essential level

- Grayscale Bitcoin Belief (GBTC) continues to commerce at a reduction to its web price

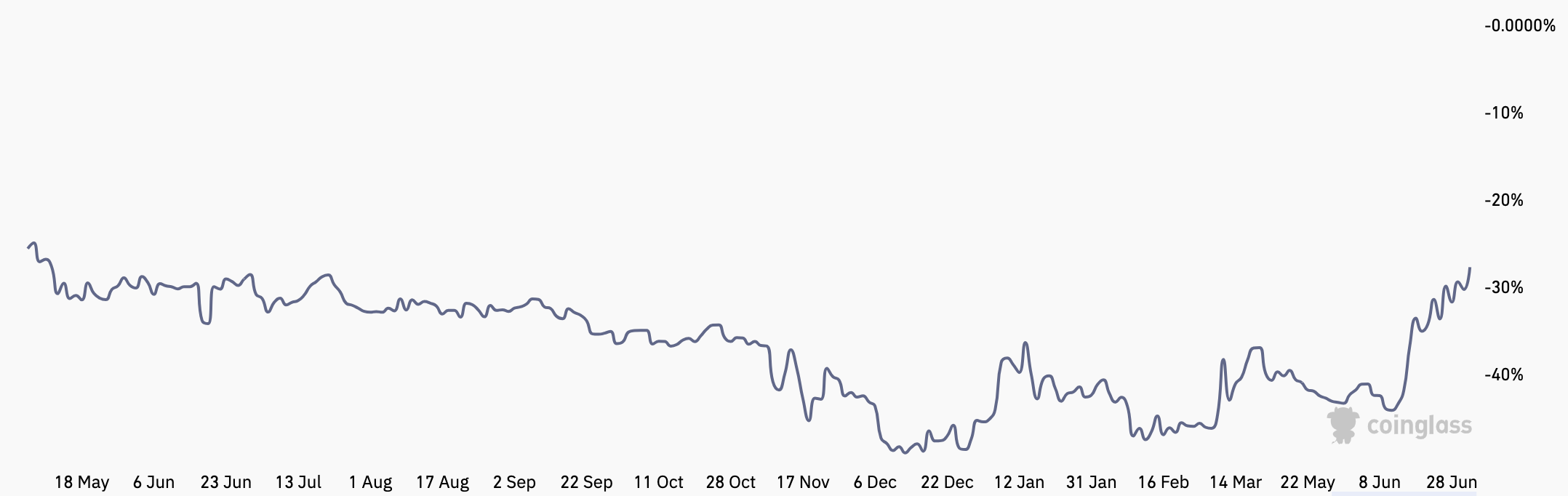

- The low cost charge shrunk to its lowest stage since September on hopes that the fund will probably convert to an ETF.

- The Total GBTC Debacle Represents a Chaos within the U.S. Institutional Regulatory Atmosphere

- Spot ETFs are a query of when, not if, and such automobiles will likely be a factor of the previous.

- That does not allay GBTC buyers’ frustration. GBTC buyers have been hit arduous by the emergence of Bitcoin alternate options and the drying up of demand for trusts.

One attention-grabbing side of the affect of the current flood of spot Bitcoin ETF filings is the way it will have an effect on the controversial Grayscale Bitcoin Belief (GBTC).

Three weeks after BlackRock’s ETF submitting was introduced, the belief surged, up 56% in three weeks.

Notably, which means that it has considerably outperformed its underlying asset, Bitcoin. Nearly as good as that sounds, it actually sums up the issues with this funding car which have solely annoyed buyers in recent times, however we’ll get to that in a second.

I’ve plotted GBTC’s motion in opposition to Bitcoin itself within the following chart. This highlights the outperformance the belief has proven since its ETF submitting, with bitcoin itself up “solely” 21%.

Grayscale low cost to web price is shrinking, however nonetheless enormous

The belief’s web asset worth low cost charge has additionally shrunk to its lowest stage since September and is now beneath 30%. That is as a result of buyers are betting that the conversion of trusts to ETFs will finally be allowed.

