The world's most populous nation crushes crypto goals because the SEC's groundbreaking Spot Bitcoin ETF approval fuels value surge.

It wasn't lengthy At a time when Indian enterprise capitalists had been scrambling to determine cryptocurrency credentials. Ethereum pockets handle now adorns Twitter profile. Greater than a dozen VC corporations rushed to publish their very own Web3 funding papers, and a few lowered the excessive hurdles to acquiring {qualifications} to rent younger analysts with experience in cryptocurrencies.

Afraid of lacking out on a doubtlessly life-changing deal, a number of younger companions have turned to the outdated guard to greenlight an funding in an early-stage crypto startup at a frothy valuation of $30 million to $100 million. I persuaded you. With cryptocurrencies going to be huge, they tried to search out the following Flipkart or PhonePe within the fast-growing discipline of digital belongings. Pitch conferences that month had been crammed with concepts for the 2 hundredth crypto change idea or the thirty third NFT market.

The joy was comprehensible. Cryptocurrencies are common worldwide and India's tech scene can also be booming. The consensus amongst main US buyers was that India's GDP would double by 2030. Indian startups have already raised greater than $100 billion previously decade. Unsurprisingly, world crypto VC funds have rushed to India, hoping to duplicate the house run that Axel, Sequoia and Lightspeed hit a decade in the past.

With cryptocurrencies changing into mainstream, it appeared like the following logical step. Bullish reviews predicted that there can be greater than 100 million crypto contributors in India, however in actuality far fewer folks take part in funding merchandise. Hackathons convey collectively hundreds of younger engineers touting goals of huge paychecks and a once-in-a-lifetime alternative to reinvent monetary markets and the Web.

Then the tide turned.

Cryptocurrency costs that had been as soon as “headed for the moon” have now flipped towards the middle of the earth. My Ethereum pockets handle has disappeared from my Twitter profile. Corporations have shelved their pending consideration of cryptocurrencies. Companions have shifted focus to different sectors and redeployed analysts to maneuver away from digital belongings.

However in India, value was solely half the issue. Equally troubling are the restrictive rules below the Reserve Financial institution of India, a central financial institution that has lengthy opposed cryptocurrencies. Regardless of an earlier blanket ban being overturned in court docket, regulators endured, likening cryptocurrencies to Ponzi schemes and pressuring banks to not do enterprise with crypto startups.

With out broader cryptocurrency adoption, this banking restriction will make the introduction of fiat currencies extraordinarily tough. Coinbase realized rapidly after CEO Brian Armstrong triumphantly launched in India in 2022, solely to stop buying and selling days later after the RBI denied compatibility with the main UPI cost community. .

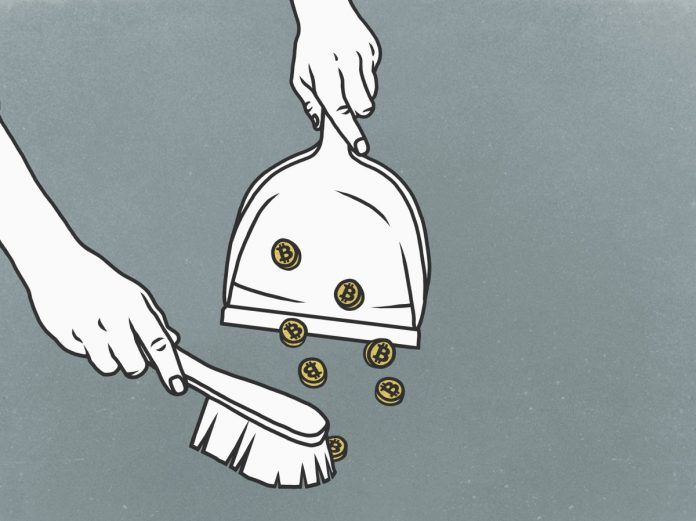

New restrictive insurance policies equivalent to a 30% tax on crypto asset remittances and a 1% TDS mandate on crypto asset purchases additional decreased buying and selling volumes. Indian change WazirX's buying and selling quantity fell to $1 billion final yr after processing $43 billion value of transactions in 2021.

Apple's elimination from the Indian App Retailer of greater than a dozen world crypto apps that had tax-evasive nature and had been relied on by massive Indian merchants is the most recent spherical of two brutal years. It's like a nail. The pending elimination on Google Play, web suppliers and different websites will finish a journey marked by closures, pivots and offshoring for Indian crypto startups. The Net 3 goals of native entrepreneurs now seem to have been dashed on the rocks of regulatory resistance.

Some entrepreneurs are nonetheless combating for India's crypto goals, calling on New Delhi to rethink its punitive 30% crypto tax. However the tea leaves clearly foreshadow what lies forward. Lawmakers proceed to make their positions clear.