- Litecoin costs are hovering round $63, with the altcoin down greater than 5% prior to now week and over 11% prior to now 30 days.

- In response to CoinGecko, LTC has fallen 84% since hitting an all-time excessive of over $410 in Could 2021.

- A downtrend that has seen one of many earliest cryptocurrencies slide out of the highest 10 by market cap has seen small traders unload as the worth approaches a key help space.

Market intelligence and on-chain analytics platform Santiment highlighted a decline in Litecoin shrimp holders (pockets addresses holding lower than 1 LTC). These wallets bought greater than 45,200 LTC, which analysts say may very well be a “turnaround.”

“Litecoin has not been thrilling social boards with its market worth down 36% since its April 1 peak. The sudden liquidation of 45.2K 0.1-1 LTC wallets signifies that smaller merchants are lastly giving up on the OG crypto asset. Small fish impatiently 'leaping ship' is usually an indication of a turnaround when an asset begins to turn into bullish once more,” Santiment analysts wrote on X.

76% of Litecoin wallets misplaced

Over the previous few months, promoting has coincided with the worth’s decline from above $110 in early April. After bouncing again from lows of $56 following the Aug. 5 cryptocurrency crash, Litecoin has fallen beneath $64 and is approaching a key help zone across the $60 mark.

Par Into the Block,In/Out of the cash indicators are usually bearish. Round 76% of addresses are in losses at present costs, and solely 18% are in income. Notable is that 22% of addresses have held LTC for lower than a 12 months, which may very well be a part of the smaller holders who’ve surrendered.

Nonetheless, 78% of wallets have held altcoins for over a 12 months.

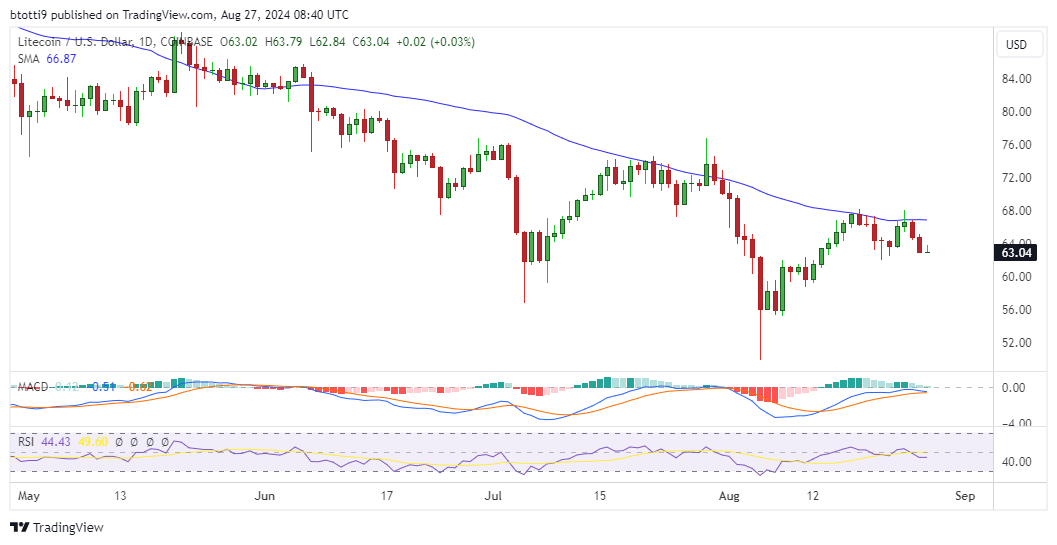

Litecoin Value Chart

On the each day chart, each the RSI and MACD indicators recommend that the bears could push Litecoin value decrease.

The worth is beneath the 50-day SMA and will act as a key resistance degree round $66, whereas additional weak spot might ship LTC exploring the demand refill zone round $55.