- Kraken is demanding a jury trial in its authorized battle with the SEC.

- The SEC accused Kraken of violating securities legal guidelines by working with out registering as a dealer and clearing home.

- A California court docket has allowed the trial to proceed, and Kraken is looking for a jury trial.

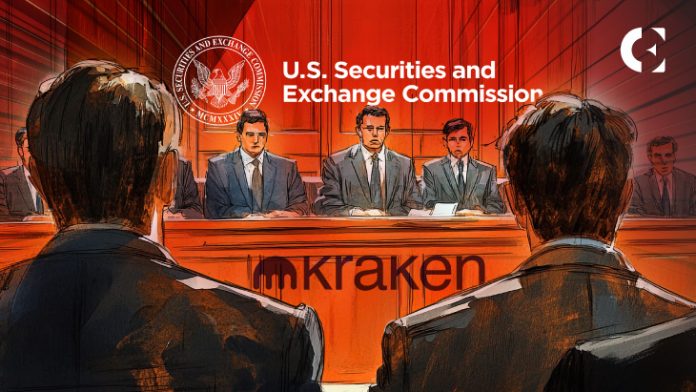

Kraken, the US trade, jury Kraken has determined to take its ongoing authorized battle with the U.S. Securities and Trade Fee (SEC) to court docket. The transfer comes after a California decide dominated {that a} lawsuit in opposition to Kraken may go to court docket. For reference, the SEC accused Kraken of violating federal securities legal guidelines by failing to register as a dealer, clearinghouse, or trade.

The SEC filed the lawsuit within the Northern District of California in November 2023, looking for to cease Kraken from violating securities legal guidelines and to disgorge “ill-gotten beneficial properties” together with different civil penalties.

In its criticism, the SEC recognized 11 digital property it categorised as “unregistered securities,” together with Cardano (ADA), Algorand (ALGO), Filecoin (FIL), Decentraland (MANA), Polygon (MATIC) and Solana (SOL).

Kraken just isn’t the one trade beneath investigation, as authorities have filed related instances in opposition to different common exchanges, together with Binance and Coinbase, for failing to adjust to registration necessities.

Kraken's Protection: Not a Safety, No SEC Jurisdiction

Kraken has defended itself by arguing that it has not engaged in any criminal activity and isn’t topic to SEC regulation beneath the present authorized framework.

The trade offered 18 defenses, together with interpretations of the Securities Act and the Securities Trade Act, which Kraken argues don’t explicitly cowl digital property and due to this fact doesn’t require registration with the SEC.

Kraken additional argues that the SEC has no authority over its actions as a result of listed digital property don’t carry the identical rights and obligations as conventional securities akin to shares and bonds.

Moreover, the swimsuit alleges that Kraken doesn’t qualify as a securities trade, clearing home or broker-dealer, regardless of its varied actions, together with itemizing over 220 crypto property, providing margin buying and selling and working an over-the-counter buying and selling desk.

The corporate additionally argues that the SEC didn’t state “any declare upon which aid could also be granted as a result of it lacked the authority to manage Kraken.”

The stakes are excessive for cryptocurrencies

The case is about to be heard in California, the place a decide will determine whether or not the SEC's movement is profitable. The result of the case may have important implications for the cryptocurrency business and will form how digital property are regulated in the US.

Notably, Kraken's request for a jury trial signifies that the trade is asking for a gaggle of abnormal residents (jurors) to determine the result of its authorized dispute with the SEC, quite than having the case determined by a decide alone.

Disclaimer: The knowledge offered on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or counsel of any sort. Coin Version just isn’t chargeable for any losses incurred on account of the usage of the content material, merchandise, or providers talked about. Readers are suggested to train warning earlier than taking any motion associated to the corporate.