It is rather necessary to observe liquidation ranges during times of worth fluctuations, as they point out that pressured sells and buys could cause giant worth actions.

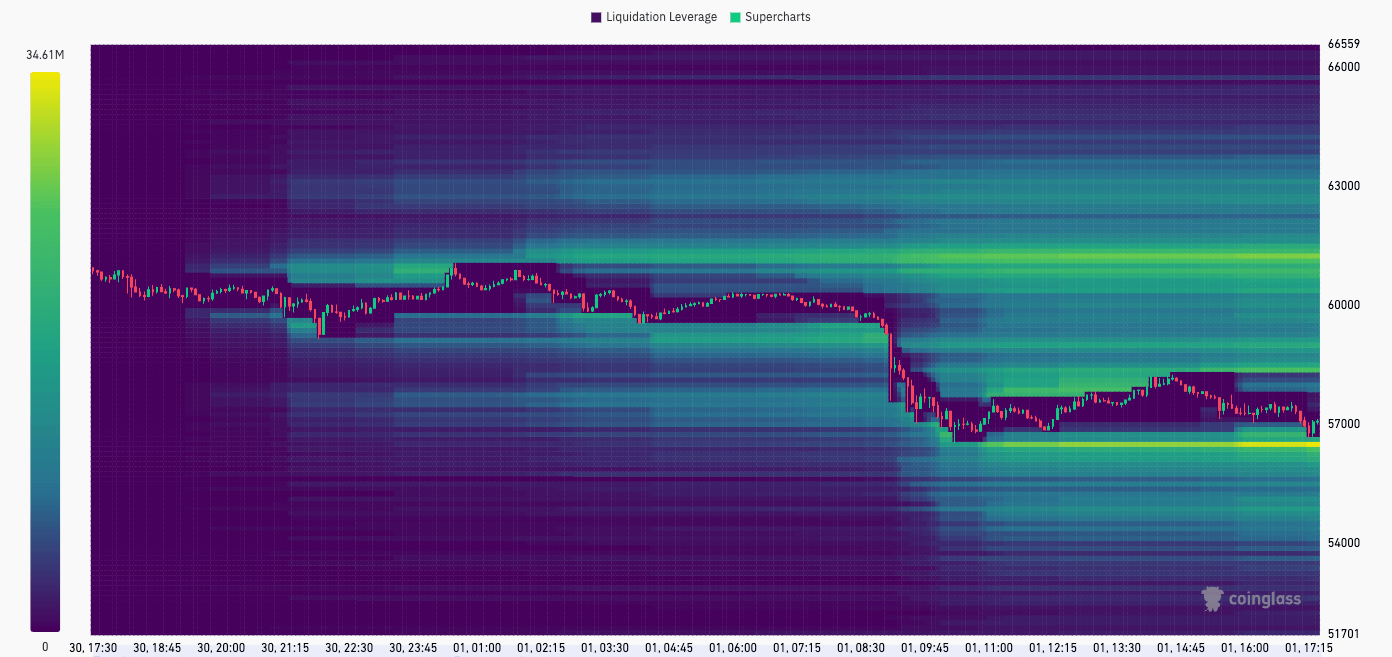

Instruments like Coinglass' Liquidation Heatmap present a visible illustration of the place the market is holding giant quantities of leveraged positions, and the potential for liquidations to happen if costs attain these ranges. Invaluable because it pinpoints worth factors.

Primarily, a liquidation heatmap acts as a technique map, exhibiting merchants potential “sizzling zones” the place unwinding leveraged positions can improve volatility. This permits for extra knowledgeable selections about entry and exit factors and danger administration, with the potential to make the most of ensuing market actions.

