- Robert Kiyosaki warns of an impending ‘large crash’.

- He recommends gold, silver, Bitcoin, and Ethereum as safety.

- Analysts are divided on whether or not his warning is significant.

Famend monetary commentator Robert Kiyosaki has as soon as once more warned {that a} international monetary collapse is imminent. In a put up on X, the investor predicted a “huge crash” that might wipe out “tens of millions of individuals” and known as on his followers to guard their wealth by investing in gold, silver, Bitcoin and Ethereum.

Why Mr. Kiyosaki recommends gold, Bitcoin, and Ethereum

Kiyosaki believes that tangible and digital belongings present higher safety for a world financial system that he considers weak. “Shield your self,” he wrote, including that holders of treasured metals and cryptocurrencies would fare higher than these counting on paper foreign money.

Kiyosaki issued an analogous warning in October, shortly after cryptocurrencies plummeted on account of new U.S. tariffs on China. The announcement of the 100% tariff despatched Bitcoin plummeting from $122,000, wiping out practically $19 billion in leveraged positions inside hours.

Kiyosaki mentioned the turmoil is additional proof of financial vulnerability. He warned that each digital and conventional methods are constructed on “paper guarantees” and as soon as once more urged buyers to maneuver in direction of tangible belongings resembling gold, silver, Bitcoin and Ethereum.

Bitcoin is presently buying and selling at $110,079, up 0.2% from the previous day. On the identical time, it has continued to say no by 7.1% over the previous month. Ethereum’s value has adopted swimsuit, buying and selling up 0.4% prior to now day and down 12% over the previous month.

Associated: Robert Kiyosaki labels US greenback ‘pretend cash’ amid inflation issues

Analysts are divided on the warning of a “large crash”

Kiyosaki’s put up sparked widespread dialogue amongst merchants and analysts. Many level out that he has been predicting an analogous crash for greater than a decade. Critics say his repeated warnings haven’t but been confirmed right and sometimes coincide with market pullbacks reasonably than long-term crashes.

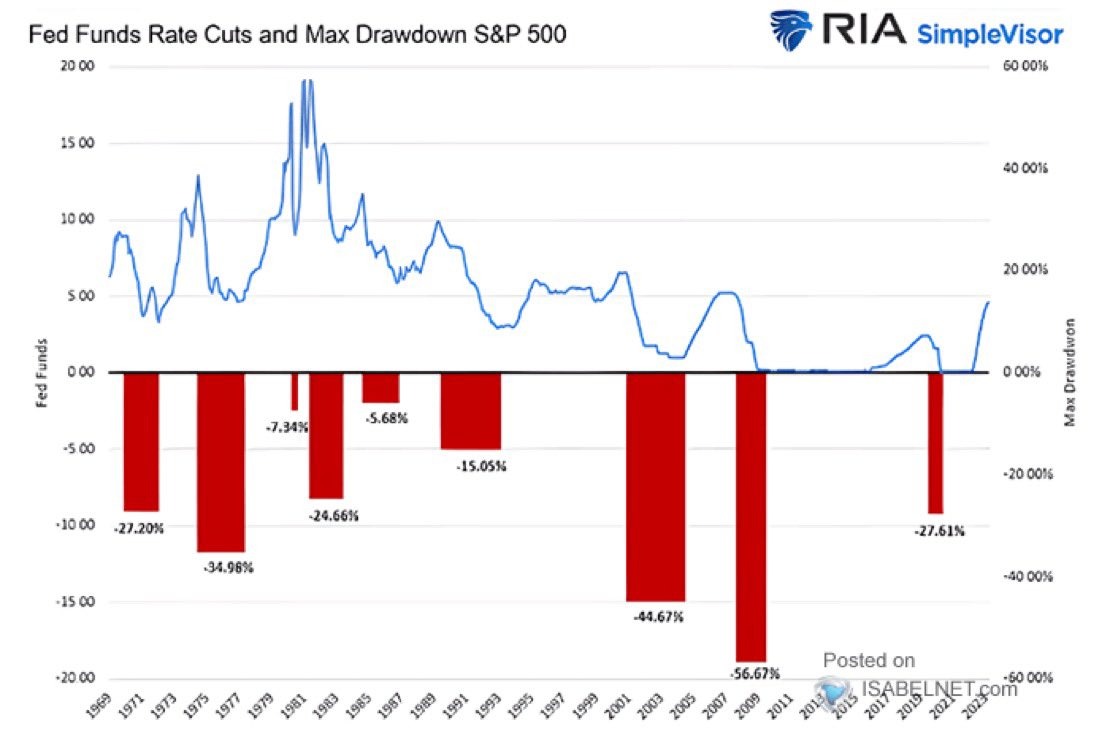

However others say latest financial patterns resemble circumstances earlier than previous market downturns. Analyst Jonesy mentioned the latest charge cuts mirror these seen earlier than the massive charge cuts in 2000, 2007 and 2020. “Price cuts have began once more,” he mentioned. “This isn’t concern mongering, that is historical past repeating itself.”

Bitcoin supporters see alternative within the warning

Supporters of Kiyosaki’s view argue that his issues are legitimate. Investor Avinash Mishra pointed to the U.S. nationwide debt, now greater than $35 trillion, and chronic funds deficits as proof of a strained monetary system.

“This bubble is about to burst,” he mentioned. “I’ve been accumulating silver and Bitcoin since 2020 to guard myself from the fiat entice.”

Some crypto supporters reacted to Kiyosaki’s feedback in a special tone, arguing that Bitcoin tends to get well strongly from market turmoil.

Associated: Ethereum value prediction: Mass outflow of ETFs will have an effect on ETH value development

On-line commentator Pac described the warning as one other stage in a fear-based narrative, saying that Bitcoin volatility usually precedes an enormous rally.

“The crash fuels the following rally,” he wrote, stressing that regardless of the latest correction, Bitcoin stays resilient above $110,000.

Disclaimer: The data contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any form. Coin Version will not be chargeable for any losses incurred because of using the content material, merchandise, or providers talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.