- KAVA value wanders between $1.17 and $1.27 resulting from bull bear crash.

- Bearish stress threatens KAVA’s uptrend.

- Investor sentiment fluctuates as KAVA value fluctuates.

Earlier within the day, the KAVA market was dominated by the bears, who managed to push the worth right down to the 24-hour low of $1.17 (help). After establishing help, the bulls worn out the bears on KAVA, pushing the worth to a 24-hour excessive of $1.27.

The bullish momentum is powerful and on the time of writing, the bulls preserve market dominance, leading to a 0.24% acquire to $1.20.

KAVA’s market capitalization elevated by 2.02% to $638,249,499 in the course of the Bull Bear match, whereas 24-hour buying and selling quantity fell by 9.57% to $178,192,211. This drop in quantity means that buyers are taking income and being cautious concerning the market in anticipation of a reversal.

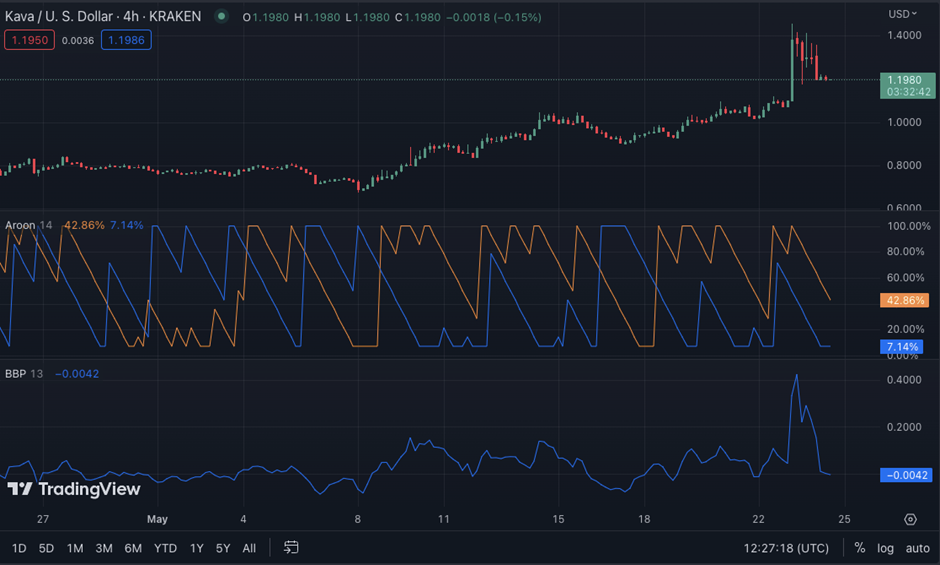

On the KAVA/USD value chart, Aroon is up 50.00% and Aroon is down 7.14%, displaying that the bulls have extra energy than the bears, signaling a doable uptrend quickly. is displaying.

Nonetheless, with the Aroon degree not above 50, the market continues to be unsure and a cease loss is required in case of a pullback.

Bullbear Energy has moved into detrimental territory at -0.0042, suggesting that optimistic sentiment within the KAVA market is fading. This transfer may point out that the bears have taken the lead and the downtrend is coming.

The Relative Energy Index (RSI) studying of 56.78 is falling beneath the sign line, indicating that the present development is dropping momentum.

If this RSI development continues and breaks beneath the ’50’ degree, it may sign a change in market sentiment from bullish to bearish. The transfer exhibits that the bulls nonetheless have an opportunity to bounce again because the market nonetheless has some shopping for momentum.

The Fisher remodel was additionally beneath the sign line with a studying of 0.22, additional strengthening the reversal prediction. This transfer exhibits that the bears are gaining power and the downtrend is approaching.

In conclusion, KAVA costs are going through uncertainty as bearish momentum is looming, suggesting a doable downtrend. Buyers ought to be cautious as market sentiment fluctuates.

Disclaimer: The views, opinions and knowledge shared on this value forecast are revealed in good religion. Readers ought to do their analysis and due diligence. Readers are strictly answerable for their very own actions. Coin Version and its associates are usually not answerable for any direct or oblique damages or losses.

(Tag Translation) Hippo (KAVA)

Comments are closed.