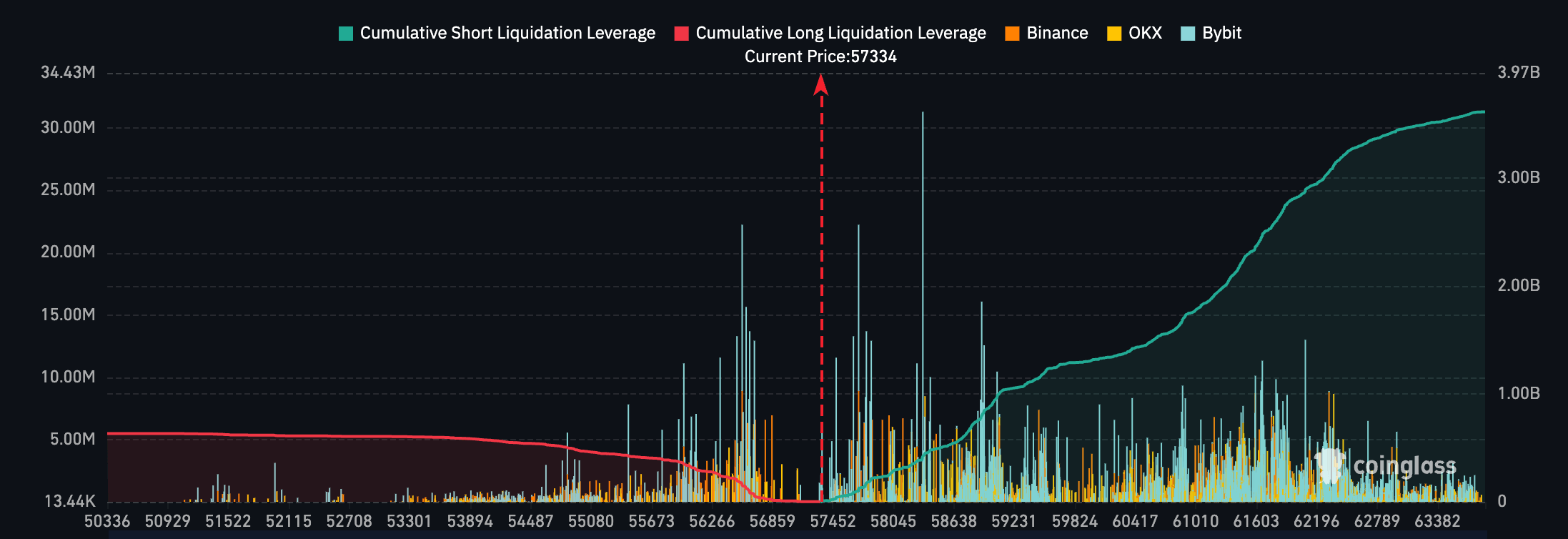

Bitcoin suffered a pointy decline on Might 1st, shedding the psychologically necessary help of $60,000 and falling to $56,500. On the time of writing, its worth is hovering round $57,000, inflicting widespread losses in the marketplace and considerably impacting sentiment that was very bullish till not too long ago.

Bitcoin's 12% decline resulted in $381.76 million in liquidations within the 24-hour interval ending at 15:30 UTC on Might 1, of which $307.92 million had been held lengthy. The worth fell from $60,600 to $57,000 in 12 hours, extinguishing a $177.36 million lengthy place.

CoinGlass’ liquidation heatmap confirmed a liquidation leverage of $16 million at a worth level of $56,880 set throughout the previous 24 hours. This degree represents the primary vital threshold, and if BTC falls thus far, it might immediate the beginning of a liquidation and probably result in elevated promoting strain.

Between $56,750 and $56,620, we see increased leverage added at $22.31 million and $19.22 million, respectively. The closeness of those ranges means that declines by means of these thresholds can have a compounding impact, with successive liquidations at every degree intensifying the downward motion in worth.

However a very powerful level is the $56,490 degree, the place the liquidation leverage is $34.04 million. Given the numerous quantity of leverage concerned, a drop to this degree could possibly be a serious set off for costs to fall much more sharply.

At subsequent ranges ($56,360, $56,230, $56,100), the liquidation leverage was $23.24 million, $19.52 million, and $19.37 million, respectively, which means {that a} slight decline in worth might set off further promoting, growing the potential worth decline. It additional reveals dense areas that will result in. Cascading results in liquidation.

These ranges point out a stack of potential triggers positioned just under the present worth, suggesting {that a} small worth drop might result in a sequence of liquidations. Every degree acts as a possible breakpoint the place the worth can briefly stabilize as a result of shopping for exercise or proceed to fall if promoting strain prevails. The focus of liquidation factors in comparatively slim worth ranges means that the market might expertise vital volatility if these worth ranges are examined.

The cumulative leverage throughout OKX, Binance, and Bybit previously day exceeded $3.5 billion. The vast majority of the leverage consists of brief positions as much as $63,380, with solely round $5 million of leveraged lengthy positions.

The post-liquidation heatmap reveals excessive volatility forward as Bitcoin falls to $57,000 appeared first on currencyjournals.