- Litecoin maintains bullish construction regardless of ETF delays and market readjustment

- The rising open curiosity reveals the belief of the up to date dealer and exploits optimism

- Sturdy EMA alignment and change outflow strengthen long-term accumulation tendencies

Litecoin (LTC) maintained a bullish setup on the 4-hour chart regardless of a short lived set-off from a delayed determination on Canary Capital’s Spot Litecoin ETF. The token trades at almost $120.54, reflecting stability even when merchants readjust their short-term expectations.

In accordance with Polymarket information, there’s a 94% likelihood of ETF approval,

Regulators postponed the decision and eliminated what many contemplate to be vital bullish drivers. Nonetheless, the underlying technical construction of Litecoin stays robust, and indicators counsel that momentum can final when the assist zone is retained.

The sustained power of transferring common sign

Litecoin has greater than the rest buying and selling than its foremost exponential transferring common, strengthening its upward development. The 20 EMA was $119.06, whereas the 50 EMA was $115.47, the 100 EMA was $113.27 and the 200 EMA was $112.71, forming a stringent cluster of dynamic assist.

Associated: Shiba Inu (SHIB) Worth Forecast: Analyst tracks breakouts from Key Triangle

This alignment confirms a sustained bullish momentum because the rebound from a $104 swing low. Moreover, the worth motion from $118 to $124.83 suggests steady integration earlier than transferring within the subsequent path.

Above the Fibonacci stage of $121.96 might doubtlessly reestablish upward momentum at $124.83. Nevertheless, a DIP beneath $118 will create short-term weaknesses, and assist could also be anticipated to be round $117.32 and $112.69. These zones coincide with Fibonacci ranges of 0.618 and 1.618, offering layered protection in opposition to draw back strain.

