- Vice President Kamala Harris has a commanding lead over Donald Trump within the presidential election betting odds.

- Bitcoin fell to an intraday low yesterday however has just lately recovered, recording a surge of round 3%.

- Peter Schiff has instructed inflation may occur if Kamala Harris wins the presidential election.

Bitcoin has fallen sharply following the US presidential debate and adjustments within the betting market. Bitcoin dropped to a every day low of $55,591 as the chances for Vice President Kamala Harris on PolyMarket rose to 56% in comparison with Donald Trump's 48%. Economist Peter Schiff commented on the rise in Harris' odds and predicted inflation was on the horizon if she wins.

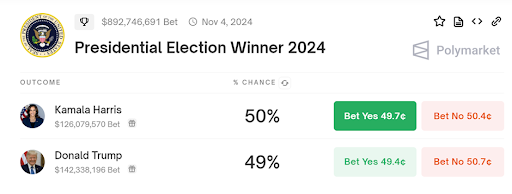

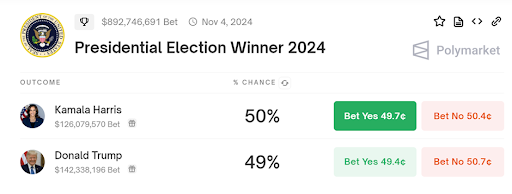

Regardless of some fluctuations, Kamala Harris stays the main presidential candidate, along with her possibilities of profitable dropping to 50% and Trump's possibilities of profitable rising to 49%, in accordance with the most recent knowledge from PolyMarket.

Schiff instructed Harris would possibly introduce a authorities funding program, elevating the potential for debt restoration underneath his management, however warned of inflationary pressures. Altcoins similar to Dogecoin have seen a steep decline as Harris has dominated the betting market, whereas the Japanese yen has risen to 140.70 to the greenback.

At press time, Bitcoin is buying and selling at $58,069, up considerably from current lows. Over the previous 24 hours, the cryptocurrency has risen 2.94% and is up 1.94% over the previous week. Dogecoin plummeted by over 4% yesterday however has recovered, rising 2.75% over the previous 24 hours.

Specialists give their opinions on the election

There are differing views on how the election will have an effect on the cryptocurrency market, with Trump, who has overtly voiced his help for cryptocurrencies and dubbed himself “President Crypto,” pinning his hopes on a attainable revival of the market.

Additionally see: Trump leads by 52% on Polymarket, Harris avoids cryptocurrency regulation

Harris has not clearly said her stance on cryptocurrencies, main some to fret that she might align herself with the anti-cryptocurrency motion. Nevertheless, others hope that her inauguration may spark a bullish pattern. The crypto group is eagerly awaiting the ultimate outcomes of the 2024 US presidential election this November.

Disclaimer: The data introduced on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or counsel of any type. Coin Version will not be chargeable for any losses incurred because of the usage of the content material, merchandise, or companies talked about. Readers are suggested to train warning earlier than taking any motion associated to the corporate.