When this transformation happens, the low cost shrinks to virtually zero as funds can transfer out and in of the car with out affecting the underlying asset. It is going to stay a belief in the intervening time, however there isn’t a solution to withdraw Bitcoin from GBTC. This, coupled with the excessive charges (2% every year), imply that the numerous reductions proceed.

In truth, the very existence of grayscale trusts is a blemish within the subject. The low cost charges being traded are farcical, and even after the current contraction, the 30% delta is a big hole, hurting buyers.

The large quantity of property below administration is inherently locked up by the character of closed funds and looks like a throwback to the times when everybody wished to the touch bitcoin by any means crucial. enhance. Grayscale was the one retailer on the town, and mixed with its monopoly energy, the demand for Bitcoin was so excessive that Bitcoin traded at a premium for many of its early historical past.

Nevertheless, as increasingly more Bitcoin-enabled mediums come on-line, the premium turns into a reduction, and the low cost turns right into a huge. Maybe it is truthful to say that this can be a return to the bull market of yesteryear, with buyers exhibiting an absence of due diligence on how the fund works.

With out the captain’s afterthought costume, there’ll at all times be rivals coming on-line, and premium will inevitably come below stress. Investing in GBTC primarily makes him do two issues. A guess on Bitcoin and a guess on the belief being transformed into his ETF. shortly.

However we’d be capable of present some sympathy to buyers in that regard. Funding supervisor Osprey Funds, which has an identical product, sued Grayscale earlier this 12 months after a competitor misled buyers concerning the potential conversion of GBTC to an ETF. They declare that that is how they’ve gained a lot market share.

“Regardless of charging greater than 4 instances the asset administration charge that Osprey expenses for its companies, Grayscale has thus far made roughly $99.50 in two taking part markets because of false and deceptive promoting and promotions. 100% market share,” the lawsuit states. declare.

Grayscale has been making an attempt and failing for years to transform this car into an ETF, whether or not it knew of the regulatory difficulties it will face. Final 12 months, the corporate sued the SEC itself for calling the denial “arbitrary.”

Adjustments in institutional local weather

My view on the belief as an entire stays unchanged. I imagine that is (clearly) a horrible funding, and its very existence is only a byproduct of the regulatory woes this trade has struggled with. There’s actually no purpose to even contemplate shopping for this except you will have different technique of gaining bitcoin publicity.

The day will come when all this warfare over trusts and ETFs will probably be nothing greater than a throwback to extra unsure instances. However time is a luxurious that many buyers do not have, grayscale is a terrifying funding, and lots of factors to the hardships the sector has gone by to bridge the hole to turning into a revered mainstream monetary asset. was typical of

Not solely is the low cost charge uncomfortable because it stands, but it surely has expanded to over 50% within the aftermath of the FTX collapse, which revealed that cryptocurrency dealer Genesis was in deep trouble. Genesis is owned by the identical father or mother firm as Grayscale, Digital Forex Group (DCG). Genesis finally filed for chapter in January.

This has raised considerations concerning the security of Grayscale’s reserves, however the firm’s refusal to offer proof of reserves on-chain, citing “security considerations,” has prompted buyers to It wasn’t precisely comforting.

6) Coinbase regularly performs on-chain verification. On account of safety considerations, we don’t launch such on-chain pockets data and affirmation data by encrypted proof-of-reserve or different superior cryptographic accounting procedures.

— Grayscale (@Grayscale) November 18, 2022

Whereas the commotion over buried treasure has subsided, the episode serves as a stark reminder of the often-repeated (however maybe not frequent sufficient) phrase, “No keys, no cash.” rice subject.

The issue for establishments thus far has been that direct entry to bitcoin has been troublesome for quite a lot of causes, principally regulatory-related. Spot ETFs additionally technically violate the “not your key” precept, however with cautious regulatory oversight and robust directors, this may very well be a secure approach for establishments to achieve publicity to Bitcoin. It must be.

That will put an finish to nonsense like trusts buying and selling at a 30% low cost (that is actually the proper phrase) and provides buyers a secure solution to persuade themselves of their opinion on Bitcoin. That could be a great distance off, but when demand for these merchandise stays, it is solely a matter of time.

(tag translation) evaluation

Comments are closed.