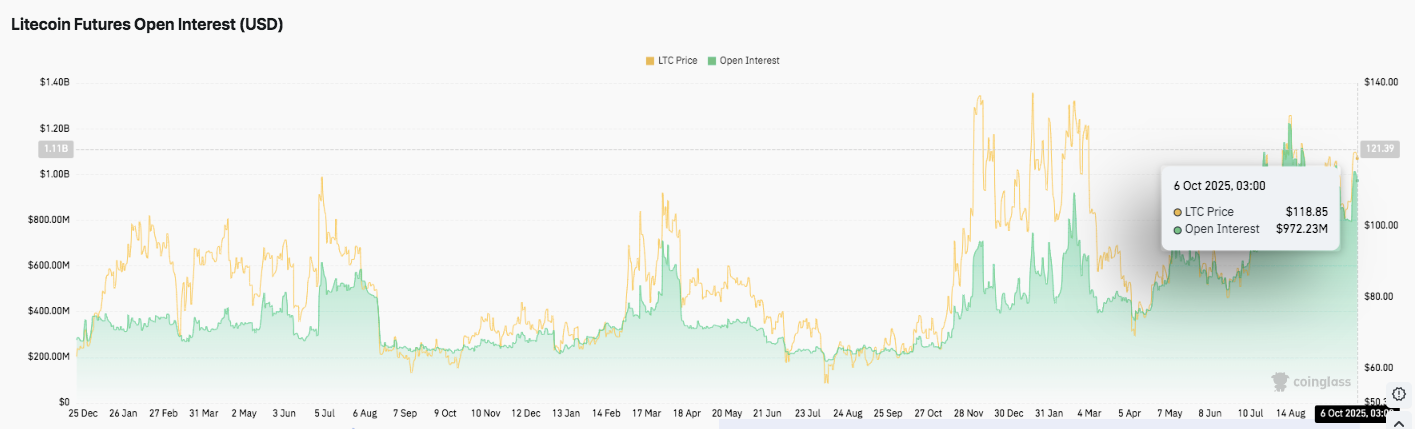

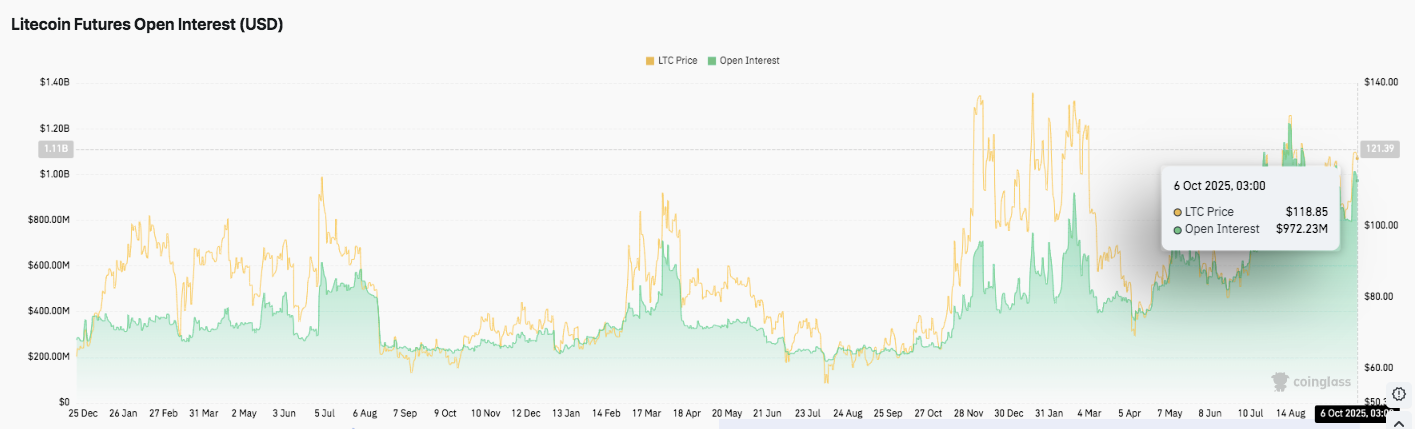

The rising open curiosity displays new participation

Along with worth stability, spinoff information reveals elevated participation by merchants. Litecoin’s public curiosity reached $972.23 million as of October 6, 2025, rising with costs rising. This parallel climbing reveals a sign indicating elevated leverage publicity and optimism amongst market members.

Traditionally, comparable surges of comparable curiosity preceded notable worth volatility. Thus, development above $110 might strengthen bullish momentum whereas inviting recent inflow from speculative merchants.

