Lido reported a rise in Ethereum staked on its platform, regardless of the U.S. Securities and Change Fee (SEC) classifying the corporate's staking program as a safety in its lawsuit towards ConsenSys.

Growing staked Ethereum

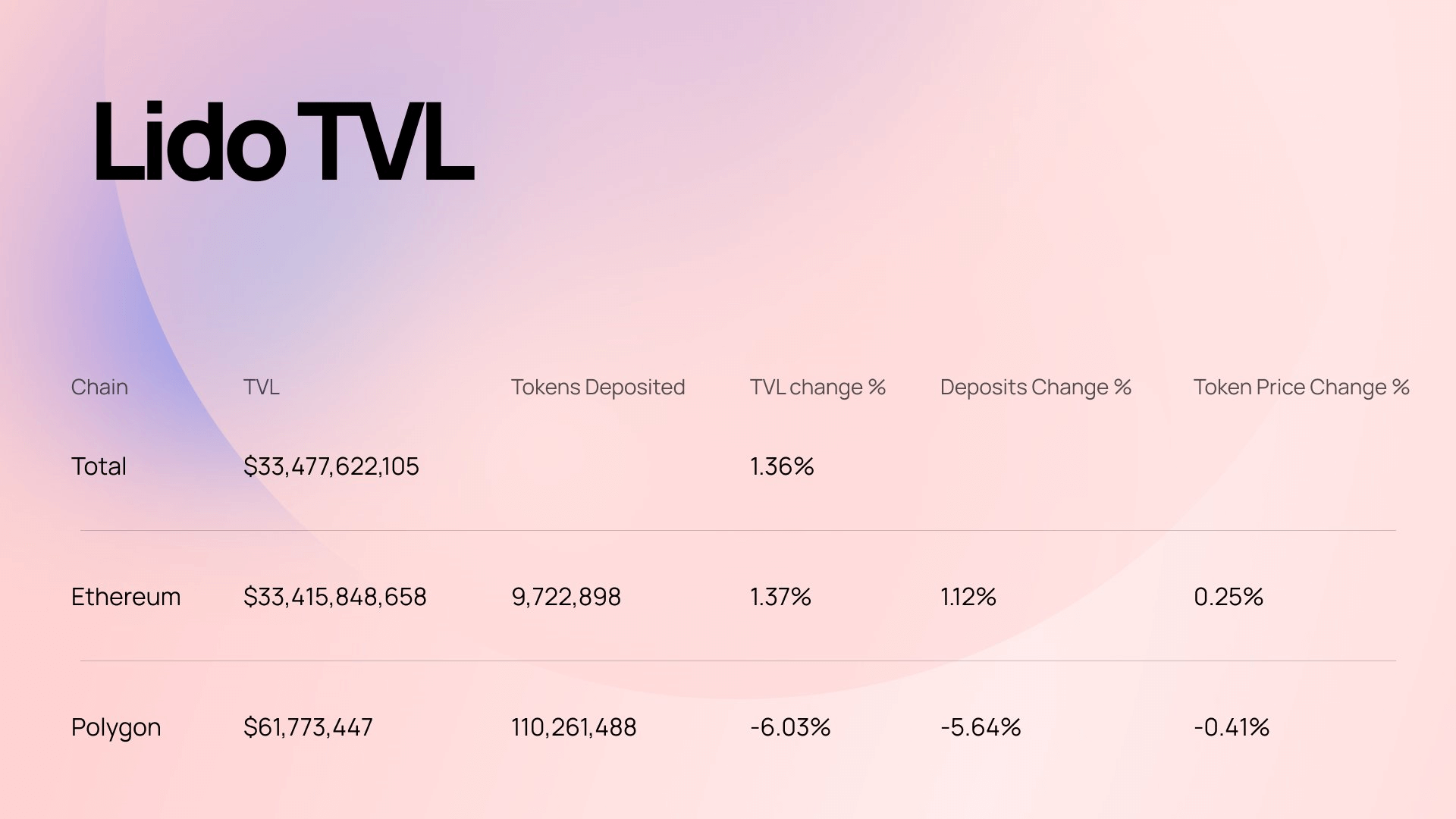

In line with a report on July 2, Lido customers staked a further 95,616 ETH between June 24 and July 1, growing the whole quantity of property staked on the platform by 1.26%, reaching $33.48 billion.

Throughout this era, Lido led the way in which in web Ethereum deposit inflows, surpassing centralized exchanges akin to Binance and Gate.io, in addition to the fast-growing liquidity re-staking venture Ether.fi.

The platform additionally uncovered important wrapped staked ETH (wstETH) exercise on Layer 2 networks akin to Scroll, Base, Arbitrum and Optimism. The overall variety of property on these blockchains grew 7.19% to 141,586, with seven-day buying and selling quantity reaching $1.23 billion.

Nevertheless, the annual share price (APR) on staked ETH has decreased barely, from 0.04% to 2.96%.

Decentralization of nodes

Lido is stepping up its decentralization efforts with the launch of a Neighborhood Staking Module (CSM) to facilitate extra decentralized Ethereum node operations.

In line with the official doc, the CSM will combine quite a lot of node operators, together with solo stakers, into the community. The module additionally permits for permissionless participation of node operators. It added:

“The last word objective of this module is to allow permissionless participation in Lido by a bigger set of Ethereum node operators, empowering solo stakers to take part within the protocol and growing the whole variety of unbiased node operators throughout the Ethereum community.”

The transfer could be a transparent shift from the earlier method, which required the DAO to approve new node operators earlier than they might be added to the platform. Nevertheless, the present effort introduces “reasonably low margins for node operators” and requires “no secondary token collateral,” which ought to make solo staking extra engaging and accessible to validators.

The module is in early deployment mode on the Holesky testnet and is scheduled to maneuver to a permissionless state on July 11, 2024.