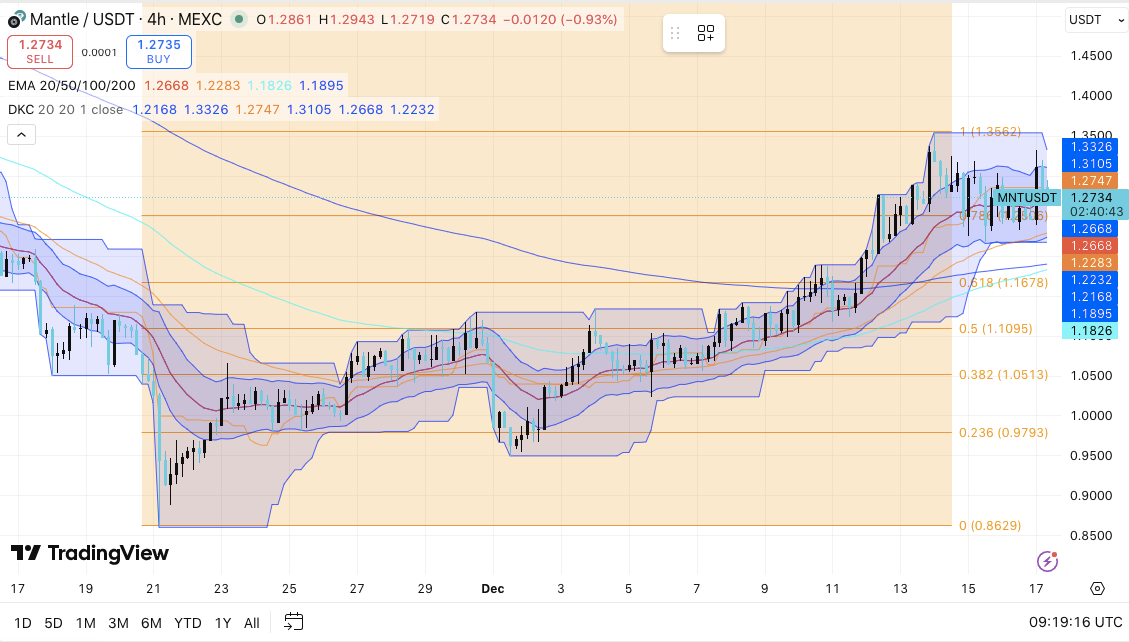

- MNT is above the rising EMA, suggesting that the bulls keep management regardless of slowing momentum.

- Speedy help between $1.27 and $1.26 is vital to take care of the near-term bullish bias.

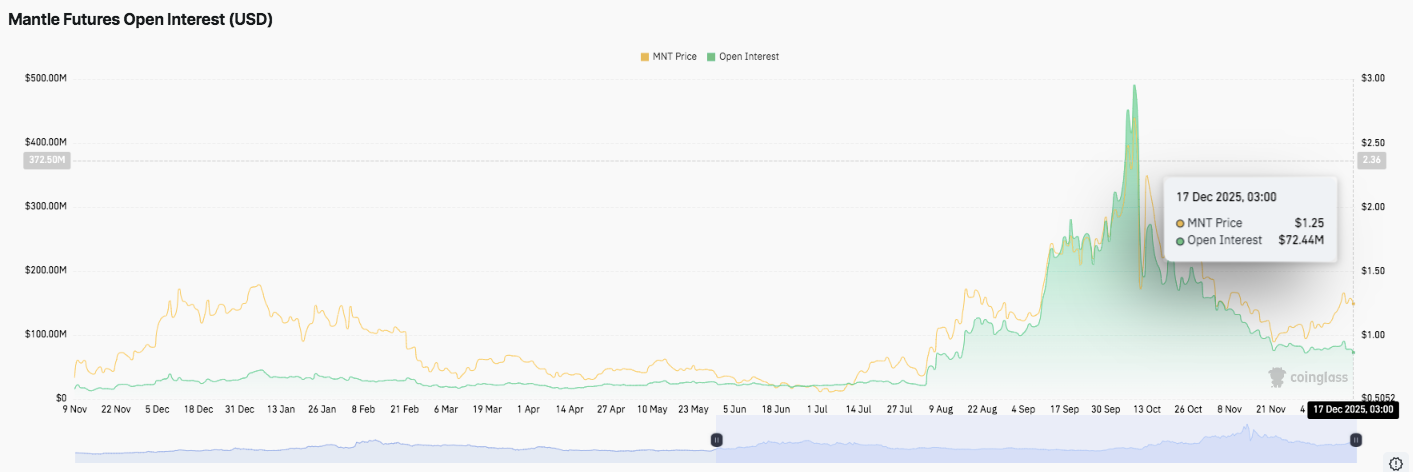

- Futures open curiosity rose to $72 million, highlighting the elevated speculative consideration close to the excessive.

Mantle’s MNT token stays within the highlight as merchants assess whether or not the current value decline helps additional upside. On the 4-hour chart, MNT maintains a near-term bullish construction regardless of the value momentum slowing after the current highs. Market contributors at the moment are targeted on whether or not key technical ranges, futures positioning, and spot movement information can maintain the broader pattern.

Value construction and main technical zones

Importantly, MNT is buying and selling above the 4-hourly rising exponential transferring common cluster. This place signifies that the client nonetheless controls the broader construction. Nevertheless, the value motion has slowed close to the current resistance stage, suggesting that merchants are cautious within the quick time period.

