The market turmoil this week, triggered by the announcement of lawsuits in opposition to Binance and Coinbase by the U.S. Securities and Trade Fee (SEC), seems to have been short-term relatively than sustained. The preliminary response was panic promoting, however the market’s fast restoration displays its power.

The SEC lawsuit stems from the SEC’s more and more tight scrutiny of cryptocurrency platforms. Binance, the biggest cryptocurrency change by buying and selling quantity, and Coinbase, a serious U.S. cryptocurrency change, have come underneath hearth from regulators over alleged violations of assorted securities legal guidelines.

The SEC allegations in opposition to Binance embrace providing securities buying and selling with out correct broker-dealer registration, and Coinbase deceptive traders with its lending program and itemizing unregistered securities. was prosecuted for failing to register as an change.

The lawsuit prompted panic promoting throughout the cryptocurrency business, wiping a large $53 billion from the market. Nevertheless, the market shortly regained equilibrium, as evidenced by the fast restoration of key indicators.

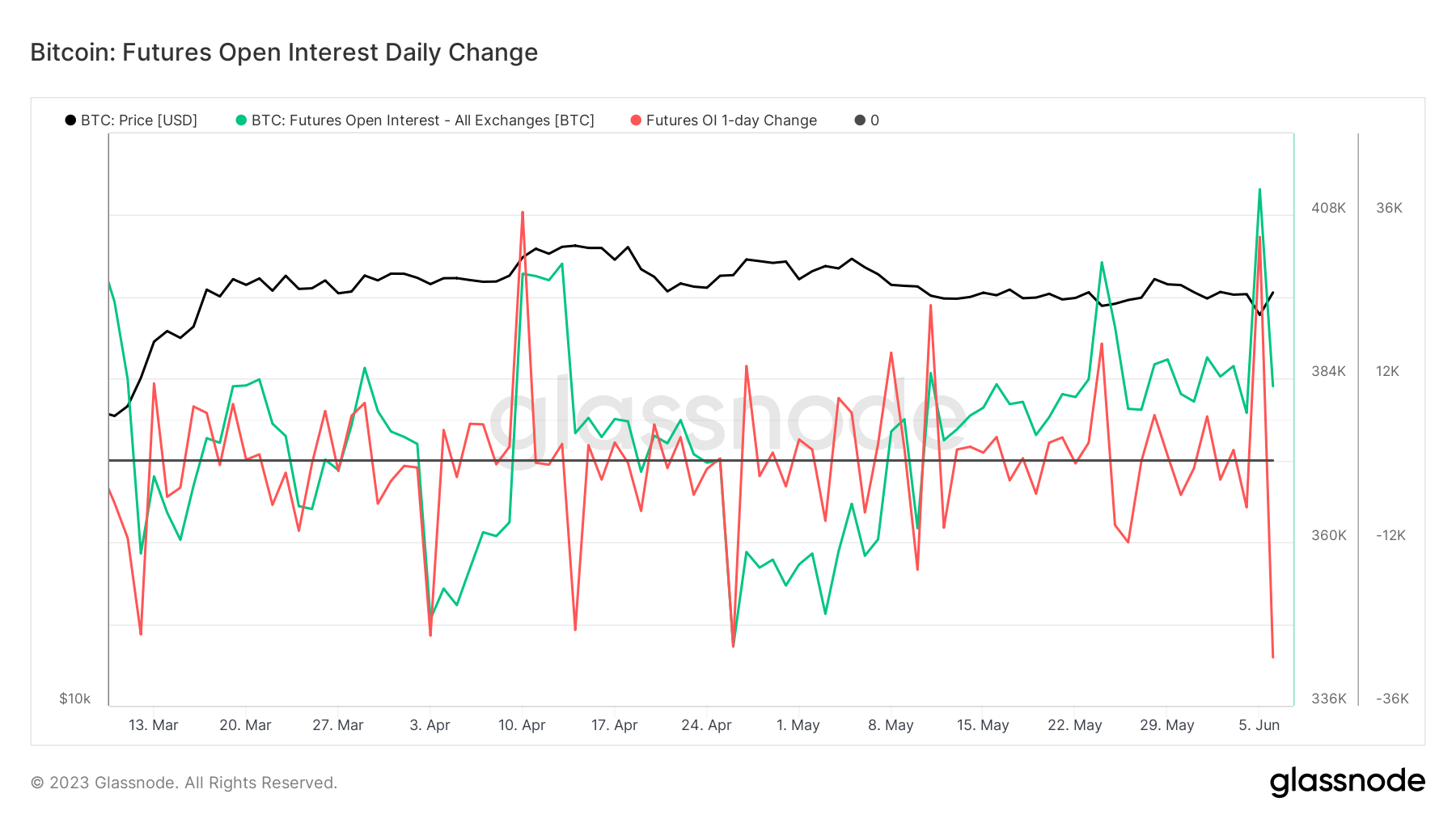

Perpetual futures are a kind of futures contract with no expiry date and are crucial within the cryptocurrency area. The open curiosity in these contracts refers back to the whole variety of excellent contracts excellent and is taken into account an essential indicator of the well being of the market.

