- Litecoin is holding agency above key Fibonacci helps, suggesting a brand new bullish construction.

- The rise in open curiosity and inflows highlights the rising confidence and accumulation of merchants.

- ETF optimism and technical corrections may push Litecoin in the direction of the $140 resistance zone.

Litecoin is displaying renewed power after a number of months of subdued efficiency, as each technical and market indicators are aligned in the direction of potential upside. The cryptocurrency briefly rose to $132.84 and is now buying and selling round $128.84, however it seems to be consolidating in preparation for its subsequent transfer. Analysts consider that after the bullish momentum stabilizes, robust structural help and a surge in market members may facilitate a continued rally in the direction of $140.

Market construction and value momentum

Litecoin lately broke by the important thing Fibonacci 0.786 stage at $125.91, indicating that consumers are lively regardless of the short-side pullback. The short-term rejection at $132.84 implies that merchants booked earnings after the rally, however the total setup stays constructive. Main help has fashioned between $120 and $126, a stage the place accumulation has traditionally occurred throughout previous value consolidations.

Moreover, the association of the 20, 50, 100, and 200 EMAs in an uptrend is an indicator of a longtime uptrend. The 20 EMA is presently close to $120.72, solidifying the $120 to $126 zone as a key bullish protection stage.

So long as the worth stays above $125.91, merchants anticipate contemporary momentum in the direction of $135 and even $140. Nonetheless, a fall beneath $120 may result in short-term weak point and will take a look at $116-$112 earlier than restoration.

