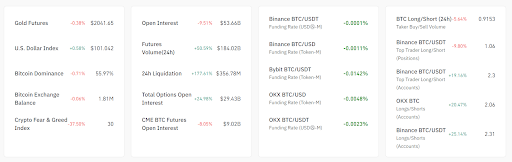

- The Crypto Concern and Greed Index is at 30 indicating worry, with Bitcoin’s dominance barely declining to 56%, indicating cautious sentiment.

BTC whales and sharks (addresses holding between 10 and 10,000 BTC) have been shopping for up Bitcoin amid total market indecision. On-chain analytics agency Santiment experiences that these whales and sharks have collected an extra 133,300 cash in whole over the previous month. In the meantime, smaller merchants have been promoting their holdings and transferring them into these bigger wallets.

Publicly traded firms have additionally been considerably growing their Bitcoin reserves: Over the previous yr, their bitcoin holdings have surged practically 200%, from $7.2 billion to $20 billion.

Based on knowledge from Bitbo, 42 publicly-listed firms at the moment maintain roughly 335,249 bitcoins, valued at roughly $20 billion. This represents a 177.7% improve within the worth of bitcoin reserves in comparison with a yr in the past, based on Nickel Digital Asset Administration.

Regardless of whale shopping for and institutional curiosity, market sentiment stays combined. The Crypto Concern and Greed Index is at 30, indicating worry. Bitcoin’s dominance has barely decreased to 56%. Moreover, 24-hour liquidation surged 137.9%, highlighting the massive strikes in futures and choices.

Whereas Bitcoin Tether (BTC/USDT) funding charges are roughly impartial throughout exchanges, the lengthy/brief ratios are wanting totally different. The variations spotlight the varied methods employed by merchants on totally different platforms. Moreover, the US Greenback Index is up 0.56%, which might affect crypto and gold costs, with gold futures barely all the way down to $2,041.65.

Moreover, open curiosity and buying and selling volumes stay excessive within the futures and choices markets, indicating continued volatility. The markets stay very lively, with dealer sentiment various throughout totally different exchanges and devices.

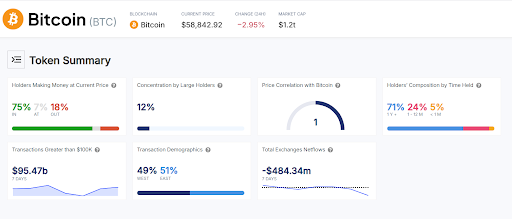

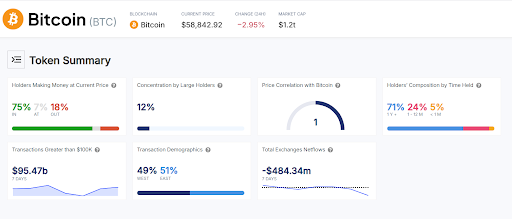

The token overview chart reveals key cryptocurrency market developments, displaying that 75% of holders are at the moment worthwhile, with 71% of them having held for over a yr. Moreover, the token has a low focus of huge holders at 12%, suggesting a extra dispersed possession construction. In consequence, the token's worth is completely correlated with Bitcoin, indicating that it’s intently monitoring broader market developments.

Wanting on the buying and selling knowledge, we see some notable motion. Massive transactions over the previous week totaled $95.47 billion, cut up evenly between the jap and western markets. Moreover, change internet inflows of -$484.34 million over the seven day interval counsel a development of tokens accumulating as they transfer off exchanges.

General, the information paints an image of a unstable cryptocurrency market with directional uncertainty, heavy buying and selling exercise and numerous dealer sentiment throughout totally different exchanges and devices.

Disclaimer: The knowledge offered on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or counsel of any type. Coin Version is just not chargeable for any losses incurred because of using the content material, merchandise, or providers talked about. Readers are suggested to train warning earlier than taking any motion associated to the corporate.