Speedy help lies between $1.27 and $1.26, the place the 20-period EMA and Donchian midband converge. Due to this fact, this zone stays the primary place of protection for bulls. Under that space, $1.23 stands out as an vital confluence close to the 50 EMA. If it continues to maintain above this stage, the bullish bias will stay intact.

Moreover, deeper help emerges between $1.19 and $1.18, coinciding with the 100 EMA and decrease volatility band. Due to this fact, this space might appeal to bullish patrons throughout sharp declines.

Associated: Bitcoin Value Prediction: BTC Extends Susceptible Part Attributable to Technical Pressures…

An important draw back stage is round $1.17, which coincides with the 0.618 Fibonacci retracement. A decisive break under this level will weaken the present pattern.

On the upside, resistance begins between $1.31 and $1.33, the place the value has not too long ago stalled. Moreover, if it exceeds $1.36, it’s going to break by means of Donchian’s higher restrict. Such a transfer might unlock a broader extension in direction of $1.45.

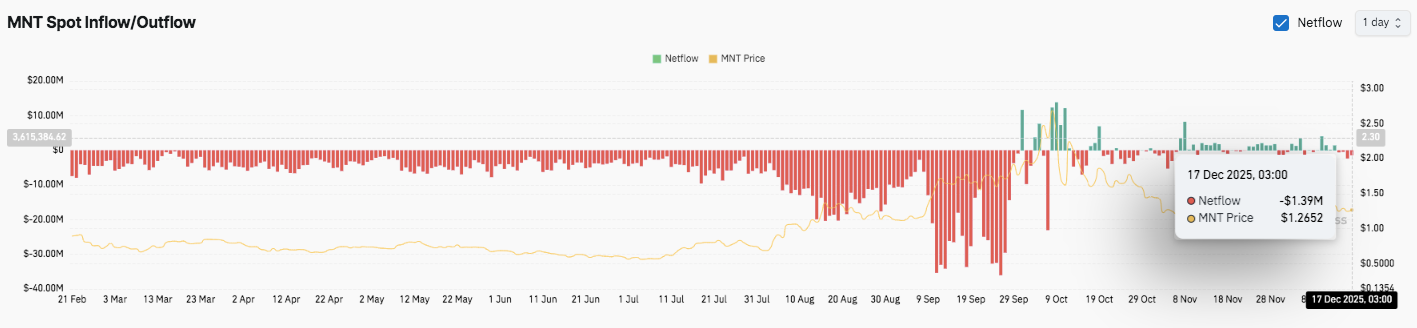

Spot movement displays cautious positioning

Along with the technical stage, spot influx and outflow information gives perception into dealer habits. Vital outflows have been seen in earlier months, notably in March and August, as costs have been on a downward pattern. Nevertheless, current information reveals an extra internet outflow of roughly $1.39 million on December 17, 2025.

Regardless of this outflow, MNT value stays steady round $1.2652. Because of this, sellers seem like proactive, however unable to power a deeper breakdown. This sample suggests revenue taking slightly than aggressive distribution.

Futures open curiosity reveals elevated consideration

Moreover, futures market information highlights a rise in participation. Open curiosity remained steady till early Could 2025, however rose steadily thereafter, peaking at practically $72.44 million in December. Throughout the identical interval, MNT value soared in direction of $2.36 earlier than falling again.

Associated: Solana Value Prediction: SOL faces short-term strain as a dealer…

This association reveals elevated speculative curiosity close to current highs. Nevertheless, the next value decline warns that leveraged positions could possibly be unwound. Due to this fact, merchants at the moment are trying to see if open curiosity cools as costs strengthen.

Technical Outlook for Mantle (MNT) Value

The important thing ranges of the mantle stay nicely outlined as costs stabilize inside a short-term bullish construction.

On the upside, fast resistance will probably be between $1.31 and $1.33, the place the current rally has stalled. If a breakout above this zone is confirmed, it might open the door to Donchian’s higher sure at $1.35-$1.36. Moreover, if momentum accelerates with elevated participation, $1.45 turns into an extension goal for the next timeframe.

On the draw back, $1.27-$1.26 will act as the primary help, consistent with the 20 EMA and the short-term pattern construction. Under that, $1.23 stays a key stage associated to the 50 EMA and midrange consolidation. A deeper decline might take a look at $1.19 to $1.18, adopted by the Fibonacci 0.618 stage at $1.17, which acts as main pattern help.

The technical setup means that MNT is digesting income slightly than coming into distribution. Value stays above the most important transferring averages, and consolidation on the higher finish signifies managed volatility.

Will the mantle rise?

The path of the mantle value will rely on whether or not patrons can defend the $1.23-$1.26 zone. Holding this vary maintains the bullish bias and helps a recent try at $1.33 to $1.36. A clear break above $1.36 might set off a transfer in direction of $1.45.

Nevertheless, failure to take care of $1.17 will weaken the construction and shift focus to a broader correction. For now, MNT stays at a essential inflection level.

Associated: Shiba Inu value prediction: Downward channel holds as regulated futures add new volatility

Disclaimer: The data contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any sort. Coin Version is just not answerable for any losses incurred on account of the usage of the content material, merchandise, or providers talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.