Derivatives and on-chain metrics

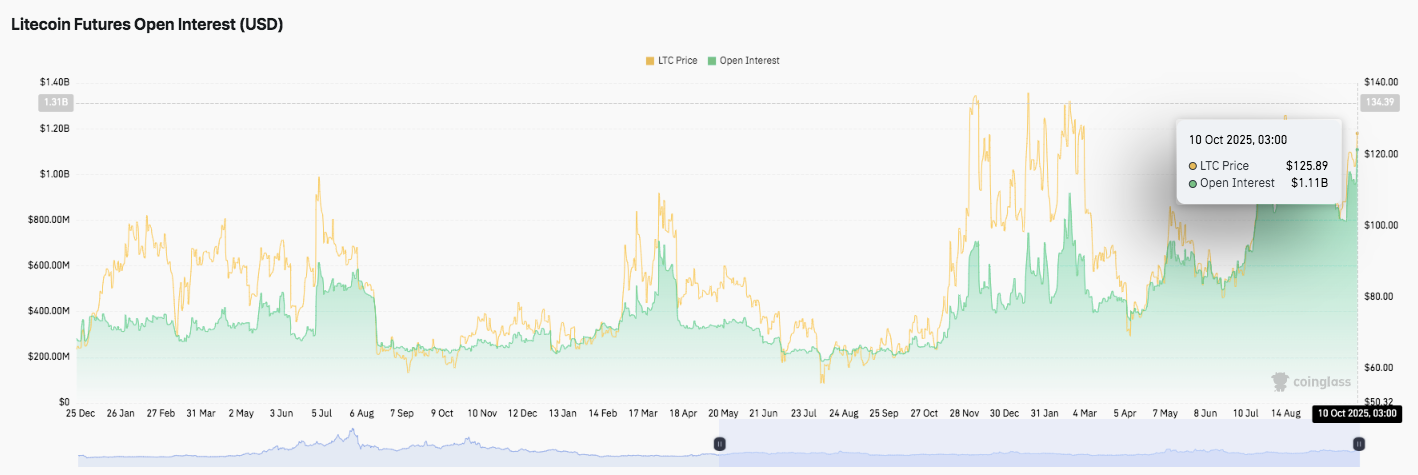

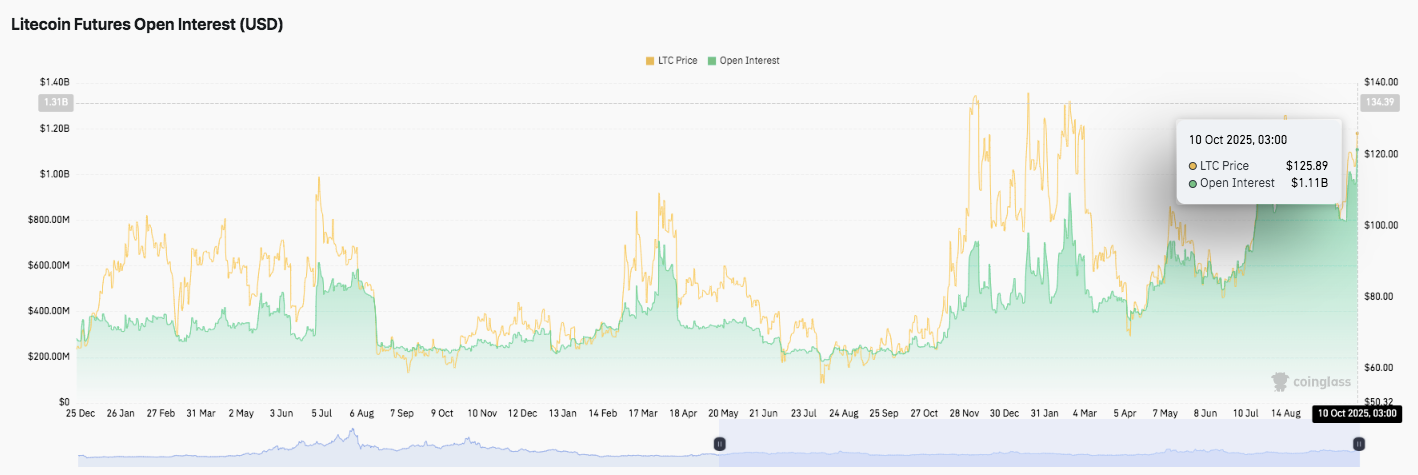

Within the derivatives market, Litecoin’s open curiosity has elevated considerably all through 2025. Knowledge as of October 10 reveals open curiosity at $1.11 billion, one of many highest ranges this 12 months.

This development signifies elevated speculative exercise and better confidence ranges amongst merchants. In the beginning of this 12 months, open curiosity remained beneath $400 million in a consolidation part, however began to rise in July because the coin’s optimistic value motion continued.

Associated: Cardano Value Prediction: Hydra Node 1.0 launch sparks new optimism

This constant improve in each open curiosity and value usually alerts the start of a robust market part. This means that merchants are positioning for a much bigger transfer as volatility picks up. Rising leverage throughout futures platforms means that the subsequent breakout, whether or not bullish or bearish, may trigger a big momentum change.

