- As inventory value volatility will increase from 2025 to 2026, metals have proven higher stability than cryptocurrencies.

- Cryptocurrencies monitor the volatility of shares extra intently and are topic to extra fast fluctuations than metals.

- The Bitcoin-to-gold ratio decreases when volatility will increase and stabilizes solely when the market calms down.

Market information tracked by Bloomberg Intelligence highlights a rising divergence between metals and crypto property as volatility dynamics change heading into 2026, in line with a current evaluation shared by Bloomberg Intelligence Strategist Mike McGlone. Two separate datasets concentrate on relative efficiency tendencies, linking asset actions to inventory market volatility relatively than speculative momentum.

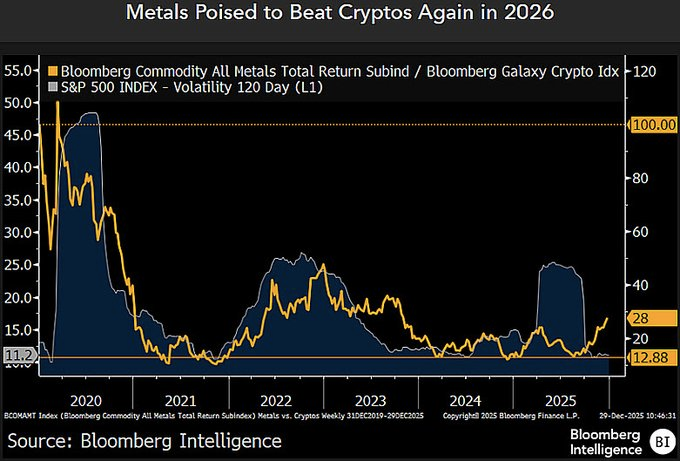

The chart titled “Metals to Beat Crypto Once more in 2026” compares the Bloomberg Commodities All Metals Whole Return Subindex and the Bloomberg Galaxy Cryptocurrency Index to the 120-day volatility of the S&P 500. Information exhibits that the metallic will expertise a rally and elevated volatility round 2020, adopted by a decline heading into 2021.

In distinction, cryptocurrency indexes exhibit bigger value fluctuations all through the interval, with robust peaks and declines in keeping with adjustments in inventory market volatility. In 2024 and early 2025, the metallic seems to be comparatively secure and fewer unstable than in earlier cycles. Nevertheless, the cryptocurrency’s efficiency displays a brand new spike in volatility throughout the identical interval.

These patterns are just like when metals outperformed crypto property throughout earlier intervals of robust monetary situations or heightened uncertainty, in line with Bloomberg Intelligence. The info presentation means that metals might proceed to point out relative resilience in comparison with the crypto market if fairness volatility stays elevated.

Associated: Wealthy Dad creator warns towards ‘faux authorities cash’, recommends BTC and metals

Bitcoin and gold ratio indicators

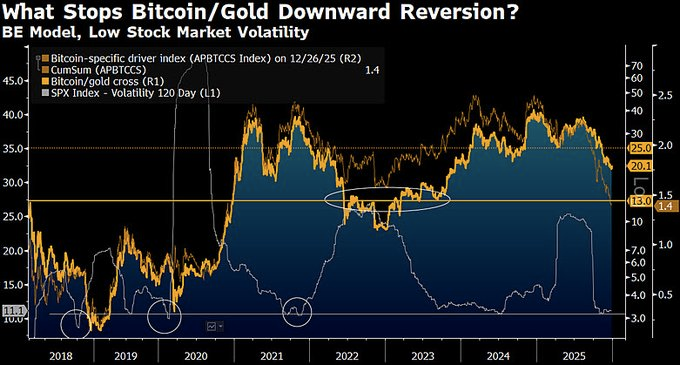

The second graph focuses on the connection between Bitcoin and Gold, inspecting the Bitcoin to Gold ratio together with inventory market volatility and a proprietary valuation framework. The chart, titled “What’s Stopping a Downward Reversal of Bitcoin/Gold? BE Mannequin, Low Volatility in Inventory Markets,” exhibits the ratio at practically 20x as of Dec. 29, with a modeled trajectory towards 13x primarily based on data from Bloomberg Economics.

Historic information on the chart exhibits that intervals of low inventory value volatility coincide with stabilization or restoration within the Bitcoin-to-gold ratio, notably between 2018 and 2020 and between 2022 and 2023. Conversely, a spike in volatility is according to downward strain on the ratio.

In the direction of the start of 2025, this ratio exhibits a decline once more because the volatility measure will increase. Primarily based solely on the historic relationship proven within the chart, Bloomberg Intelligence frames the info as proof that inventory market volatility stays an vital variable influencing the relative efficiency of digital property and metals.

Associated: Bitcoin vs. Gold & Silver: Who Will Win Traders within the 2025 Onerous Cash Race?

Disclaimer: The data contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any sort. Coin Version shouldn’t be accountable for any losses incurred because of the usage of the content material, merchandise, or companies talked about. We encourage our readers to conduct due diligence earlier than taking any motion associated to our firm.