A bull market correction was anticipated, however Bitcoin's fall from its all-time excessive of $99,600 to $92,000 eliminated a big quantity of optimism from the market. The tempo of Bitcoin's development for the reason that US presidential election in November has led many to consider that Bitcoin will break by means of the coveted $100,000 mark comparatively rapidly and enter a full-blown bull market by the top of the yr. I anticipated it to be loud.

Earlier currencyjournals analysis analyzed futures funding charges and investigated how the price of holding a place displays market sentiment. Persistently excessive volume-weighted and open interest-weighted funding charges mirrored market optimism and indicated that the rise was primarily pushed by derivatives buying and selling.

Nevertheless, it additionally offered a big threat of market overheating, as rising funding charges are an indication of extreme leverage making a fragile market surroundings. Intervals of excessive funding charges usually precede sharp corrections as overextended merchants are compelled to exit positions.

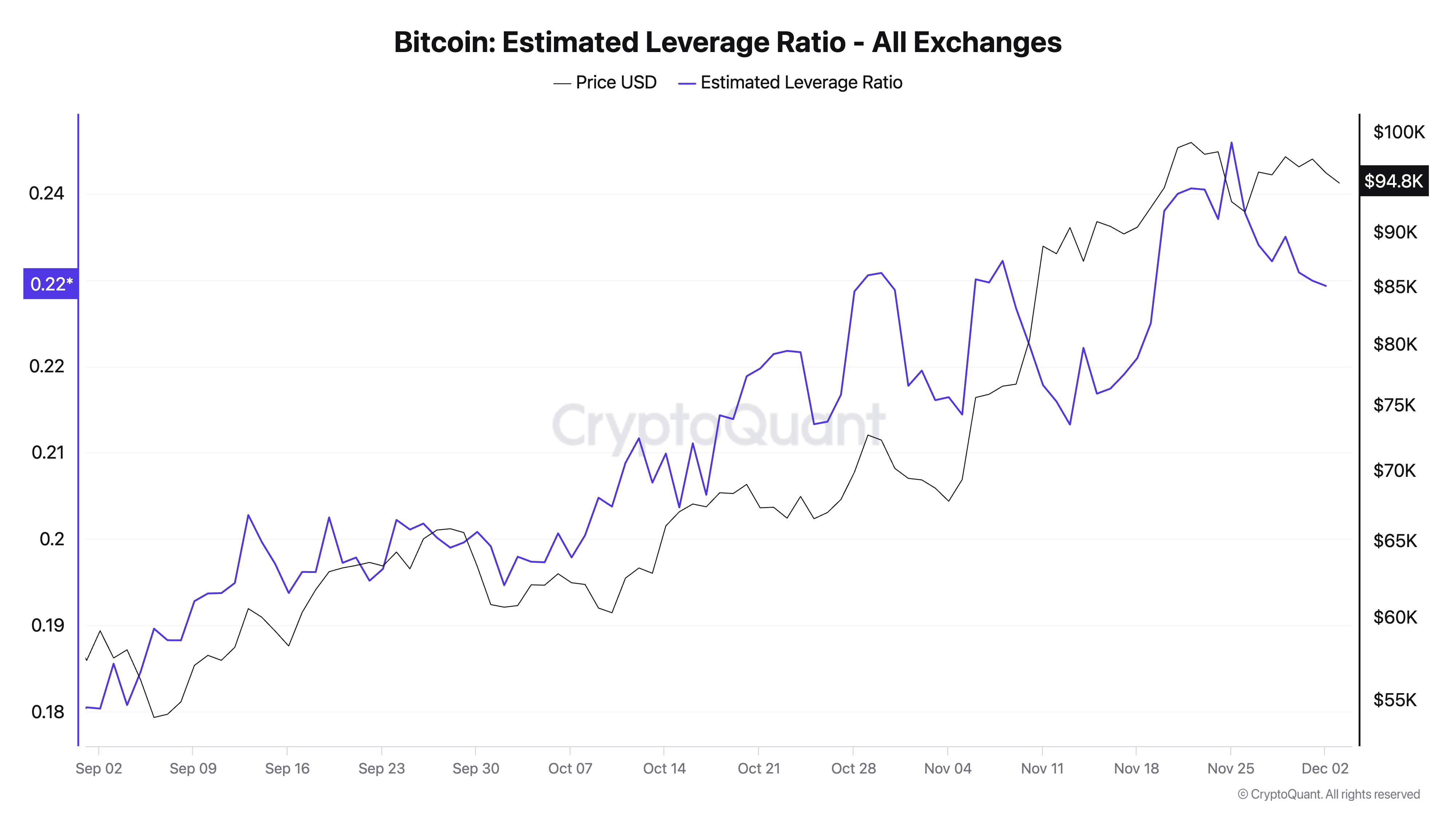

The diploma of this leverage may be decided by means of the Estimated Leverage Ratio (ELR). The ELR is calculated by dividing the open curiosity within the derivatives market by the whole Bitcoin international trade reserves. An increase in ELR signifies that extra leverage is getting used in comparison with obtainable Bitcoin, indicating elevated hypothesis.

ELR additionally offers a measure of how aggressively leveraged positions merchants are taking and the way a lot of the market is pushed by derivatives relatively than spot buying and selling. Because the starting of September, ELR has elevated considerably as Bitcoin rose from $65,000 to $98,000. This means that merchants have taken benefit of the bullish momentum and deployed leverage alongside the way in which, amplifying the upward worth motion seen over the previous three months.

Nevertheless, throughout the previous few days of November, the ELR started to say no whilst Bitcoin costs remained close to or at all-time highs. This divergence is especially essential when analyzing the market because it signifies a stage of deleveraging or threat discount.

Merchants could have began exiting leveraged positions to guard income or keep away from liquidation threat in an more and more risky surroundings. The decline within the ELR signifies that leveraged exercise is curbing and the speculative pressures that drove the rise are waning.

Given the present market sensitivity, this deleveraging couldn’t have gone unnoticed and BTC fell additional to $92,000.