Inflows, sentiment, and ETF outlook

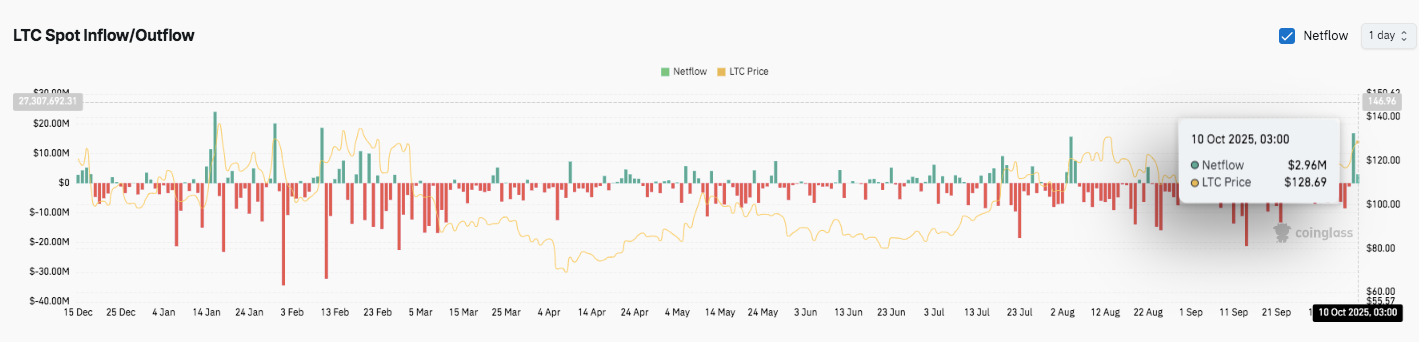

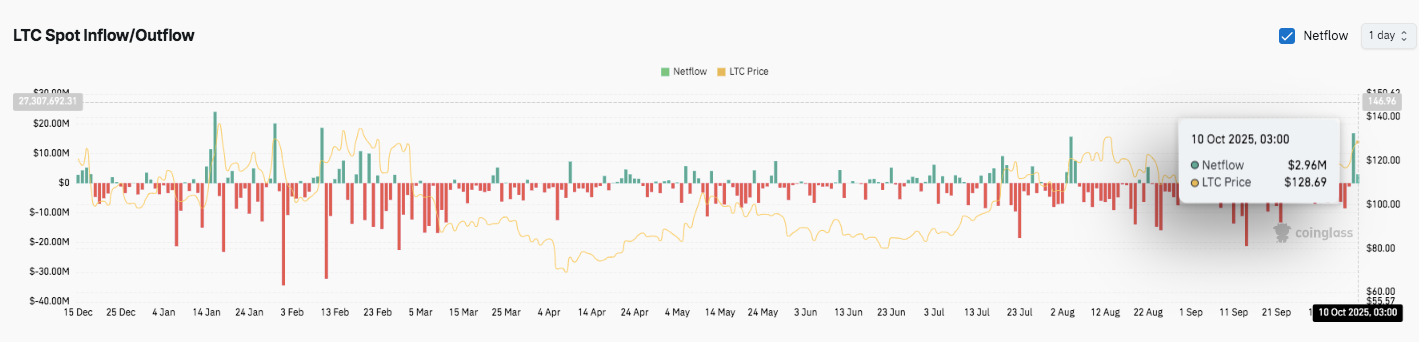

Litecoin’s on-chain flows additional strengthen its sentiment enchancment. After a number of months of unfavourable web inflows from March to September, inflows turned optimistic in October, with web inflows of $2.96 million recorded on October tenth. Traditionally, such surges in inflows precede value recoveries, suggesting buyers are as soon as once more piling on money.

Furthermore, regulatory optimism provides one other layer to Litecoin’s bullish setup. Market members are more and more assured {that a} Litecoin Spot ETF might be permitted by late 2025. Based on Polymarket’s forecast information, the chance of approval is 96%, a big improve for the reason that starting of the 12 months. This optimism is just like the pre-launch tendencies of the Bitcoin and Ethereum ETFs, each of which induced vital market good points.

Litecoin’s lengthy historical past, robust safety profile, and classification as a non-security asset make it a possible early candidate for inclusion in an ETF. The asset’s inclusion within the SEC’s common crypto ETF itemizing requirements reinforces this view, whereas statements from business leaders stress that the asset meets most regulatory approval standards.

Litecoin value technical outlook

Key ranges stay nicely outlined heading into mid-October.

Prime stage: $132.84 (latest excessive) is the primary resistance stage, adopted by $135.00 and $137.00. If momentum strengthens, a confirmed breakout above these may prolong to $140.00 and $145.50.

Lower cost stage: $125.91 (Fib 0.786) acts as fast help, adopted by $120.47 (Fib 0.618 and 20-EMA confluence) and $116.64. A breakdown beneath $116 may reveal a deeper retracement in the direction of $112.82 and $108.00.

Higher restrict of resistance: $132.84 stays a key stage for medium-term bullish continuation. If the worth continues to shut above this resistance stage, we’ll see new upward stress concentrating on the $140 zone.

Technical images: Litecoin stays solidly above the key transferring averages, with all EMAs (20, 50, 100, 200) in ascending order, indicating continued pattern power. This construction suggests an ascending channel formation the place consumers are guarding essential help to take care of high-low building.

Will Litecoin proceed to rise?

Litecoin’s October value prediction depends upon whether or not the bulls can preserve the $125-$120 demand zone and regain $133. A bullish exit from the lows supported by optimistic inflows and growing open curiosity may gasoline an upward march in the direction of the $140 highs for LTC.

Associated: Shiba Inu value prediction: Analysts deal with $0.000014 restoration as holders surge

Conversely, in the event you finish the day with out holding $120, you threat a correction to $116-112. For now, LTC stays in a key zone the place short-term sentiment is guided by ETF optimism and technical power.

Disclaimer: The data contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any variety. Coin Version will not be liable for any losses incurred on account of the usage of the content material, merchandise, or companies talked about. We encourage our readers to conduct due diligence earlier than taking any motion associated to our firm.