- XRP advocate Invoice Morgan dismissed the weak demand for ETFs after GraniteShares utilized for 2 3x leveraged XRP ETFs.

- Skeptics warn that leveraged funds might amplify volatility and delay approval amid US authorities closures.

- Morgan mentioned historical past is in favour of long-term holders, recalling the entry underneath $0.50 earlier than XRP rose 400%.

XRP advocate Invoice Morgan mentioned he’ll proceed to panic buy-out XRP after criticism that digital property are “in weak demand.”

His feedback got here according to GraniteShares’ newest software to launch a brand new leveraged XRP fund with the Securities and Trade Fee. Particularly, some critics have doubts that there’s low curiosity within the XRP ETF and that XRP is shedding momentum or making ready for a comeback. Nonetheless, the ETF submissions present a special scenario.

Morgan believes the rise in ETF purposes signifies that the market nonetheless considers XRP probably the greatest digital property together with Bitcoin, Ethereum and Solana.

Associated: Caleb Franzen units XRP Fibonacci targets at $4.40 and $6 as merchants concentrate on assist from $2.68

GraniteShares promotes leveraged XRP ETF

Morgan’s feedback got here shortly after international fund issuer GraniteShares utilized to the US SEC to launch two 3x leveraged ETFs based mostly on XRP.

The proposed ETFs, 3x Lengthy XRP Each day and 3x Quick XRP Each day, are designed to inflict traders 3 times the revenue or lack of each day XRP. Buying and selling might start round December 21, 2025, roughly 75 days after the appliance on October seventh.

These are leveraged ETFs, so each income and losses can improve. For instance, if XRP falls 33.3% in a day, traders with a 3x lengthy ETF might lose their complete funding. An identical worth rise might wipe out traders in brief ETFs.

Functions for GraniteShares be a part of seven different XRP ETF purposes at the moment underneath SEC evaluate. For Morgan, the continuing submissions show that institutional traders haven’t misplaced curiosity, however has solely been suspended because of regulatory bottlenecks.

“It will have a foul consequence,” analyst warns

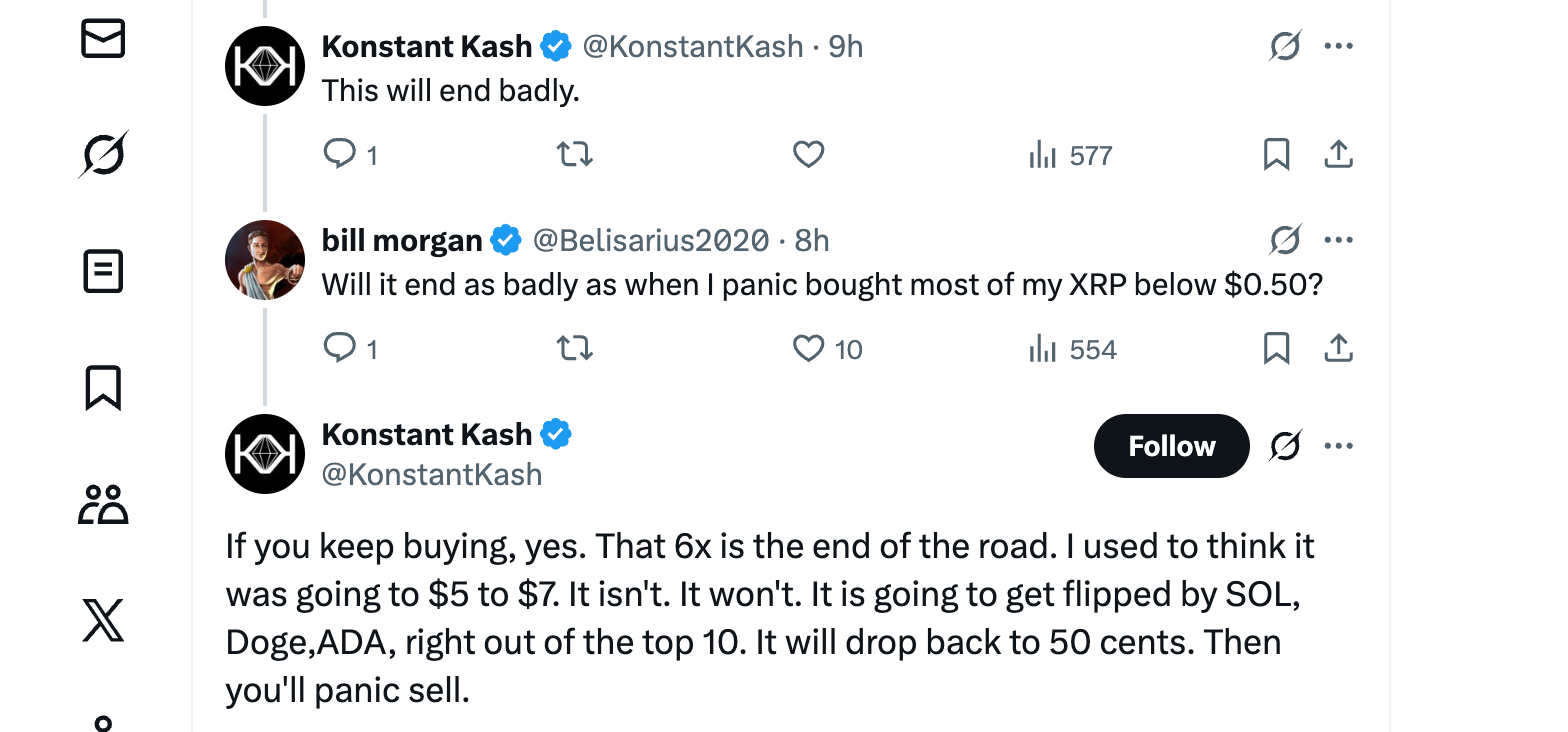

Not everybody shares Morgan’s optimism. Analyst Constantine Kasch warned Morgan in a tweet: “It will have a horrible consequence.”

