- In response to on-chain knowledge, BTC is prone to bear a excessive liquidation between the $42,000 and $46,000 value marks.

- After the ETF approval, the value of BTC fell by about 10%.

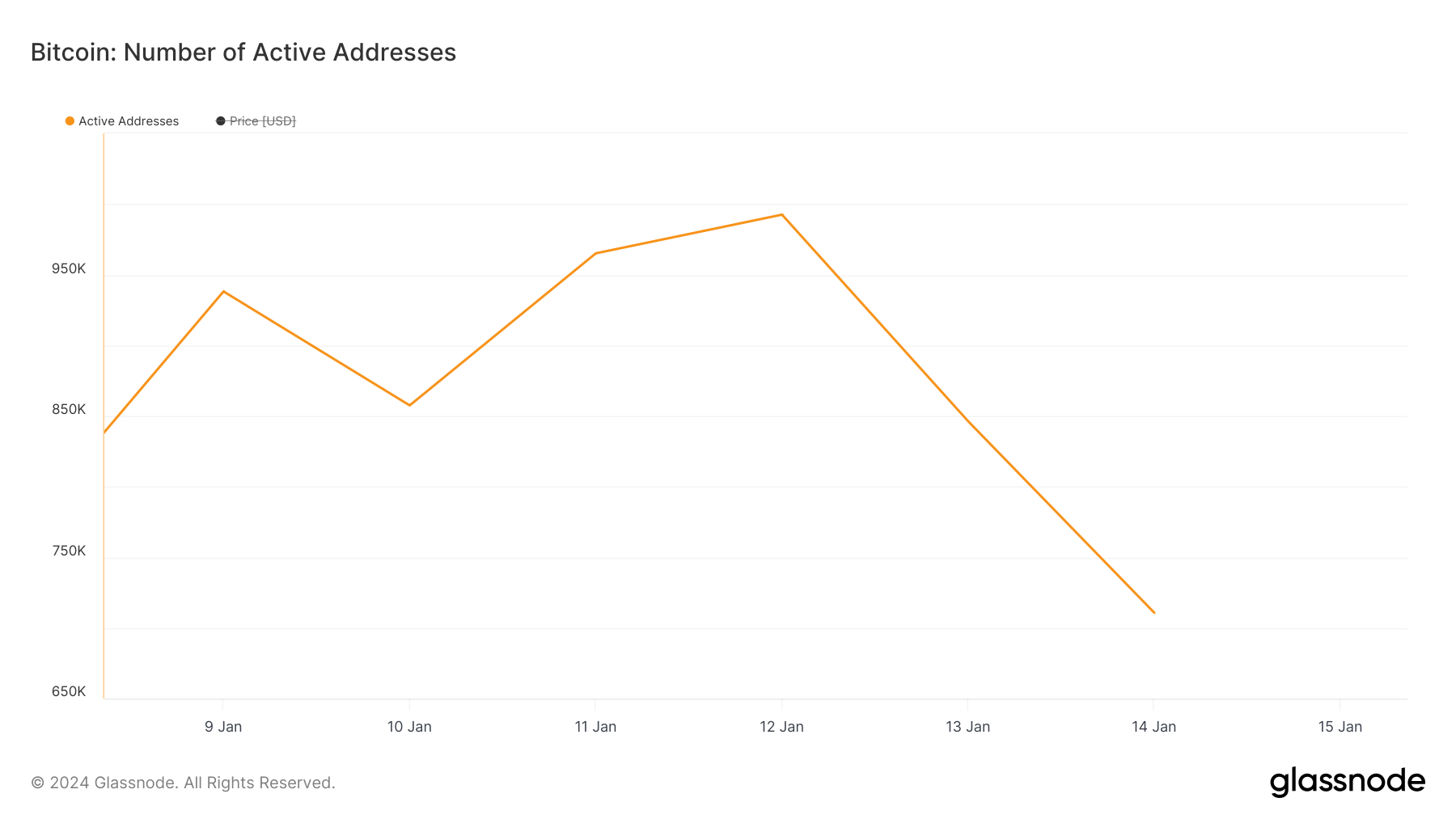

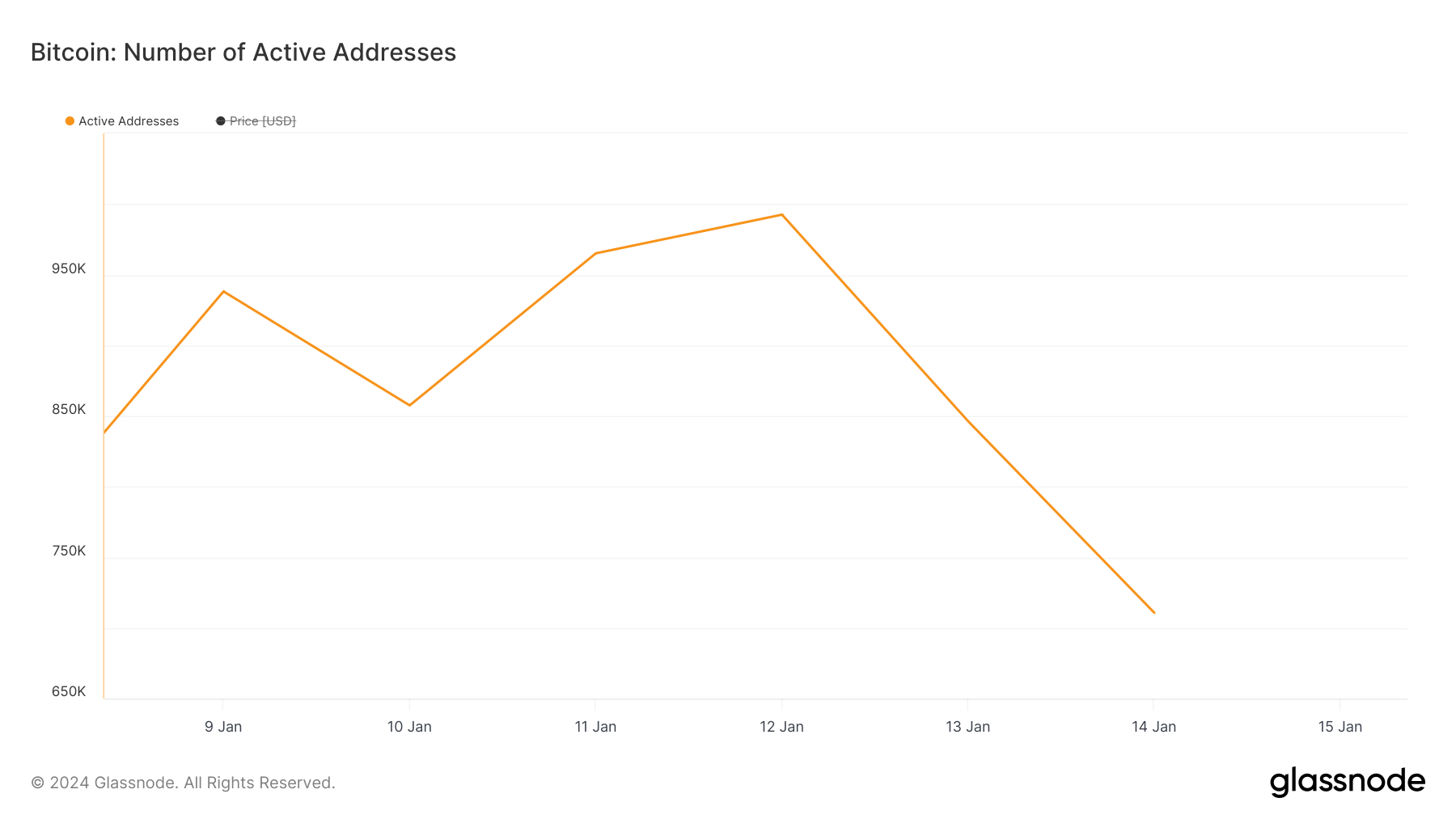

- Since January twelfth, BTC demand has been lowering.

