- MATIC bounced off resistance at $0.72 as demand pushed the worth to a 30-day excessive.

- The CMF stated more cash was pouring into MATIC, however the momentum was prone to gradual.

- Shopping for stress elevated, with majority of merchants opening lengthy positions.

Polygon (MATIC) recovered from a week-long decline, gaining 7.46% in opposition to Bitcoin (BTC) and seven.47% in opposition to Ethereum (ETH). All of this occurring within the final 24 hours has ensured that MATIC has been in a position to break his $0.72 resistance that emerged on July 4th.

From the day by day chart, MATIC failed to interrupt above $0.72 after a sequence of bullish orders on July 1st. Nevertheless, after rising to $0.72, promoting stress pulled the axis again and MATIC returned to the $0.65 demand space.

Worth goes up as capital goes up

Nevertheless, the bulls had different plans and because the shopping for stress elevated, MATIC was in a position to make new highs at $0.74. Along with the optimistic value response, the Chaikin Cash Circulate (CMF) confirmed excessive ranges of liquidity flowing into MATIC over the previous 21 days.

Additionally, the CMF was within the optimistic vary at 0.04. This subsequently signifies that there’s extra shopping for stress given the cash flowing into the asset. Nevertheless, merchants could must be conscious that the CMF is trending southward.

If this development continues, capital inflows to MATIC may decline. This might counteract the bullish bias. Subsequent, MATIC’s value motion might be adversely affected, with the worth prone to return to the $0.65 territory.

In the meantime, the Relative Energy Index (RSI) was above the impartial worth of fifty. The RSI is 59.63, indicating that there are extra consumers than sellers available in the market. Subsequently, the potential for additional value will increase nonetheless exists.

Merchants Stay Bullish Regardless of Potential Retracement

Nonetheless, you might also wish to control volatility ranges, as Bollinger Bands (BB) present. On the time of writing, MATIC’s volatility had exited excessive ranges. Nevertheless, the asset value hit the higher restrict at $0.74.

This means that MATIC could also be overbought. Furthermore, until RSI-supported demand resists a rebound, the worth could reverse.

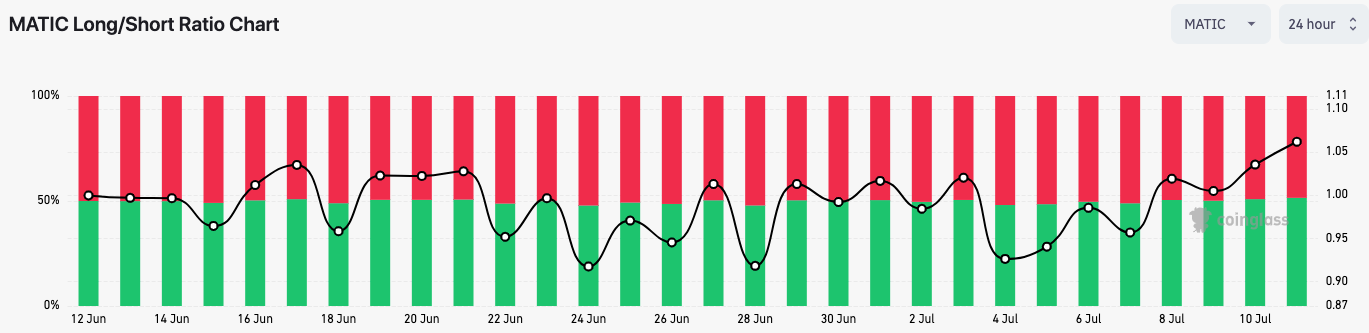

Moreover, derivatives data portal Coinglass revealed that many merchants are bullish on MATIC whatever the metric. That is indicated by a rise within the lengthy/brief ratio to 1.06.

A protracted/brief ratio above 1 often signifies that there are extra lengthy positions than brief positions. Nevertheless, if this ratio is beneath 1, it implies that the common sentiment is bearish.

So, MATIC’s lengthy/brief ratio of 1.06 implies that 51.5% of merchants have been bullish on MATIC. Then again, 48.5% have been bearish.

In conclusion, MATIC’s subsequent path might be harmful. Nevertheless, because it stands, the possibilities of the token falling beneath $0.65 are extraordinarily low. Additionally, if shopping for stress continues to take priority over promote orders, the worth may rise above $0.74.

Disclaimer: The views, opinions and data shared on this value forecast are printed in good religion. Readers ought to do their analysis and due diligence. Readers are strictly answerable for their very own actions. Coin Version and its associates usually are not answerable for any direct or oblique damages or losses.

Comments are closed.