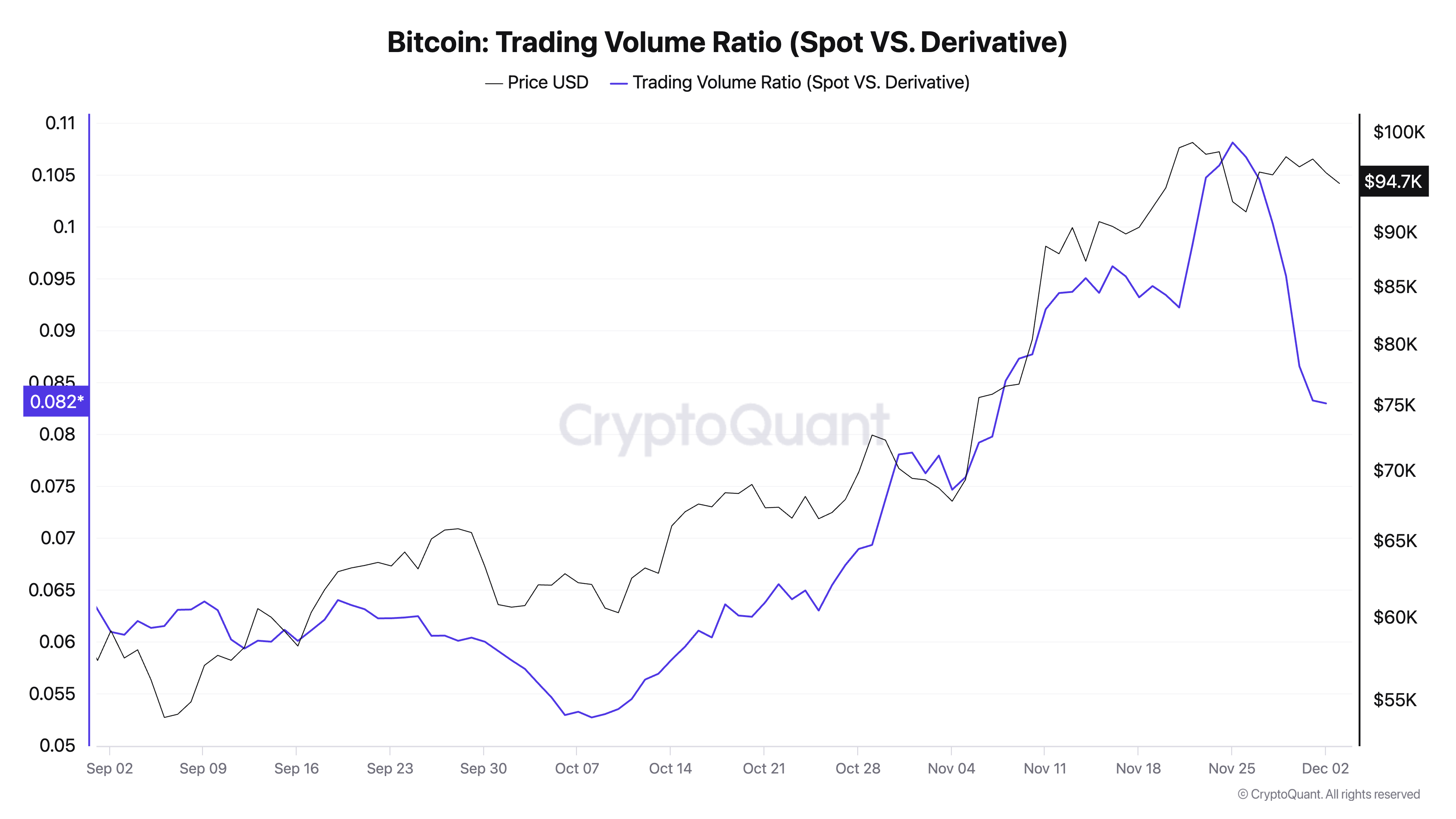

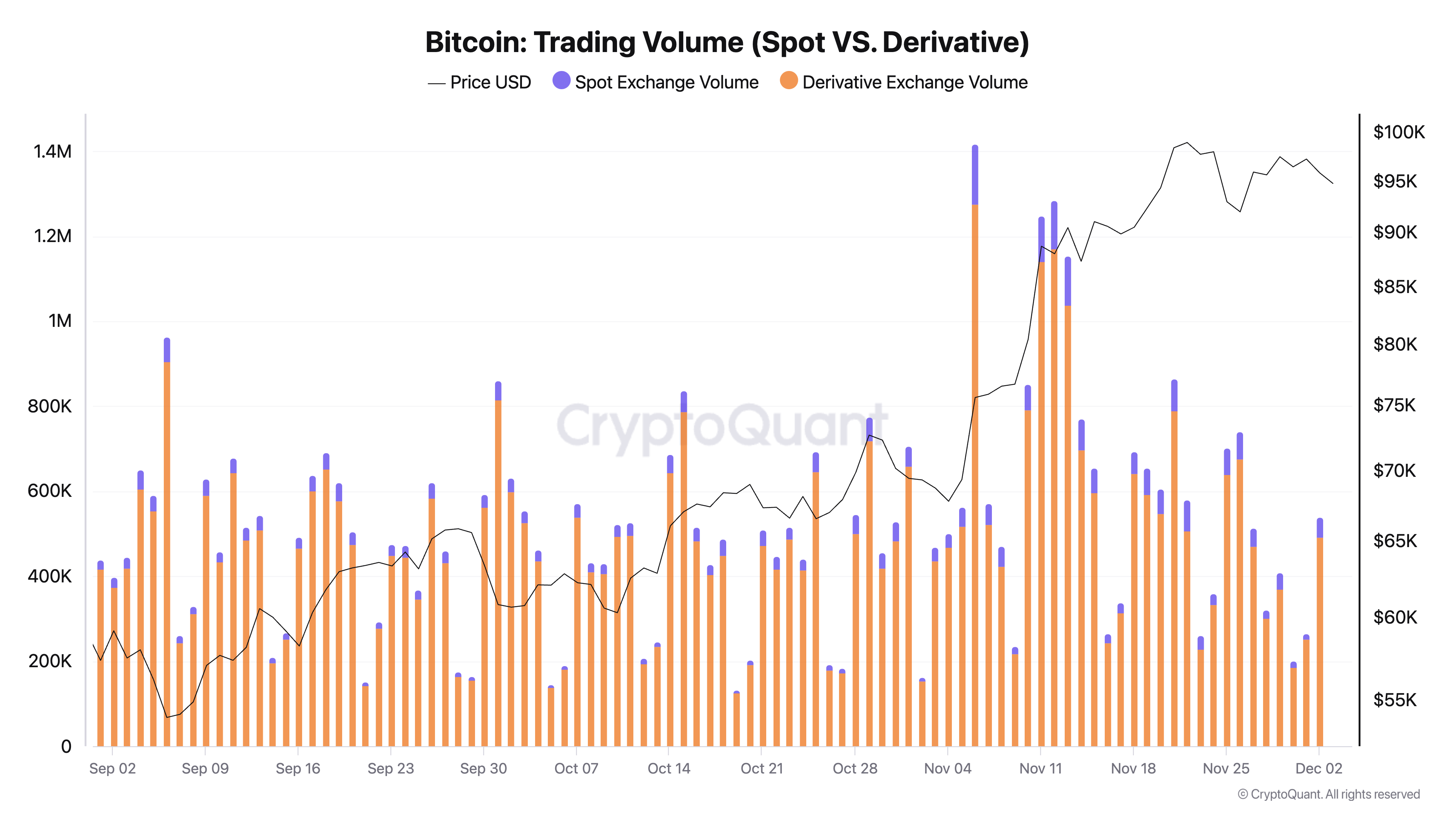

Wanting on the ratio of spot buying and selling quantity to derivatives buying and selling quantity, we are able to see that deleveraging within the derivatives market is liable for this decline. Derivatives spot buying and selling volumes have been constantly dwarfed, exhibiting how speculative exercise is influencing costs.

The buying and selling quantity ratio between the spot market and the derivatives market remained low in November, indicating that almost all exercise was concentrated in derivatives relatively than the spot market. As soon as costs peaked, derivatives buying and selling volumes surged even additional, whereas spot buying and selling volumes grew much less dramatically. This means that the value enhance was pushed extra by leveraged merchants relatively than pure demand from spot consumers.

Over the last day of November and the primary two days of December, derivatives buying and selling volumes started to say no sharply, which was mirrored in each absolute buying and selling volumes and buying and selling quantity ratios. This decline in derivatives exercise coincides with a decline in ELR, suggesting that merchants are scaling again speculative positions.

Spot and derivatives quantity ratios fell throughout the rally and recovered barely as costs stabilized round $95,000, suggesting that the speculative fever is briefly receding. Nevertheless, the decline within the total ratio signifies that even throughout the deleveraging part, the derivatives market stays the principle driver of Bitcoin worth actions.

Combining ELR and buying and selling quantity metrics reveals the extent to which speculative exercise drives Bitcoin worth actions, and the way leverage amplifies each rallies and corrections. The latest decline in ELR and derivatives buying and selling volumes, mixed with a slight restoration within the spot-to-derivatives ratio, means that the market is coming into a interval of consolidation.

Elevated natural spot exercise might present a more healthy foundation for future worth actions.

The article “Large deleveraging prevents Bitcoin from breaking above $100,000” was first printed on currencyjournals.