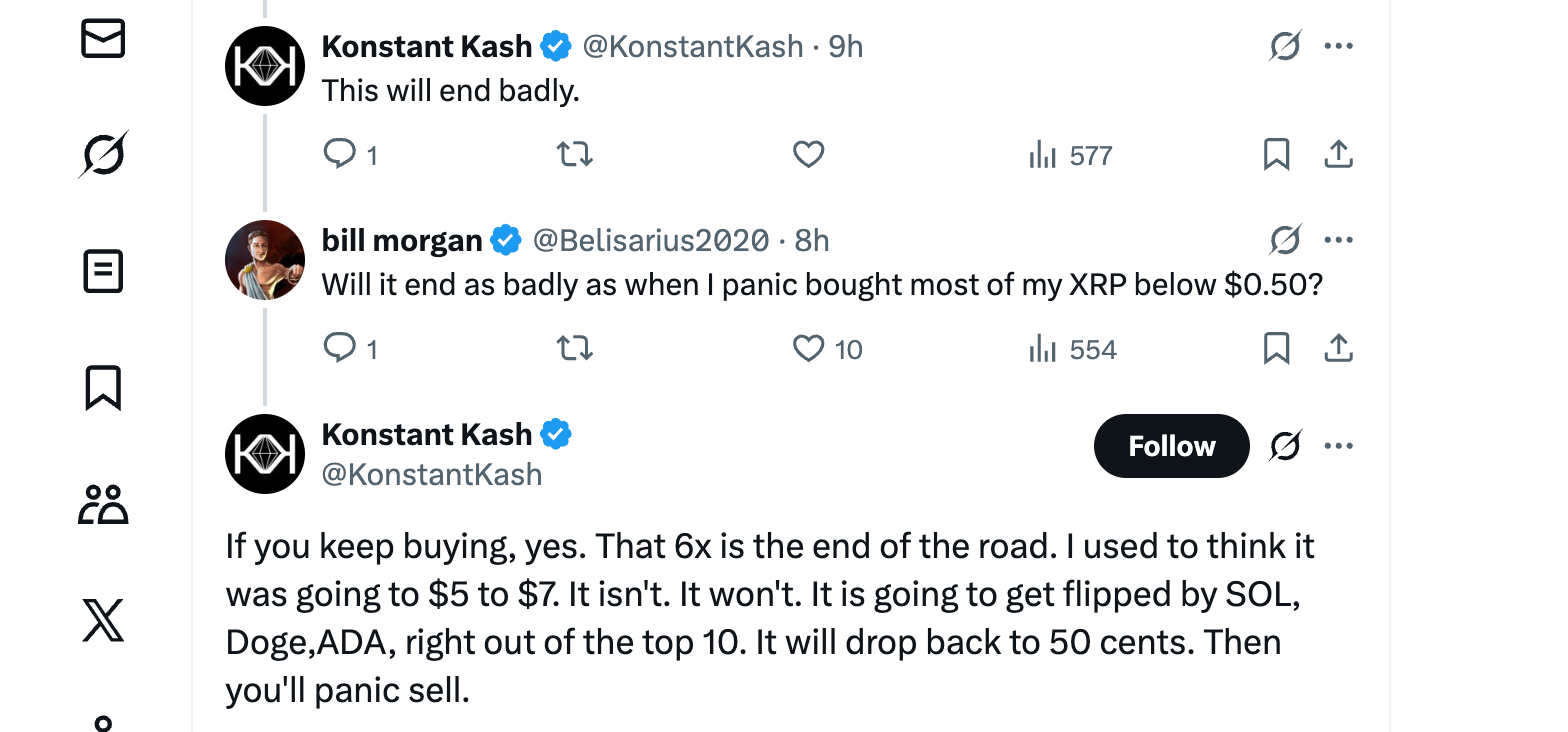

Morgan fought again by referring to his earlier determination to build up XRP if it trades under $0.50. “Wouldn’t it finish as badly as I panicked and purchased most of my XRP for underneath $0.50?” he requested.

Since then, XRP has skyrocketed over 400%, rising from underneath $0.50 to $2.87. This sharp rise from the November low highlights XRP’s resilience and sustained belief amongst traders regardless of continued criticism.

Nonetheless, Kash stays skeptical and criticised XRP fundamentals. He argues that the worth of the token is raised and that the possession may be very concentrated. He mentioned “20 wallets include 50% of the whole provide,” calling the system “rackets.”

He expects the XRP to return to $0.50 and could possibly be overtaken by rivals akin to Solana, Dogecoin and Cardano. Morgan identified that about 70% of the XRP provide saved in these wallets is locked into Ripple’s escrow accounts, that means it’s not used for lively distribution or market manipulation.

Associated: BNB reverses XRP and turns into the world’s third largest cryptocurrency in market capitalization

ETF buying and selling stagnates because of delayed approval

In the meantime, the persevering with closure of US authorities businesses has disrupted the SEC’s operations, inflicting delays in ETF approval. Earlier this month, the SEC has handed the Canary Capital proposed Litecoin ETF determination deadline, which raises issues that XRP-related purposes might face comparable delays.

Analysts level out that the SEC is at the moment utilizing a general-purpose itemizing standards framework that permits ETF purposes to be permitted or rejected at any time. Consequently, regular approval schedules will now not apply.

Disclaimer: The knowledge contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any variety. Coin Version will not be liable for any losses that come up on account of your use of the content material, services or products described. We encourage our readers to take nice care earlier than taking any motion associated to us.