Bitcoin open curiosity surged from 379,000 BTC to 411,000 BTC on Monday. Inside a day, nevertheless, it dropped to 382,000 BTC, indicating an efficient market correction. crypto slate It was the second largest single-day unfavourable transfer in open curiosity this 12 months, in response to the evaluation.

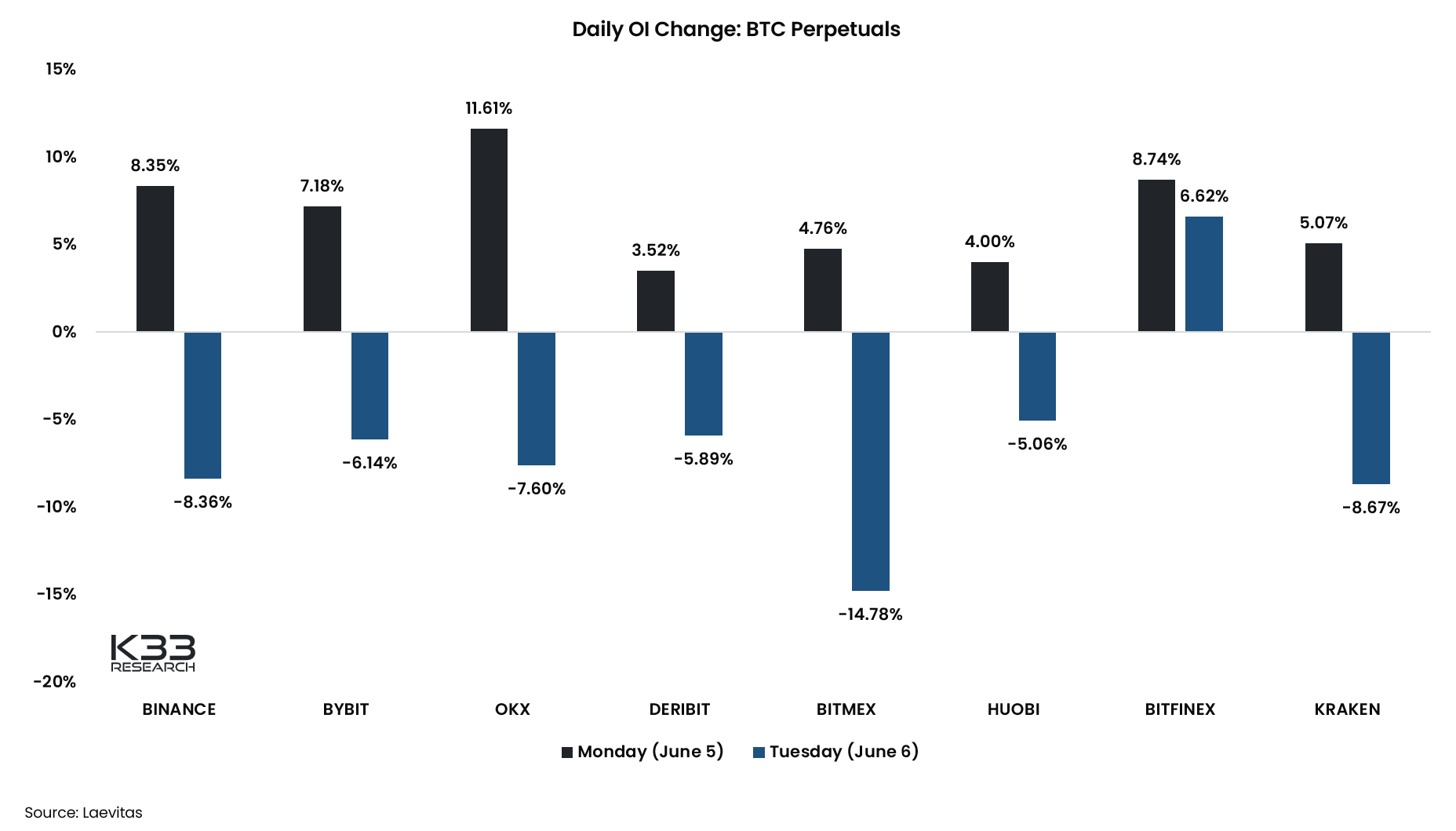

Binance, Bybit, OKX, Deribit, BitMEX, Huobi and Kraken noticed Bitcoin futures open curiosity rise on June 5 and fall the next day, in response to knowledge from K33 Analysis.