Associated: BNB Worth Forecast: BNB Holds $1,200, Eyes Breakout of $1,300

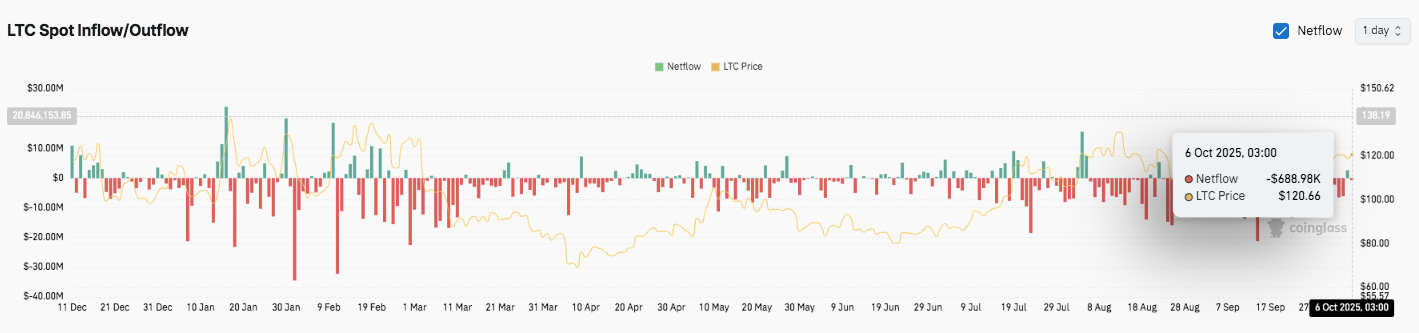

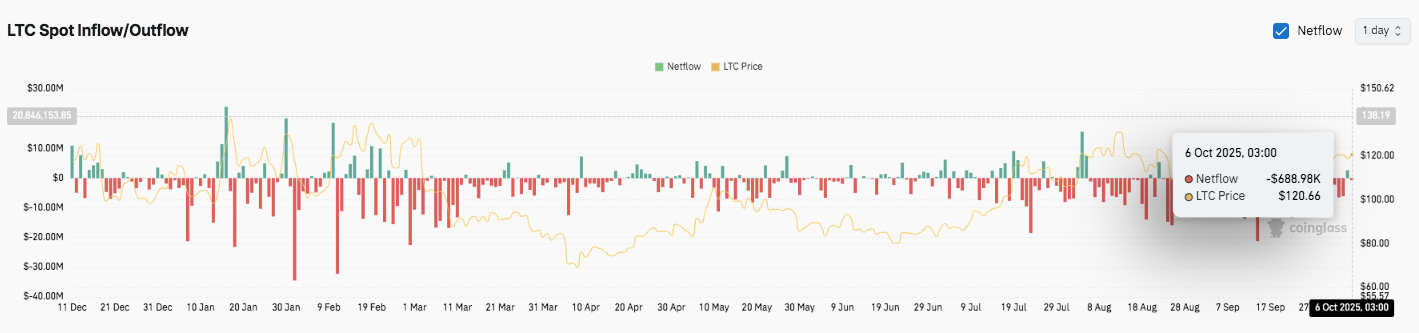

Trade outflow highlights the development of accumulation

Moreover, on-chain information reveals a everlasting LTC leak from the 2025 change. Frequent crimson bars on the Netflow chart point out that the holder is transferring the cash to a non-public pockets.

On October sixth, Litecoin recorded a web spill of roughly $688,000 throughout a commerce of almost $120.66. Such constant drawers usually cut back gross sales strain and improve market stability.

Litecoin Technical Outlook (LTC/USD)

As October progresses, key ranges stay nicely outlined.

- Upside Degree: $121.96, $123.50, and $124.83 stand as instant resistance zones. A breakout above $124.83 might shift to $127.00 and psychological boundaries to $130.00.

- Drawback stage: $118.93 was the primary key assist, adopted by $117.32 and $112.69 close to the 200 EMA. Holding over $118 will proceed to result in a short-term bullish bias.

- Ceiling of resistance: The $123.50 to $124.83 space stays a pivotal zone to show over for medium-term bullish continuation. A sustained closure above this area can affirm the depth of the development and goal a better Fibonacci enlargement.

The present construction reveals a litecoin that mixes all main exponential transferring averages, reflecting robust bullish momentum. A worth discount of $118 to $124 means that the potential volatility might be expanded sooner or later.

Will Litecoin lengthen the assembly?

Litecoin’s worth motion heading into mid-October will depend upon consumers who preserve a assist zone of between $118 and $119. A profitable protection introduced an up to date momentum to $127, or in some circumstances $130.

Conversely, if you cannot exceed $117, you possibly can be uncovered to a deeper pullback to $113-112, working with 200 EMA assist. The technical setup stays constructive total, however a affirmation above $124.83 is important to verifying your subsequent bullish leg.

Associated: Dogecoin Worth Prediction: 401(ok) Complete Rumors Trigger Bullish Tales

For now, LTC stays inside its essential vary. The tightening construction, elevated open curiosity, and robust EMA alignment counsel {that a} vital breakout can outline the following main directional motion.

Disclaimer: The knowledge contained on this article is for data and academic functions solely. This text doesn’t represent any form of monetary recommendation or recommendation. Coin Version is just not accountable for any losses that come up because of your use of the content material, services or products talked about. We encourage readers to take warning earlier than taking any actions associated to the corporate.