Monitoring modifications in liquidity is BitcoinOn-chain information for. Worth fluctuations, whether or not up or down, put a variety of stress on liquidity. One technique to analyze the modifications that value actions deliver to the market is to take a look at market depth.

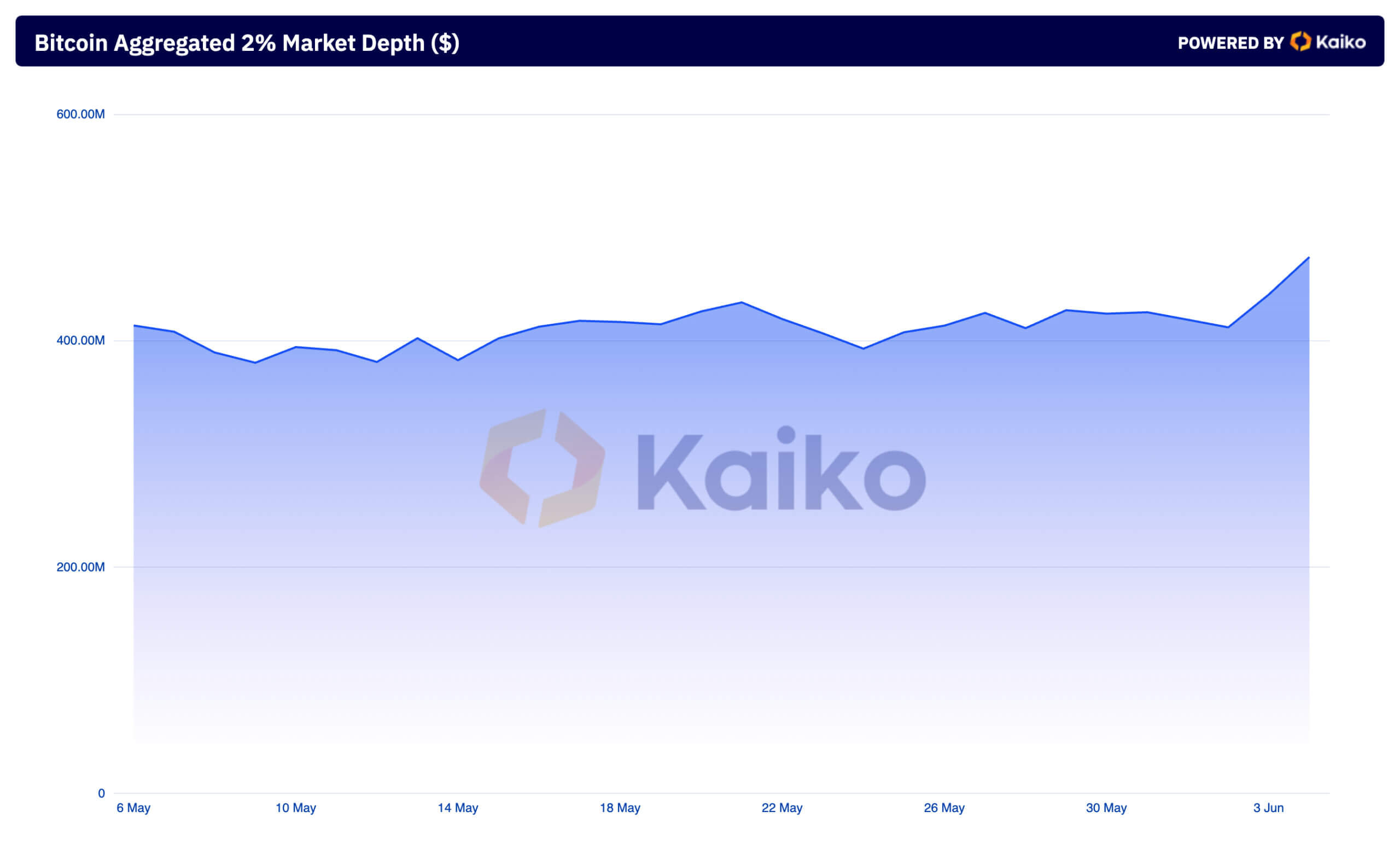

The aggregated 2% market depth and a couple of% bid-to-ask depth are good indicators of market liquidity and sentiment for Bitcoin. Aggregated market depth represents the mixed worth of purchase and promote orders inside a 2% vary of the present value. This offers perception into how a lot BTC might be traded with out important value motion. On June 2nd, the aggregated market depth throughout centralized exchanges tracked by Kaiko was $411.83 million. On June 4th, the depth spiked to $473.97 million, the best it has been up to now two months.

