- Robert Kiyosaki is urging People to save lots of in Bitcoin, gold, and silver because the U.S. debt hits $35 trillion.

- U.S. Senator Cynthia Lummis has proposed shopping for 1 million Bitcoin to deal with the nationwide debt disaster.

- Donald Trump's Bitcoin plan proposes holding BTC for 20 years to assist scale back the US debt.

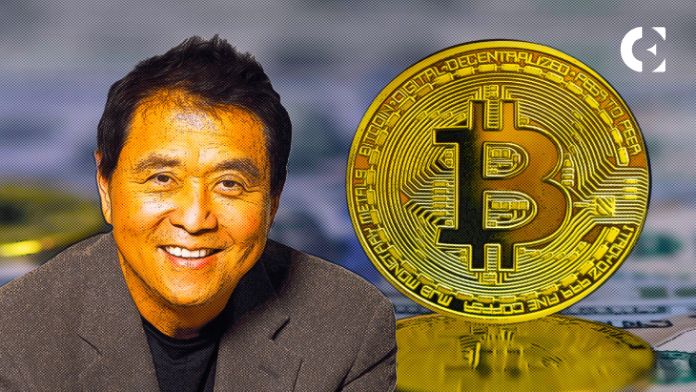

Robert Kiyosaki, writer of Wealthy Dad Poor Dad, has sounded the alarm over the US's $35 trillion nationwide debt. He believes that the rising debt disaster will certainly threaten the economic system. He additionally claims that neither Donald Trump nor Kamala Harris can resolve the looming disaster. Kiyosaki advocates dumping the US greenback and investing in belongings similar to Bitcoin, gold and silver.

Bitcoin as a hedge in opposition to the debt disaster

Kiyosaki highlights the US authorities's dependancy to debt as the elemental downside. Curiosity on the nationwide debt is nicely over $1 trillion per 12 months, greater than all different US spending mixed. The debt grows by $1 trillion each 100 days, Kiyosaki argues, which is spurring inflation and devaluing the greenback.

Additionally learn: Robert Kiyosaki predicts Bitcoin will hit $105,000 if Trump wins the 2024 election

Senator Cynthia Lummis additionally proposed a Bitcoin technique to deal with the U.S. debt downside. She steered the U.S. authorities buy 1 million Bitcoin over the subsequent 5 years, following El Salvador's method of accumulating Bitcoin as a part of its nationwide fiscal technique.

President Trump's Bitcoin Technique Sparks Controversy

Even Donald Trump is making an attempt to make use of Bitcoin to deal with the US debt downside. His technique is to purchase a considerable amount of Bitcoin and maintain it for 20 years, aiming to repay the debt with the potential earnings. The concept has obtained combined reactions from economists, with some acknowledging its potential and others highlighting Bitcoin's volatility.

Additionally learn: President Trump's Daring Imaginative and prescient for 2024: Bitcoin and the US Debt Resolution

Bitcoin is already being thought of by some institutional traders as a hedge in opposition to financial crises. Monetary specialists like Michael Saylor predict that the worth of Bitcoin might skyrocket and attain tens of millions of {dollars}. Bitcoin proponents argue that if the worth reaches such astronomical figures, it could go a good distance in fixing the US debt disaster.

Discussions about Bitcoin as an answer to the US debt disaster have been gaining extra consideration as celebrities and organizations have grown more and more connected to the cryptocurrency, however the effectiveness of this technique in stabilizing the economic system stays a matter of debate.

Disclaimer: The knowledge offered on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or counsel of any form. Coin Version is just not answerable for any losses incurred on account of the usage of the content material, merchandise, or companies talked about. Readers are suggested to train warning earlier than taking any motion associated to the corporate.