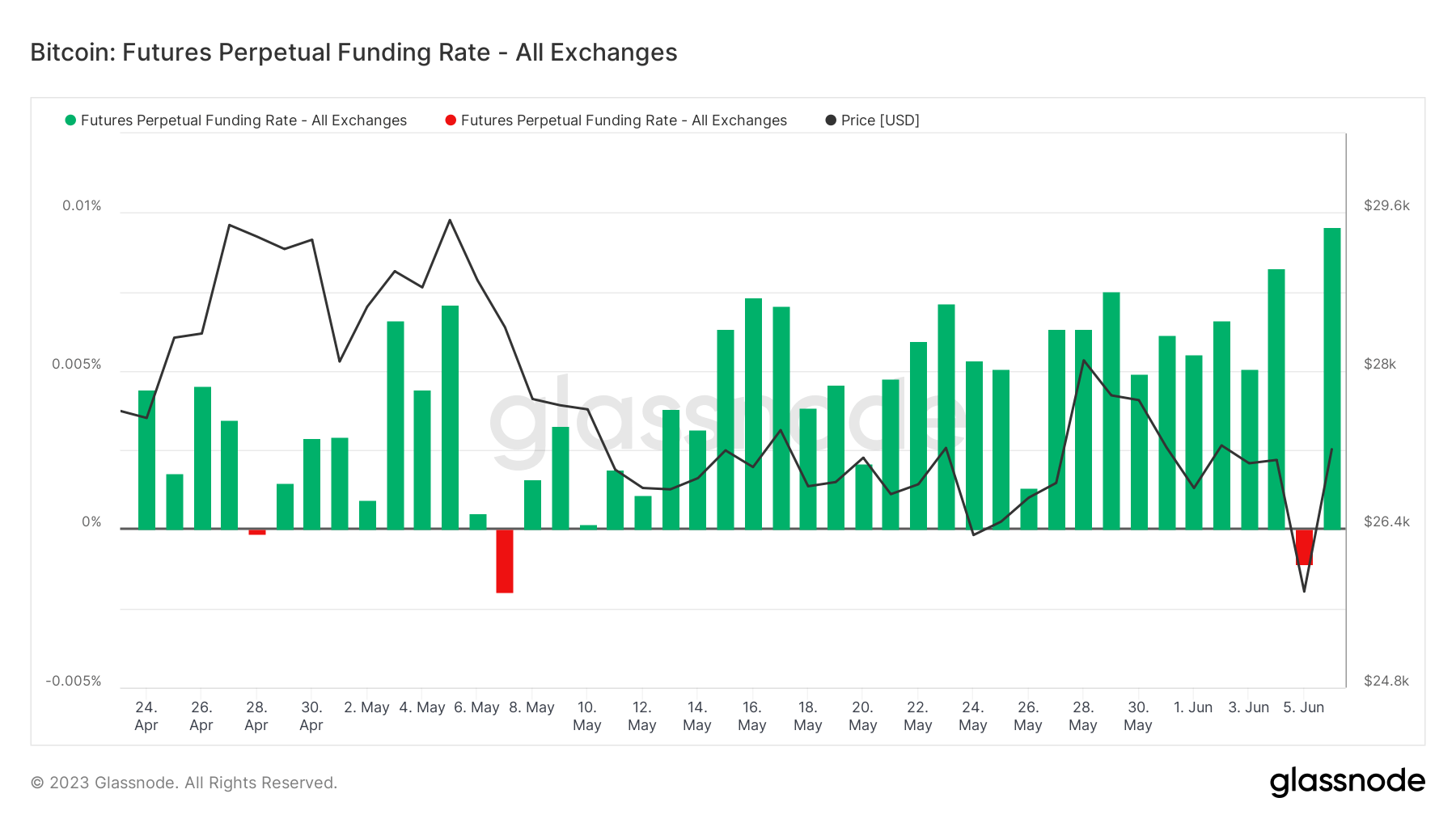

Bitcoin perpetual futures funding charges fell to their lowest stage since March on June 5, sending a wave of concern throughout the market. The funding charge is a mechanism that promotes worth convergence between perpetual futures and spot costs, guaranteeing market stability.

Regardless of the short-term decline, rates of interest returned to steady Might ranges inside 24 hours, demonstrating the resilience of the market.