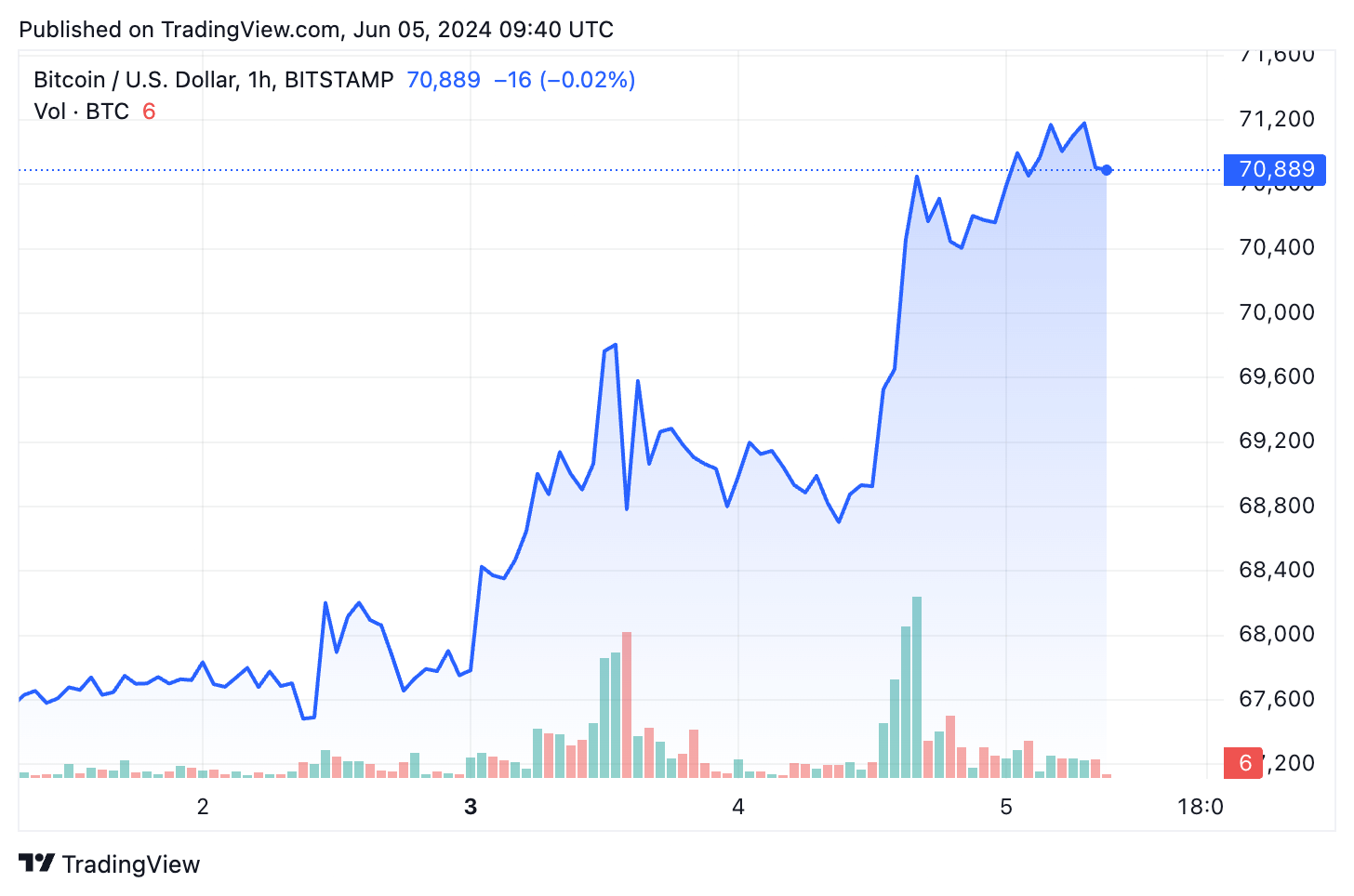

The surge in market depth got here after Bitcoin's value rose from $67,750 to $70,600. Whereas this will not be an enormous proportion improve, $70,000 is a very vital psychological milestone. The surge turns into much more important when you think about that BTC has been hovering within the mid-$60,000 vary for a number of weeks.