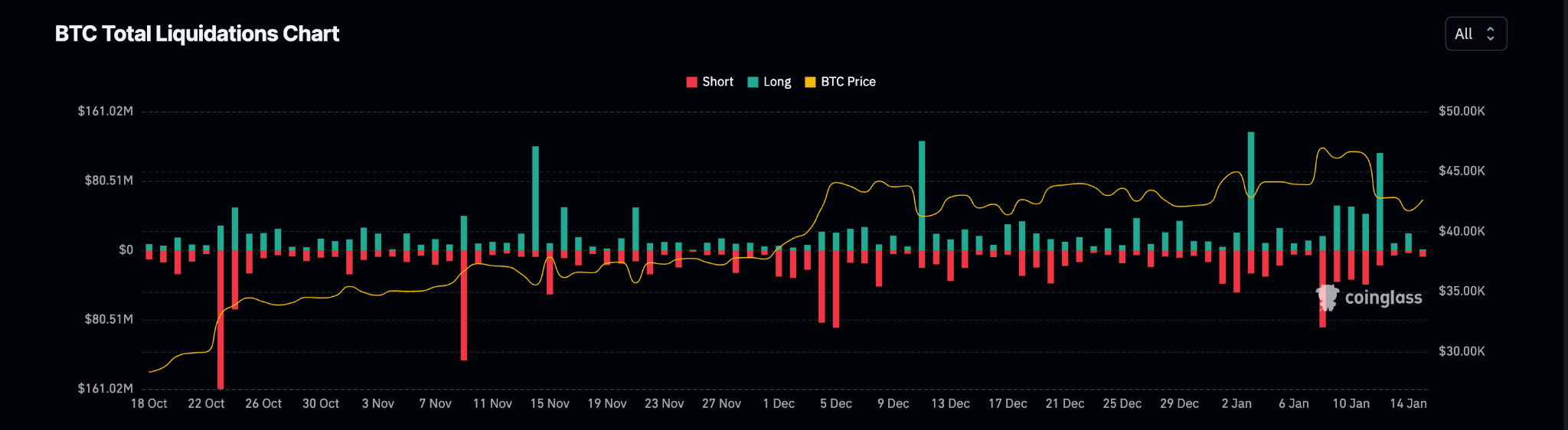

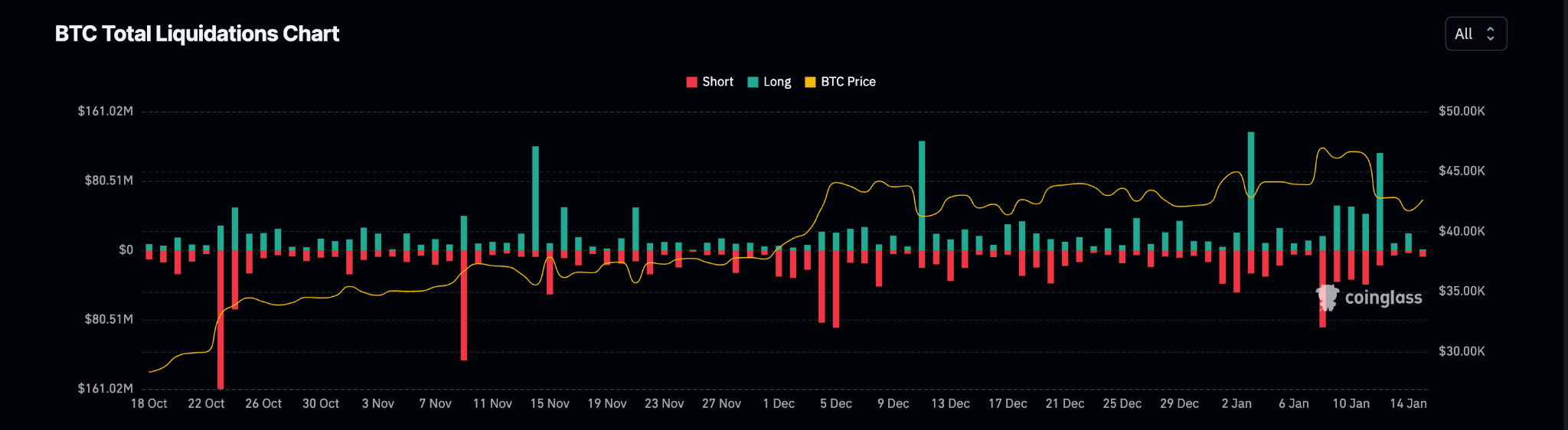

A Bitcoin liquidations heatmap evaluated on a 3-day chart reveals that the Bitcoin market tends to expertise excessive liquidations within the $42,000 to $46,000 value vary.

A liquidation happens when a dealer's leveraged place is pressured to shut as a result of the BTC value strikes in the wrong way.

In response to knowledge from Coinglass, the BTC market recorded a excessive lengthy liquidation quantity of $112 million on January 12, marking the second highest lengthy liquidation quantity for the reason that starting of the yr.

This matched the 7% value decline recorded on the identical day, in line with CoinMarketCap knowledge.

What’s subsequent for BTC?

On the time of writing, the main crypto asset is buying and selling at $42,658. Though many anticipated it to soar by greater than $50,000 after the ETF was authorised, BTC costs have plummeted by practically 10% since then.

Each day demand for BTC peaked on January twelfth and has been declining since then. On-chain knowledge obtained from Glassnode confirmed that the every day variety of distinctive addresses concerned in BTC transactions hit a excessive of 992,491 on January twelfth and has since declined by 28%.

As of January 14, solely 710,706 distinctive addresses have been energetic as senders or receivers on the BTC community.

Observing the value actions of BTC on the every day chart reveals that the drop in demand for the coin coincided with a bearish crossover between the MACD line and the development line. On January twelfth, the MACD line broke beneath the development line, indicating the bears' re-entry into the market.

On the time of writing, BTC's Relative Energy Index (RSI) was beneath the middle line, signifying a rise within the coin's decline. The momentum indicator returned a worth of 46.66, suggesting that promoting strain exceeded the coin’s accumulation.

Moreover, market volatility has skyrocketed since January twelfth. Since then, the hole between the higher and decrease bands of BTC's Bollinger Bands (BB) indicator has step by step widened.

If the hole between the higher and decrease bands of the BB indicator for an asset is rising, it signifies that its value tends to fluctuate considerably.

Disclaimer: The data contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any type. Coin Version shouldn’t be answerable for any losses incurred because of using the content material, merchandise, or providers talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.