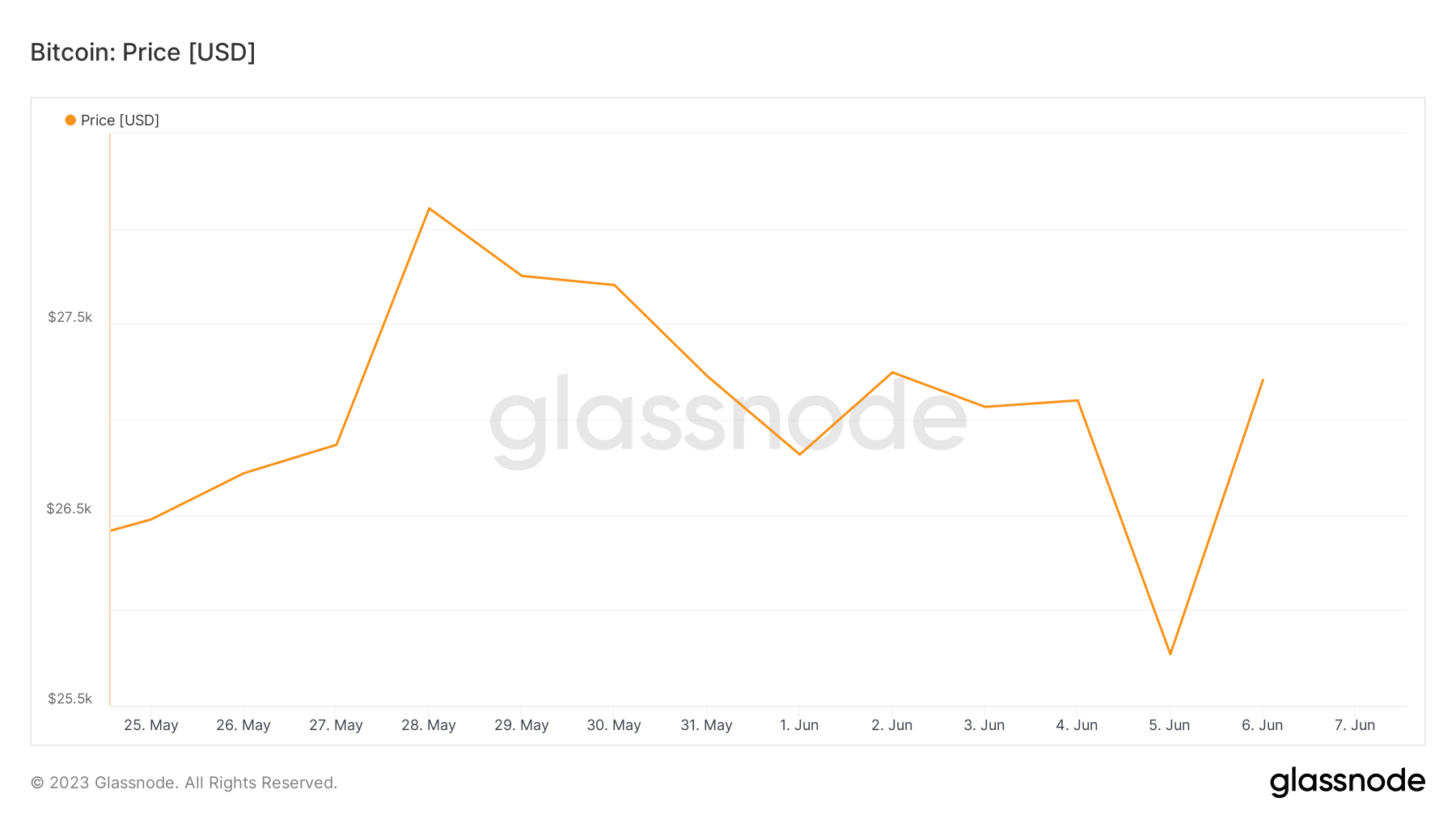

Bitcoin’s spot worth, the real-time market worth, was the primary to be shocked by the lawsuit information, dropping to a low of $25,770. Nevertheless, the bearish momentum didn’t final lengthy and Bitcoin rallied again to the $27,000s.

These indicators clearly present the resilience of the cryptocurrency market. The fast restoration from the panic promoting triggered by the SEC lawsuit underscores the maturity of market sentiment. This means that regulatory developments, whereas impactful, are much less more likely to destabilize the cryptocurrency market in the long term.

An article in regards to the market rebound after an SEC lawsuit triggered a brief panic first appeared on currencyjournals.

Comments are closed.