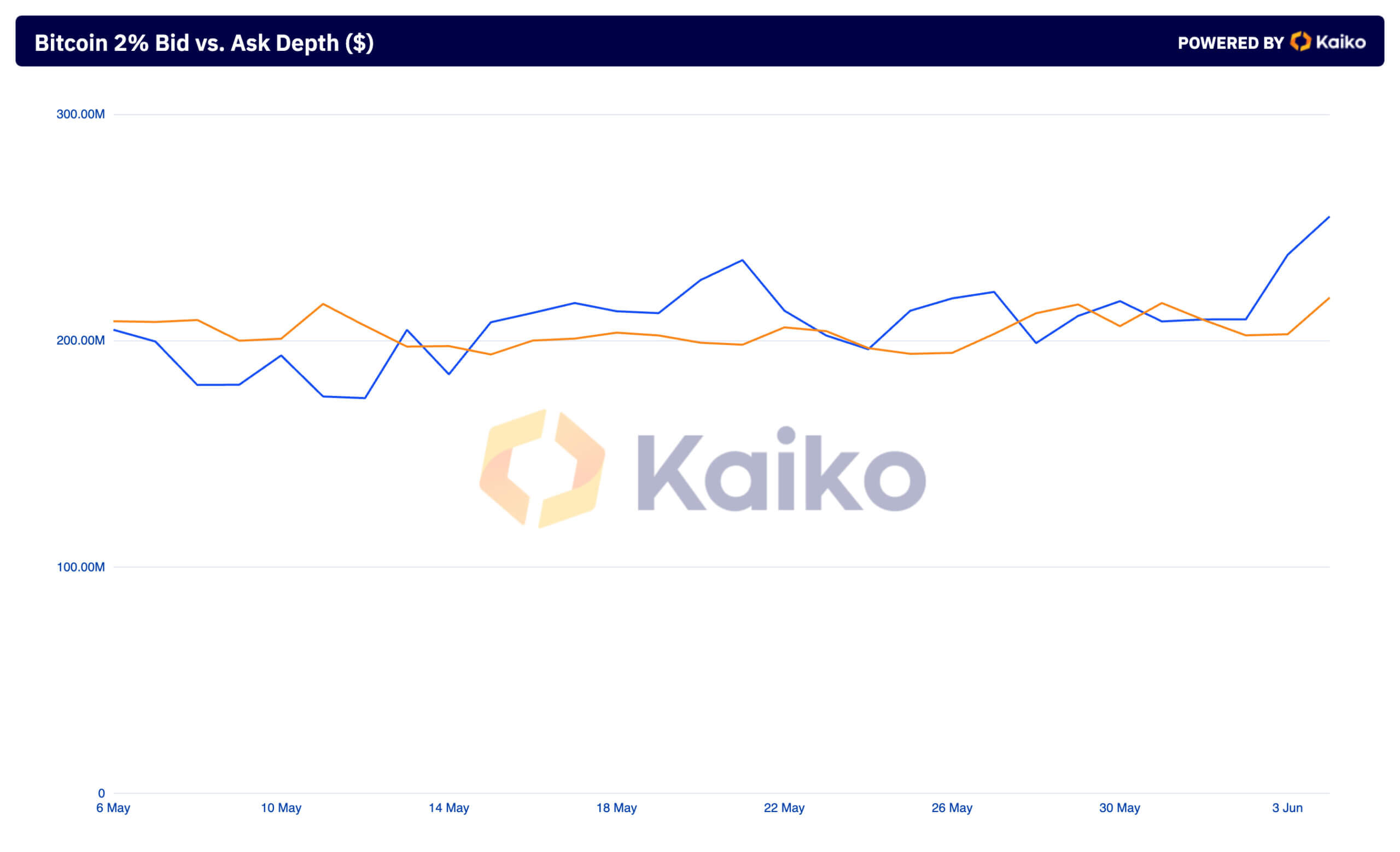

The bid-ask depth exhibits the worth of purchase and promote orders throughout the similar 2% vary. This unfold has additionally seen a notable improve over the previous few days. On June 2nd, the bid was $202.4 million and the ask was $209.44 million. That is down from the earlier 10.1%. currencyjournals evaluationThe market turned out to be roughly cut up between consumers and sellers.

By June 4, bids had elevated to $219.06 million and promote orders had soared to $254.91 million, creating the biggest unfold between promote and bid orders since early April. The rise in each market depth and the depth of promote and purchase orders signifies elevated market exercise.

An general improve in market depth signifies that the market is ready to deal with bigger trades with much less impression on value. This can be a clear indication of elevated market liquidity. This increased liquidity signifies that merchants can execute bigger volumes of trades with out inflicting important value fluctuations, contributing to the general stability of the market. A simultaneous improve in bid and ask depth displays higher exercise and confidence amongst merchants. Seeing extra purchase and promote orders inside a 2% vary signifies that merchants are actively collaborating out there.

The higher improve in promote order depth over purchase order depth implies that sellers are pricing increased in anticipation of a continued value rise. This sentiment is supported by the numerous improve in purchase order depth, indicating sturdy demand for Bitcoin at increased value ranges. As consumers prepared to buy at these increased costs enter the market, the market's upward momentum is strengthened. The elevated liquidity, coupled with increased promote and purchase order volumes, paints a strong buying and selling atmosphere the place massive trades might be executed with minimal impression on value.

The majority of this buying and selling got here from the Spot Bitcoin ETF, which noticed inflows of $886.6 million on June 4, its second-highest day of inflows since its inception, in accordance with information from Far Facet. currencyjournals report This was the biggest influx ever recorded on a day when U.S. ETFs, together with GBTC, recorded no outflows. The widening unfold between bid and ask costs means that sellers are anticipating continued value will increase and are pricing costs increased accordingly. Elevated liquidity is supporting value stability, making the market extra enticing to establishments and enormous merchants. The elevated institutional curiosity, as evidenced by elevated ETF inflows, is solidifying demand for Bitcoin and contributing to the opportunity of sustained value development within the coming months.

The put up Market Depth Reveals Bitcoin’s Underlying Power at $70,000 appeared first on currencyjournals.